Sustainable World ETF

VanEck Sustainable World Equal Weight UCITS ETF

Sustainable World ETF

VanEck Sustainable World Equal Weight UCITS ETF

Fund Description

The VanEck Sustainable World Equal Weight UCITS ETF is a force for a better world. It invests in the 250 most liquid, most highly capitalised companies globally that comply with the UN Global Compact Principles for responsible corporate behavior. Additionally, it excludes sectors that do not follow responsible business practices, including: alcohol, animal testing for cosmetic products, military, weapons, gambling, pornography, tobacco, nuclear power.

-

NAV€32.35

as of 19 Sep 2024 -

YTD RETURNS12.63%

as of 19 Sep 2024 -

Total Net Assets€750.7 million

as of 19 Sep 2024 -

Total Expense Ratio0.20%

-

Inception Date13 May 2013

-

SFDR ClassificationArticle 8

Overview

Fund Description

The VanEck Sustainable World Equal Weight UCITS ETF is a force for a better world. It invests in the 250 most liquid, most highly capitalised companies globally that comply with the UN Global Compact Principles for responsible corporate behavior. Additionally, it excludes sectors that do not follow responsible business practices, including: alcohol, animal testing for cosmetic products, military, weapons, gambling, pornography, tobacco, nuclear power.

- Sustainable, exclusion-based investing in line with the UN Global Compact Principles

- Broad diversification: global universe, equal weight per stock, regions capped at 40%

- Long-standing track record

- Backed by sustainability intelligence from VE, part of Moody’s ESG solutions

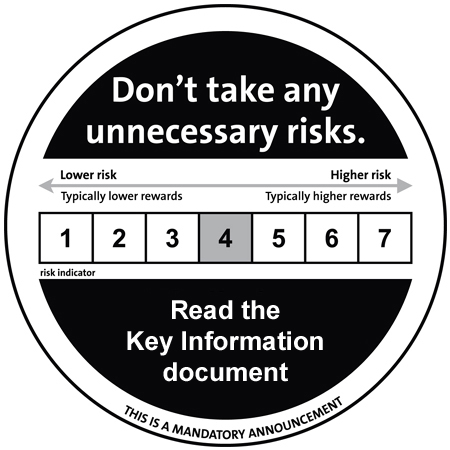

Main Risk Factors: Foreign currency risk, equity market risk, market risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Please note, as of 8th October 2021, the sub-fund VanEck Global Equal Weight UCITS ETF has merged into the sub-fund VanEck Sustainable World Equal Weight UCITS ETF. You can find more information about the merger in the document section.

Underlying Index

Solactive Sustainable World Equity Index GTR (TTMTTSWE)

Fund Highlights

- Sustainable, exclusion-based investing in line with the UN Global Compact Principles

- Broad diversification: global universe, equal weight per stock, regions capped at 40%

- Long-standing track record

- Backed by sustainability intelligence from VE, part of Moody’s ESG solutions

Risk Factors: Foreign currency risk, equity market risk, market risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Please note, as of 8th October 2021, the sub-fund VanEck Global Equal Weight UCITS ETF has merged into the sub-fund VanEck Sustainable World Equal Weight UCITS ETF. You can find more information about the merger in the document section.

Underlying Index

Solactive Sustainable World Equity Index GTR (TTMTTSWE)

Capital Markets

VanEck partners with esteemed market makers to ensure the availability of our products for trading on the mentioned stock exchanges. Our Capital Markets team is committed to continuously monitoring and assessing spreads, sizes, and prices to ensure optimal trading conditions for our clients. Furthermore, VanEck ETFs are available on various trading platforms, and we collaborate with a wider range of reputable Authorized Participants (APs) to promote an efficient and fair trading environment. For more information about our APs and to contact our Capital Markets team, please visit factsheet capital markets.pdfPerformance

Holdings

Portfolio

Distributions

Literature

Index

Index Description

The Solactive Sustainable World Equity Index tracks the performance of a selection of the top 250 shares from global developed markets which have been screened according to sustainability criteria set by the renowned sustainability research firm VigeoEIRIS now part of Moody’s ESG Solutions. The screening is based on the ten principles of the UN Global Compact, complemented with specific exclusions. The equity universe of the underlying index consists of all developed countries in North America, Europe and Asia.

Index Key Points

Underlying Index

Solactive Sustainable World Equity Index GTR (TTMTTSWE)

Index composition

The index has the followings specifications:

- The index tracks the performance of a selection of the top 250 shares from global developed markets (North America, Europe and Asia) which have been screened according to sustainability criteria’s set by EIRIS. The selection model filters the shares according to a liquidity threshold of EUR 50 million 6-month ADV and includes subsequently the top ranked shares based on free-float adjusted market capitalization. It is an equally weighted index.

Starting with a FactSet Universal Screening:

- Screen for securities that have a primary listing in one of the following countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Japan, Luxembourg, Netherlands, New Zealand, Norway, Portugal, Singapore, South Korea, Spain, Sweden, Switzerland, United Kingdom and United States.

- Filter out any shares which are not ordinary, preferred or Depositary Receipts.

- Filter out any Limited Partnerships.

- Remove all securities with a 6-month ADV (as sourced from FactSet) below EUR 50 million.

- Remove any security primary listed in Hong Kong and which derives more than 75% of its revenues outside the 24 countries mentioned above.

- For each company keep only the most liquid share line and most liquid listing.

- The renowned sustainability research firm Vigeo Eiris (Ethical Investment Research Information Service, www.vigeo-eiris.com), acquired by Moody’s in April 2019, applies on top of this process an ESG screening based on the ten principles of the UN Global Compact as well as specific exclusions related to controversial sectors. Here is a list –non exhaustive- of some of the controversial sectors, when going beyond defined thresholds, that are removed from the index composition: Alcohol, Animal testing, Military, Weapons, Gambling, Pornography, Tobacco, Nuclear power.

- The index is reviewed annually on the fourth Tuesday of March.

Index Provider

Solactive