Sustainable Moat ETF

VanEck Morningstar US Sustainable Wide Moat UCITS ETF

Sustainable Moat ETF

VanEck Morningstar US Sustainable Wide Moat UCITS ETF

Fund Description

The VanEck Morningstar US Sustainable Wide Moat UCITS ETF invests in US equities with long-term competitive advantages and an attractive valuation.

-

NAV$59.94

as of 25 Sep 2024 -

YTD RETURNS11.24%

as of 25 Sep 2024 -

Total Net Assets$485.5 million

as of 25 Sep 2024 -

Total Expense Ratio0.49%

-

Inception Date16 Oct 2015

-

SFDR ClassificationArticle 8

Overview

Fund Description

The VanEck Morningstar US Sustainable Wide Moat UCITS ETF invests in US equities with long-term competitive advantages and an attractive valuation.

- Strategy based on a proven and transparent indexing model from Morningstar, the renowned research partner

- Companies with long-term competitive advantages for 20 years or longer (switching costs, intangible assets, network effect, cost advantage, efficient scale)

- Based on the concept of economic “Moat“s, a term first coined by Warren Buffett

- Targets companies trading at attractive prices relative to Morningstar’s estimate of fair value

- Excludes companies deriving revenues from Controversial Weapons, Civilian Firearms and Thermal Coal as defined by Sustainalytics

- Screens out companies with higher levels of ESG- and Carbon-related risks according to Sustainalytics Estimates

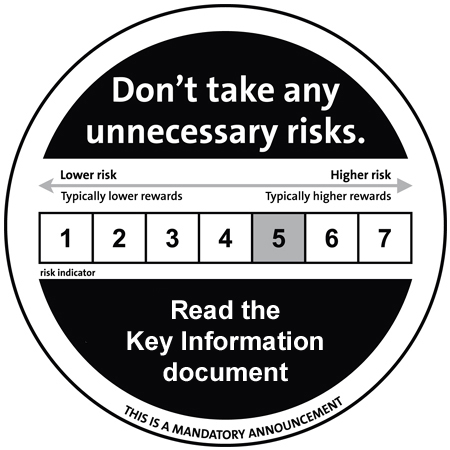

Main Risk Factors: Equity market risk, limited diversification risk, foreign currency risk. Please refer to the

and the Prospectus for other important information before investing.

As part of its efforts to increase VanEck’s sustainable footprint, VanEck Morningstar US Sustainable Moat UCITS ETF (“the Fund”) changed its underlying index to Morningstar US Sustainability Moat Focus Index that incorporates ESG considerations in the index selection, effective 17 December 2021 EOD. Prior to that, the Fund was called VanEck Morningstar US Wide Moat UCITS ETF and was following Morningstar Wide Moat Focus Index. The new index exhibits improved Sustainability characteristics1, as well as superior risk-return statistics2. For further details on the Fund and its Index, please see the Index Transition Communication on the Documents page of the Fund.

1Source: Morningstar, Sustainalytics as of 6 October 2021.

2Source: Morningstar, Bloomberg as of 31 October 2021. Returns are calculated in USD on a Net Return basis. The data before 11 February 2021 reflects backtested strategy returns. Past performance is not indicative of future results.

Underlying Index

Morningstar US Sustainability Moat Focus Index (MSUSSMNU)

Fund Highlights

- Strategy based on a proven and transparent indexing model from Morningstar, the renowned research partner

- Companies with long-term competitive advantages for 20 years or longer (switching costs, intangible assets, network effect, cost advantage, efficient scale)

- Based on the concept of economic “Moat“s, a term first coined by Warren Buffett

- Targets companies trading at attractive prices relative to Morningstar’s estimate of fair value

- Excludes companies deriving revenues from Controversial Weapons, Civilian Firearms and Thermal Coal as defined by Sustainalytics

- Screens out companies with higher levels of ESG- and Carbon-related risks according to Sustainalytics Estimates

Risk Factors: Equity market risk, limited diversification risk, foreign currency risk. Please refer to the

and the Prospectus for other important information before investing.

As part of its efforts to increase VanEck’s sustainable footprint, VanEck Morningstar US Sustainable Moat UCITS ETF (“the Fund”) changed its underlying index to Morningstar US Sustainability Moat Focus Index that incorporates ESG considerations in the index selection, effective 17 December 2021 EOD. Prior to that, the Fund was called VanEck Morningstar US Wide Moat UCITS ETF and was following Morningstar Wide Moat Focus Index. The new index exhibits improved Sustainability characteristics1, as well as superior risk-return statistics2. For further details on the Fund and its Index, please see the Index Transition Communication on the Documents page of the Fund.

1Source: Morningstar, Sustainalytics as of 6 October 2021.

2Source: Morningstar, Bloomberg as of 31 October 2021. Returns are calculated in USD on a Net Return basis. The data before 11 February 2021 reflects backtested strategy returns. Past performance is not indicative of future results.

Underlying Index

Morningstar US Sustainability Moat Focus Index (MSUSSMNU)

Capital Markets

VanEck partners with esteemed market makers to ensure the availability of our products for trading on the mentioned stock exchanges. Our Capital Markets team is committed to continuously monitoring and assessing spreads, sizes, and prices to ensure optimal trading conditions for our clients. Furthermore, VanEck ETFs are available on various trading platforms, and we collaborate with a wider range of reputable Authorized Participants (APs) to promote an efficient and fair trading environment. For more information about our APs and to contact our Capital Markets team, please visit factsheet capital markets.pdfPerformance

Holdings

Portfolio

Documents

Publications

Index

Index Description

The Morningstar US Sustainability Moat Focus Index tracks the overall performance of attractively priced US companies with sustainable competitive advantages according to Morningstar’s equity research team, subject to ESG screening based on Sustainalytics data. The rules-based index is reviewed semi-annually. Please consult http://indexes.morningstar.com for detailed index information.

Index Key Points

Underlying Index

Morningstar® US Sustainability Moat Focus IndexSM

Index composition

The Index contains at least 40 attractively priced U.S. companies with sustainable competitive advantages, according to Morningstar's equity research team, that have been screened for ESG risks.

Companies eligible for inclusion in the Index

- Derived from Morningstar® US Market IndexSM (Parent Index)

- Assigned an Economic Moat rating of wide by Morningstar’s equity research team

- Assigned a fair value estimate by Morningstar's equity research team

- ESG risk score: must be in the medium, low or negligible categories (excludes high and extreme ESG risk companies)

- Controversy score: must be 4 (out of 5) or lower through the trailing 3 years

- Carbon risk score: if rated, must be in the medium, low, or negligible categories (excludes high and extreme carbon risk companies)

- Product involvement exclusions: tobacco, controversial weapons, civilian firearms, thermal coal

Methodology highlights

- Staggered reconstitution:

Index is divided into two equally-weighted sub-portfolios, and each is reconstituted and rebalanced annually, one in June and the other in December

Each sub-portfolio will contain 40 equally-weighted securities at its annual reconstitution and weights will vary with market prices until the next reconstitution date.

Each sub-portfolio is reweighted to 50% of the total index every twelve months. - Buffer rule:

At each review, current index constituents ranked within the top 150% of the eligible universe based on current market price/fair value ratio are given preference for inclusion - Sector cap: The greater of 40% or corresponding weight in Parent Index + 10%

- Momentum screen : The Bottom 20% of eligible companies are excluded based on trailing 12-month price return

Index Provider

Morningstar Inc.

Please note that prior to 17th December 2021 EOD, the fund was called VanEck Morningstar US Wide Moat UCITS ETF and was following Morningstar Wide Moat Focus Index. You can find more information about the change in the documents section.