Why Chinese Yuan Stands Out Among EMFX

05 November 2020

Read Time 3 MIN

We wrote last month about the attractive yield pickup that onshore Chinese bonds currently offer versus U.S. and developed markets fixed income, which is particularly striking given several technical and fundamental tailwinds impacting the asset class. Like many non-U.S. dollar investments, particularly in emerging markets, investors need to consider not only the yield level but also the potential for currency appreciation or depreciation. Local currency emerging markets bonds have historically provided several tactical opportunities to take advantage of bouts of U.S. dollar weakness over the past five years, but overall currency movements have detracted from total return. We believe that the Chinese yuan (CNY), however, should not be grouped into the broad category of emerging markets currencies (EMFX) and has several characteristics that set it apart, potentially making exposure attractive to global bond investors—even those wary of EMFX volatility. These characteristics may also help China’s onshore bonds improve the risk-return profile of broad emerging markets local currency debt allocations.

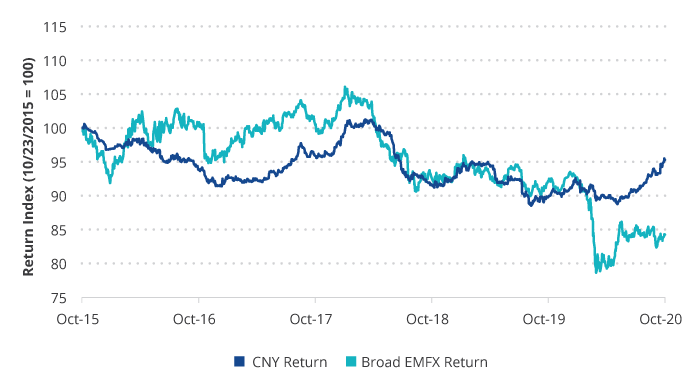

CNY Has Behaved Differently Vs. Broader EMFX

Source: J.P. Morgan and VanEck as of 10/26/2020. Broad EMFX is represented by the foreign currency return of the J.P. Morgan GBI-EM Global Diversified Index.

Looking at the chart above, CNY has been less volatile and displayed greater resiliency than the basket of currencies that represent broad emerging markets exposure. In fact the correlation between the CNY and this basket has been historically low, at only 20%.1 CNY’s value is determined through a managed rate pegged to a basket of currencies, and is only allowed to move within a narrow band on a daily basis. This has reduced the currency’s volatility, but longer term the currency’s value should generally reflect fundamentals. Even with the recent removal of the “countercyclical adjustment,” there are many factors that we believe provide long term support.

Strong and resilient economic growth, particularly this year, has been a key driver of CNY strength relative to the U.S. dollar and in contrast to the weakness experienced by other more vulnerable emerging markets. More broadly, China’s massive economy and role in driving global growth set it apart from other emerging markets. Although no currency can match the U.S. dollar in terms of its role in the global economy, the CNY is growing in importance. It now makes up approximately 2% of foreign exchange reserve assets and that is expected to grow to up to 10% by 2030, according to Morgan Stanley. That will make it the third largest reserve currency, behind the U.S. dollar and euro. As China’s economy continues its transformation into a more consumer led economy that is less dependent on lower value exports, policymakers have also continued the gradual opening of onshore markets to foreign investment. As China’s weight in global bond and equity indices continues to increase, foreign investor flows may provide further support to the CNY. Note in the chart above that, despite the improving fundamental and technical stories, the currency is still 5% weaker versus the U.S. dollar than it was just two-and-a-half years ago.

In the context of a portfolio or index of emerging markets local currency bonds, China’s onshore bonds’ growing weight may act as a stabilizer in future periods of U.S. dollar strength. With less than half the volatility and a low correlation with the broader EMFX universe, CNY exposure can provide valuable diversification benefits and relative stability within a portfolio while also still providing an attractive yield pickup.

1 Source: Bloomberg. Data as of 10/31/20.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.