Marketing Communication

Five Reasons Why Investors are Rediscovering Dividend Stocks

15 January 2026

Amid all of the attention given to AI and the big US tech stocks, the fact that some investors have been quietly rediscovering high dividend stocks is less appreciated. They’re going back to basics, favoring big companies that pay high dividends year after year, providing investors with income that can be reinvested for capital gains.

Take our VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF (TDIV). In 2025, inflows helped quadruple its size – from USD 1.2 billion at the beginning of the year to USD 4.8 billion as of the year-end.*

The question, though, is why did investors flock to high dividend stocks during the year and what does it say about their views on equity markets in 2026? In my opinion, dividend stock investing has five main attractions.

Performance History - VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF

| 2021 | 2022 | 2023 | 2024 | 2025 | |

| ETF | 26.94 | 15.77 | 11.76 | 16.00 | 23.78 |

| MSDMDLGE (Index) | 27.24 | 16.58 | 12.56 | 16.71 | 24.72 |

Source: VanEck. Past performance does not predict future results. Calendar year as of December 31st, 2025.

1. Dividend Payers Tend to Be More Resilient

In uncertain times, the solidity of big companies paying high dividends is more appealing than ever. They have profits backed by strong cash-flows that underpin dividends, even through moderate economic downturns. Their commitment to maintaining, or even growing, annual dividend payments makes them disciplined about the internal projects they spend capital on. These strong fundamentals help explain why dividend strategies can perform comparatively well in both rising and volatile markets, although this is not assured. 2025 illustrated this well, with the TDIV ETF proving less volatile than world markets, represented by the MSCI World Index, following the announcement of US tariffs in April 2025 (see chart). It is worth noting that every situation is unique and past performance does not predict future returns.

Rolling 3 Months Volatility

Source: Morningstar, December 2025.

2. Dividends Help Manage Volatility Without Leaving Equities

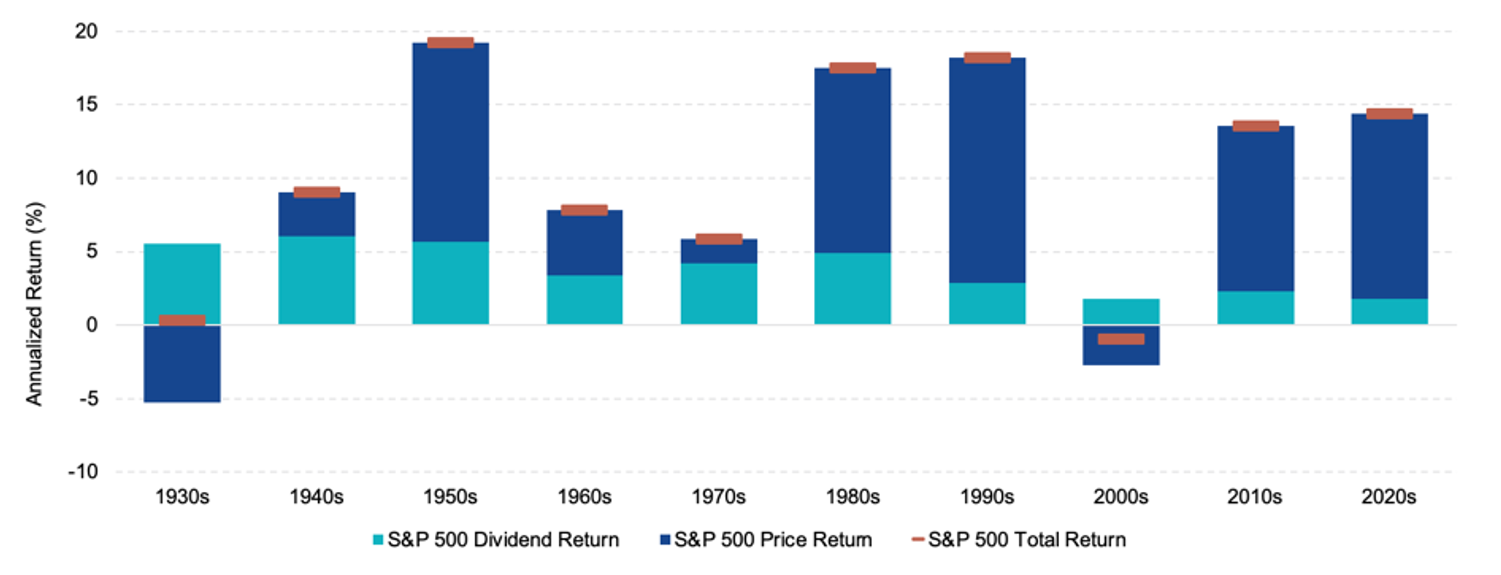

For investors who are nervous about the outlook but do not want to sell, dividend stocks may be the answer. As 2025 shows, they can provide resilience in volatile markets. Our research indicates that dividends have underpinned stock returns over the past 80 years, especially when inflation has spiked higher as it did in the 1940s and 1970s (see chart).

Dividends Are Key In Periods of Muted Returns | Dividend Contribution to S&P 500 Total Return / 1/1/1930 - 30/06/2025

Source: Morningstar, June 2025.

3. Higher-for-Longer Rates Have Changed Investor Priorities

After years of low interest rates when investors prized ‘growth at any price’, they once again value cash returns. In the 2010s, exceptionally low rates around zero encouraged investors to put a premium on growth companies in sectors like technology that offered the prospect of high future earnings growth. But with European Central Bank short-term interest rates around 2%, some investors now prefer the tangible returns of high dividends. Even if rates do fall somewhat from here, it appears that investor expectations have shifted.

ECB Deposit Interest Rate

Source: ECB, December 2025.

