Low Rates – The Natural Order of Things?

20 April 2023

Read Time 2 MIN

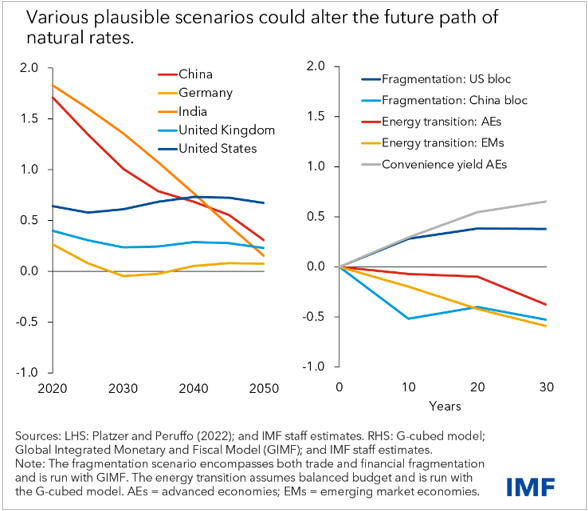

Natural Rates

The markets are getting increasingly accustomed to the prospect of a 25bps U.S. rate hike in May (90% implied probability as of this morning). Meanwhile, the IMF published an interesting report in which it argues that the current spike in real interest rates is likely to prove temporary, and interest rates are set to return to the pre-pandemic levels – once inflation is under control, of course. It is reassuring that the report also talks about alternative scenarios (see chart below), including the rising public debt, “green transition,” and de-globalization. Another important factor is emerging markets (EMs) ability – and willingness – to invest their surplus dollars into developed markets (DM) instruments. Many EMs already showed interest in high-quality EM instruments as potential reserve assets. EMs are also eager to accumulate reserve gold, and EMs’ domestic savings will be increasingly spent to finance the “green transition.”

Rate Cuts

Talking about lower rates, some EM central banks are getting antsy – despite various warnings about premature policy moves/communications. The Hungarian central bank tested the waters yesterday with comments about potential near-term easing, and the central bank of Uruguay surprised with a 25bps “proper” policy rate cut. Judging by the Hungarian forint’s reaction, the market is not yet ready to talk about policy easing in that part of the world, given that both core and headline inflation is still in their 20s. Uruguay’s move did not produce a lot of optimism either, even though the real policy rate is high, and both core and headline inflation are on their way down (and much lower than in Hungary). There are concerns that inflation expectations might prove stickier than expected, while mega-drought in neighboring Argentina poses obvious risks to food prices.

Disinflation

Most EMs are not yet ready to take the easing plunge. The Chilean central bank’s minutes sounded very hawkish, talking about upside surprises in both inflation and domestic demand and saying there are not enough signs that inflation is indeed converging to the target. Central banks in EM Asia might be better positioned to pause and eventually cut rates safely, as inflation generally peaked at much lower levels, and food prices are moderating at a faster pace. Malaysia’s central bank left the door open for another hike at its last meeting, but today’s downside inflation surprise (3.4% year-on-year in March) should reassure monetary authorities that the pause can be extended without jeopardizing the disinflation progress. Stay tuned!

Chart at a Glance: Future Interest Rates – Alternatives Matter

Source: International Monetary Fund.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.