“Too High For Too Long” – Inflation? Rates? Both?

16 March 2023

Read Time 2 MIN

DM Rate Hikes

The market tried to bounce on the news that Credit Suisse was allowed to borrow from the Swiss National Bank, but concerns about the debacle’s impact on bank lending standards – and, hence, the growth outlook both in Europe and the U.S. – led to some back and forth. The European Central Bank’s (ECB’s) decision to go for a larger 50bps rate hike refocused the market’s attention on economic fundamentals – specifically, persistent price pressures in developed markets (DM), which, according to the ECB, were “projected to remain too high for too long”. The consensus expects headline inflation in Europe and the U.S. to remain outside the target until 2025. The question is whether the U.S Federal Reserve (Fed) will follow suit with a hawkish message next week, or will the banking sector anxieties take precedence? As of this morning, the Fed Funds Futures showed around 70% probability of a 25bps rate increase in March, and implied around 90bps of rate cuts in the rest of the year.

EM Rate Cuts

The policy landscape in emerging markets (EM) is less dramatic these days – aggressive post-pandemic policy tightening means that the real rates are high (=a safety cushion for EMFX), and disinflation is underway in most places. As a result, more and more EM central banks can pause safely (and enjoy the DM show). The Indonesian central bank did just that earlier today – keeping the policy rate on hold and main economic forecasts broadly unchanged. And the Brazilian central bank is expected to do the same next week – with a calmer messaging if the government’s new fiscal framework proposals (expected any day now) look orthodox enough.

EM Disinflation

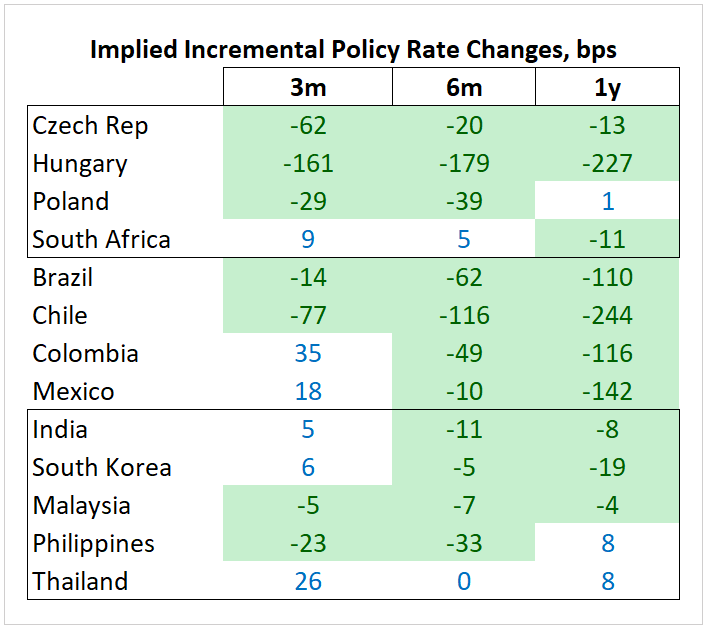

We consider it a sign of EM resilience that the market continues to price in rate cuts in the next 12 months, despite recent turbulence in DM (see chart below). But we have to admit that the bar for policy easing can be (should be?) high – in part, because the disinflation progress is uneven, core inflation is often sticky and inflation is still far away from the target in many countries. We’ve got some reminders today, as Poland’s core inflation surprised to the upside in February (accelerating to 12% year-on-year), and South Africa’s inflation expectations moved higher in Q1. Actually, several EM central banks might need to tighten a bit more before contemplating a pause – Mexico, and potentially South Africa. Stay tuned!

Chart at a Glance: Implied Rate Cuts in EM – Market Turbulence Notwithstanding

Source: Bloomberg LP.

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.