All Quiet on the Growth Front?

27 February 2023

Read Time 2 MIN

China’s Rebound

The next wave of emerging markets (EM) activity gauges is about to hit the shore, starting with China’s official PMIs (Purchasing Managers Indices) tomorrow evening. China’s 2023 growth outlook is bottoming out - the consensus forecast has been raised from 4.8% to 5.2% on the back of reopening news. However, the market now has additional questions regarding the recovery’s timeline, whether it will be more unbalanced than previously thought, and how much of “excess” savings will be used to boost consumption (rather than precautionary savings). The housing sector is still sluggish, which can also weigh on consumer sentiment – China watchers hope the forthcoming National People’s Congress meeting will provide more color regarding additional policy support.

Global Growth Outlook

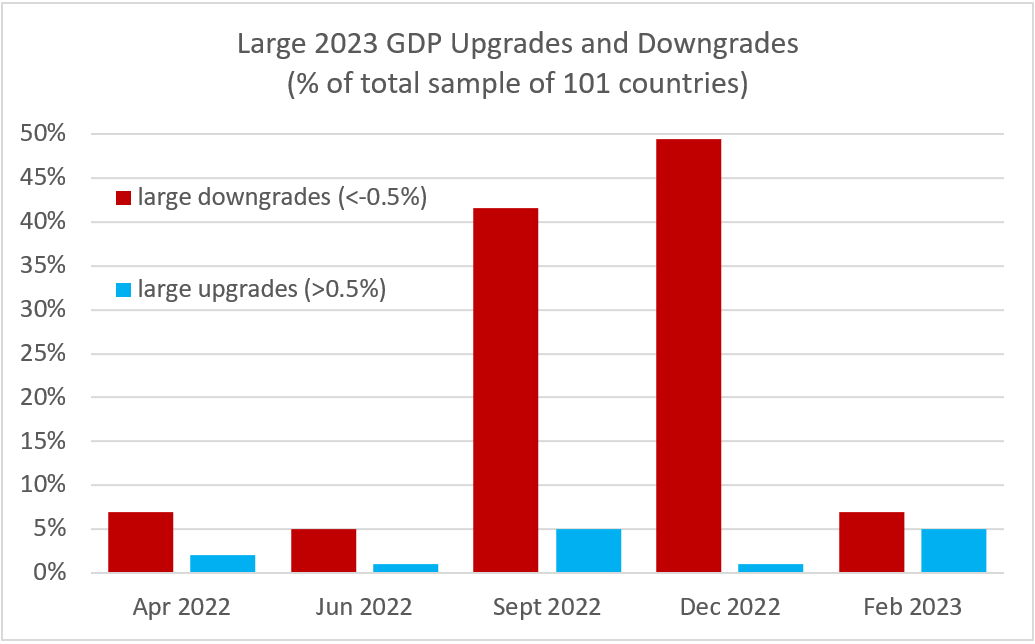

The global growth backdrop for EMs does not look as desperate as in September. The Bloomberg consensus survey (101 countries) shows that the share of large growth downgrades (-0.5% and more) dropped to 6-7% from about 50% at the end of last year (see chart below). At the same time, the share of large growth upgrades is still very low (5%). The last batch of EM PMIs was also mixed/inconclusive. The ratio of expansion-to-contraction was still below 50% in January, and the ratio of improvements-to-deteriorations looked about the same. As regards market implications, the growth outlook is important not only for EM carry trades (a better outlook can offset the impact of higher Fed rates) but for sovereign spreads as well (helping to cope with “risk-free” rates’ volatility – especially for High Yielding bonds).

DM GDP Forecasts

The developing markets (DM) “portion” of global growth looks more promising, according to high-frequency data. Downside risks for Europe appear to be contained, with the recession no longer part of the consensus story. The economic surprise index for the U.S. continues to grind higher, supporting the market expectations of the higher peak rate (5.4% or so) and less need for “emergency” rate cuts in H2 (Fed Funds Futures now imply only 12-13bps). Some EM central banks might feel the need to match the Fed’s higher policy rate trajectory (Mexico comes to mind here), but this does not apply to all EMs, many of which hiked early and aggressively and now have very high real policy rates. Stay tuned!

Chart at a Glance: 2023 Growth Upgrades – Wait-n-See Mode (For Now)

Source: VanEck Research; Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.