4. Dividends Have Historically Driven a Large Share of Total Returns

As investors begin to go back to basics, they appreciate that dividends have provided a large proportion of total stock market returns. Looking back at the US stock market over 35 years, reinvested dividends have provided approximately half of the key S&P 500 Index’s total return for investors (see chart).

Source: Morningstar, December 2025.

5. Stability in an AI-Driven Market

Lastly, dividend stocks offer the likelihood of greater stability at a time when some investors are nervous that AI stocks might be in a bubble. If for any reason that bubble should burst, the type of well-known stocks in a high dividend ETF are backed by well known, solid companies that have stood the test of time. For instance, the top 10 holdings in our TDIV ETF are large well-known companies from a variety of sectors such as Exxon Mobil, Nestle and Roche (see below).

| Top 10 Holdings (%) as of 31 Dec 2025 |

Total Holdings : 100 | |||

| HOLDING NAME | Ticker | Shares | Market Value (EUR) | % of Net Assets |

| EXXON MOBIL CORP | XOM US | 2,344,575 | 240,236,730 | 5.03 |

| VERIZON COMMUNICATIONS INC | VZ US | 6,008,577 | 208,377,734 | 4.36 |

| NESTLE SA | NESN SW | 2,175,450 | 184,097,351 | 3.85 |

| PFIZER INC | PFE US | 8,176,829 | 173,360,253 | 3.63 |

| ROCHE HOLDING AG | ROG SW | 458,275 | 161,647,043 | 3.38 |

| SHELL PLC | SHEL LN | 4,850,408 | 152,206,223 | 3.18 |

| TOTALENERGIES SE | TTE FP | 2,503,659 | 139,178,404 | 2.91 |

| PEPSICO INC | PEP US | 1,128,960 | 137,960,974 | 2.89 |

| ALLIANZ SE | ALV GR | 347,254 | 135,602,687 | 2.84 |

| NOVO NORDISK A/S | NOVOB DC | 2,670,969 | 116,311,223 | 2.43 |

| Top 10 Total (%) | 34.49 |

These are not recommendations to buy or to sell any security. Securities and holdings may vary.Due to certain corporate actions, the holdings may contain shares with a very small weighting. In addition, more shares may be included in the portfolio than in the normal composition. During the review, these shares normally fall from the index.

Source: VanEck, December 2025.

Key risks to consider alongside these five attractions:

Although dividend stocks may appear attractive for their perceived resilience and income potential, dividends are never assured and can be reduced or suspended, while share prices can still decline significantly. A high-dividend approach may also underperform broader equity markets – particularly during growth-led rallies – and may entail greater exposure to certain sectors or countries, which can amplify the impact of sector- or region-specific setbacks. Returns can be further influenced by currency fluctuations and changes in interest rates. As with any ETF, investors should also take into account product-specific risks, including tracking difference.

* Source: VanEck, December 2025.

IMPORTANT INFORMATION

This is marketing communication.

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company VanEck Asset Management B.V. (“ManCo”). A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Stadthausstrasse 14, CH-8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from a financial intermediary for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as financial intermediaries and Wealth Managers.

This information originates from VanEck (Europe) GmbH, which is authorized as an EEA investment firm under the Markets in Financial Instruments Directive (“MiFiD”). VanEck (Europe) GmbH has its registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the ManCo, which is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

This material is only intended for general and preliminary information and does not constitute an investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. All relevant documentation must be first consulted.

The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and has not been independently verified for accuracy or completeness and cannot be guaranteed.

Please refer to the Prospectus – in English language - and the KID/KIID - in local language - before making any final investment decisions and for full information on risks. These documents can be obtained free of charge at www.vaneck.com, from the ManCo or from the appointed facility agent.

VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF ("ETF") is a sub-fund of VanEck ETFs N.V., a UCITS umbrella investment company, registered with the AFM, passively managed and tracking an equity index. The product described herein aligns to Article 8 Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. Information on sustainability-related aspects pursuant to that regulation can be found on www.vaneck.com. Investors must consider all the fund's characteristics or objectives as detailed in the prospectus, in the sustainability-related disclosures or related documents before making an investment decision.

The value of the ETF may fluctuate significantly as a result of the investment strategy. The ETF´s holdings are disclosed on each dealing day on www.vaneck.com under the ETF´s Holdings section and as per PCF under the Documents section and published via one or more market data suppliers. The indicative net asset value (iNAV) of the ETF is available on Bloomberg. For details on the regulated markets where the ETF is listed, please refer to the Trading Information section on the ETF page at www.vaneck.com. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets. Tax treatment depends on the personal circumstances of each investor and may vary over time. The ManCo may terminate the marketing of the ETF in one or more jurisdictions. The summary of the investor rights is available in English at: summary-of-investor-rights.pdf.

Morningstar, Morningstar Indexes and Morningstar® Developed Markets Large Cap Dividend Leaders Screened Select IndexSMare registered trademarks of Morningstar, Inc. The Morningstar® Developed Markets Large Cap Dividend Leaders Screened Select IndexSMhas been licensed to VanEck Asset Management B.V. for the purpose of creating and maintaining the VanEck’s ETF. VanEck’s ETF is not sponsored, endorsed, sold or promoted by Morningstar, Inc., or any of its affiliates (collectively, “Morningstar”) and Morningstar makes no representation regarding the advisability of investing in it. It is not possible to invest directly in an index.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. It is not possible to invest directly in an index.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk for any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”), expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, noninfringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. It is not possible to invest directly in an index.

Investing is subject to risk, including the possible loss of principal. For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

1 - 3 of 3

17 February 2026

Dmitrii Ponomarev

Product Manager

20 January 2026

16 December 2025

Dmitrii Ponomarev

Product Manager

15 December 2025

Dmitrii Ponomarev

Product Manager

18 November 2025