Inflation Concerns – A Recurring Nightmare?

02 March 2023

Read Time 2 MIN

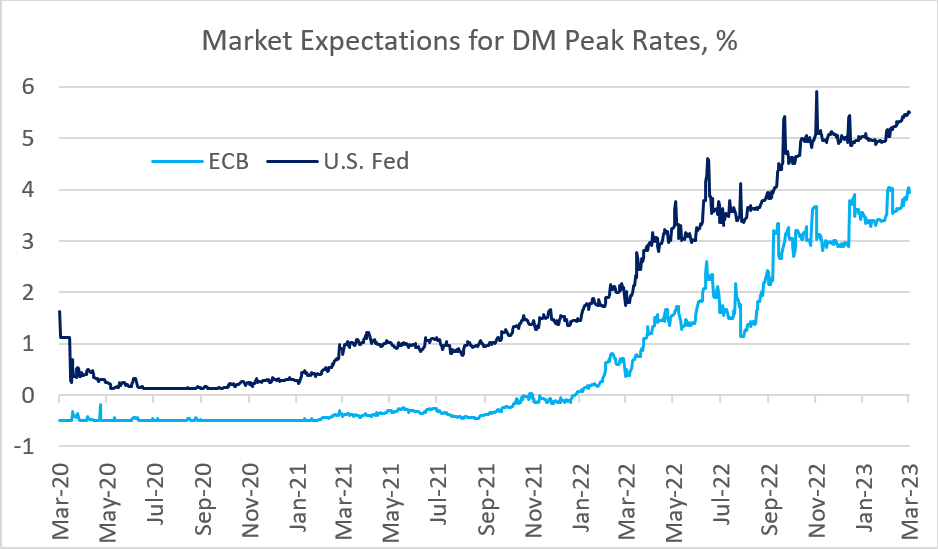

DM Peak Rate Expectations

Developed markets (DM) inflation worries are back, and this means that global rates are under pressure yet again, while the market expectations for DM peak rates are re-testing the past highs (see chart below). This week, an upside inflation surprise in the Eurozone (especially in core prices) was probably the most “visible” indicator. Still, a big jump in the “prices paid” component of February’s ISM manufacturing survey and today’s very unfortunate combo of lower Q4 productivity growth and higher unit labor costs added to concerns about the inflation outlook for the U.S... Tomorrow’s “prices paid” sub-index in the ISM survey for services is likely to attract some extra attention as well.

Inflation Surprises

The inflation surprise index for DMs changed direction recently and started to move higher – much more than a similar index for emerging Ms. Does it mean that EMs are better positioned to escape the inflation “curse”? As you know, we try to look through high-frequency data noise, but we have to admit that the question about potentially diverging longer-term inflation trajectories in EM and DM started to pop up in our discussions more frequently. China aside, EMs’ demographic situation is more favorable than in DM, which means fewer labor supply constraints and the rising middle class (with a greater pool of savings, including pension funds).

EM Inflation Outlook

Another point is that emerging economies, on average, have lower debt/GDP ratios, and EM governments are aware that the market and rating agencies will notice a lack of fiscal discipline. Arguably, this reduces the need for fiscal dominance (which, by the way, tends to produce undesirable side effects), allowing policy rates to do their job properly. Finally, new technologies would require significant future investments both in EM and DM, but many EMs – especially “EM Graduates” – skipped some technological states and have the newer infrastructure (=potentially a better “fit” between the pool of savings and the need for capital). We know that EMs already pay higher real rates, but aren’t recent developments mean further support for EM going forward, not less? Stay tuned!

Chart at a Glance: DM Peak Rate Expectations – Re-Testing the Highs

Source: VanEck Research; Bloomberg LP.

Related Insights

07 April 2025

06 March 2025

20 February 2025

16 January 2025

07 April 2025

Trump’s tariffs spark trade war fears, fueling market volatility, inflation risk, and recession threats. With global retaliation likely, near-term growth is clearly at risk.

06 March 2025

Trump’s tariffs, AI’s next phase, and a potential U.S. gold revaluation could shake markets—investors who stay ahead of these transitions will be best positioned.

20 February 2025

China's AI breakthrough, persistent inflation, gold’s outperformance, and rising energy demand underscore a shifting investment landscape.

16 January 2025

In 2025, navigating turbulence means balancing tech innovation, inflation hedges, energy shifts, and risks from spending cuts and inflation.

05 December 2024

"Trump Trade 2.0" fueled U.S. equity and digital asset rallies, while real assets faltered under a strong dollar, with global markets reacting unevenly to pro-growth policies.