EM Bonds – Policies Matter

04 January 2023

Read Time 2 MIN

China Policy Support

We had two strong contenders for today’s daily chart – China and Brazil – as both countries demonstrate the impact of changing government policies on bond returns. China’s reopening and concerted efforts to support real estate developers after the 20th communist party congress have led to a massive corporate bond rally (High Yield in particular) at the end of 2022. Reports about more support – especially for systemically important players – ensured that the rally continued in the early days of 2023, despite surging COVID infections and outright scary domestic activity gauges (such as 41.6 non-manufacturing Purchasing Managers Index).

Brazil Populism Concerns

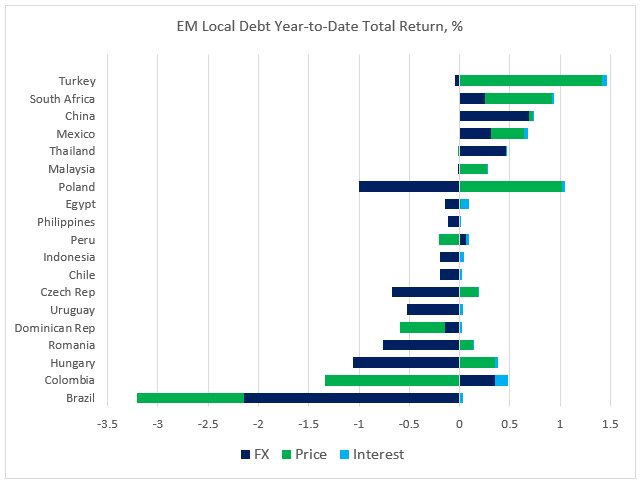

The policy U-turn in Brazil, however, is producing the opposite result. The market initially gave President-elect Luiz Inácio Lula da Silva the benefit of the doubt, hoping his latest political “incarnation” would be less populist. But this does not seem to be quite the case – judging by spending initiatives and inauguration speeches – which explains the market’s concern about reforms rollback and fiscal expansion. These concerns are strong enough to offset the impact of other – much more positive – factors, such as Brazil’s very high real interest rates, fast disinflation, and solid external accounts (high international reserves, basic balance surplus). Brazil’s local bonds underperformed GBI-EM peers by a wide margin so far this year (see chart below), continuing the post-runoff trend. Policy concerns are also a reason why the market prices in only 65bps of rate cuts in Brazil in 2023.

EM Tightening Exits

Central Europe’s combo of dovish policy shifts (Poland, Czech Republic) and emergency rate hikes (Hungary) caused heart palpitations on more than one occasion last year. Still, strong institutions and a prospect of cooling inflation helped to reassure the market in Q4. The region is not yet out of the woods, though. Hungary’s large twin deficit (a sum of fiscal and current account deficits) might require additional bond issuance (including U.S. Dollar denominated bonds) – especially if there are further delays in the disbursement of the EU funds. Poland’s election cycle is expected to widen the budget deficit from estimated 3.9% of GDP in 2022 to 5.4% of GDP this year – potentially testing the market and the central bank’s dovish resolve. Stay tuned!

Chart at a Glance: Brazil – At the Bottom of EM Local Debt Pack

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.