Hawks vs. Growth Headwinds

28 July 2022

Read Time 2 MIN

Fed Hikes, U.S. Recession

The below-consensus Q2 GDP print in the U.S. (0.9% sequential contraction) came on the heels of yesterday’s 75bps rate hike by the U.S. Federal Reserve (Fed) and Chairman Jerome Powell’s hawkish press-conference, at which he mentioned a possibility of another “unusually large” move in September. This is a reminder that the Fed is willing to tolerate a recession in order to bring inflation down. Incidentally, the U.S. is among the countries with the sharpest cuts in the 2022 and 2023 growth forecasts in the just-updated World Economic Outlook (IMF).

Global Growth Headwinds

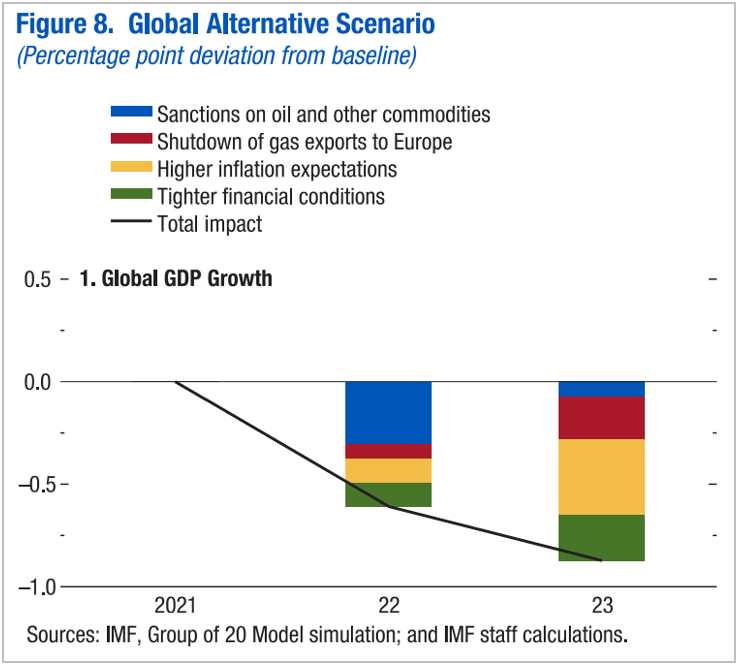

The IMF believes that the global balance of risks is squarely to the downside due to a combination of the Russia/Ukraine war’s impact on gas prices, higher inflation and higher costs of disinflation and tighter financial conditions. The new 2022 world GDP forecast is 0.4% lower than April’s projection, and the 2023 forecast was cut by 0.7%. An adverse scenario sees even deeper cuts in global growth projections (see chart below). What was a bit surprising is that the downward revision of the growth forecasts for emerging markets (EM) as a whole was relatively small. In part, this might be due to the fact that parts of EM are expected to benefit from higher commodity prices – these are some Middle Eastern economies and LATAM.

China Growth Slowdown

China, however, is not that lucky. The IMF thinks that the Chinese economy will expand only by 3.3% in real terms this year, which is 1.1% lower than the April estimate. China’s 2023 forecast was cut by 0.5%, to 4.6%. Both numbers are significantly lower than the official growth target of about 5.5%. This is why the market keeps a very close eye on new policy initiatives that could potentially reverse the negative impact of the past – growth-negative – policy initiatives (this sounds like circular reasoning, but…). The central bank’s intention to create a bailout fund (up to CNY1T) to give low-interest loans to real estate developers so that they can complete unfinished apartments (“diffusing” the mortgage payers’ strike in the process) looks promising. But we also learned today that the Politburo was not too keen on aggressive stimulus. Near-term, our focus is on the July batch of China’s activity surveys (out this weekend), which will show whether the economy (especially consumption) enters Q3 in a meaningfully better shape or whether the improvement is still marginal. Stay tuned!

Chart at a Glance: What’s Behind Adverse Growth Scenarios

Source: International Monetary Fund, World Economic Outlook Update, July 2022

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.