China Growth Pullback – What’s Next?

01 August 2022

Read Time 2 MIN

Overview

China’s latest activity surveys looked weak – in part due to weaker global demand - but surging construction/infrastructure can improve the growth outlook in H2.

China Slowdown

China’s first activity survey for Q3 was disappointing. The official manufacturing PMI1(Purchasing Managers Index) dropped back into contraction zone (49.0) after spending just 1 month above 50.0, and the services PMI moderated more than expected (53.8). Details show that the deterioration was wide-spread – all manufacturing PMIsub-indices except two were in contraction territory, including large companies, employment, imports, and new orders. An uptick in the number of COVID cases is one plausible explanation, especially as regards services. The weaker consumer sentiment due to the on-going uncertainty in the housing market is another likely reason.

Global Growth Headwinds

Many commentators also drew attention to growth headwinds created by weaker global demand. This narrative was corroborated by the fact that China’s new export orders PMI moved deeper into contraction zone (47.4). South Korea’s daily export growth – an often-used global activity gauge – also showed virtually no signs of a sequential rebound after a very weak print in June. Further, the latest batch of activity surveys in DM (developed markets) was generally weaker than expected. And, finally, there are signs of an H2 growth “cliff” in parts of EM (emerging markets), with a sharp deterioration in July PMIs in Poland, the Czech Republic, Mexico, and Turkey.

China Policy Stimulus

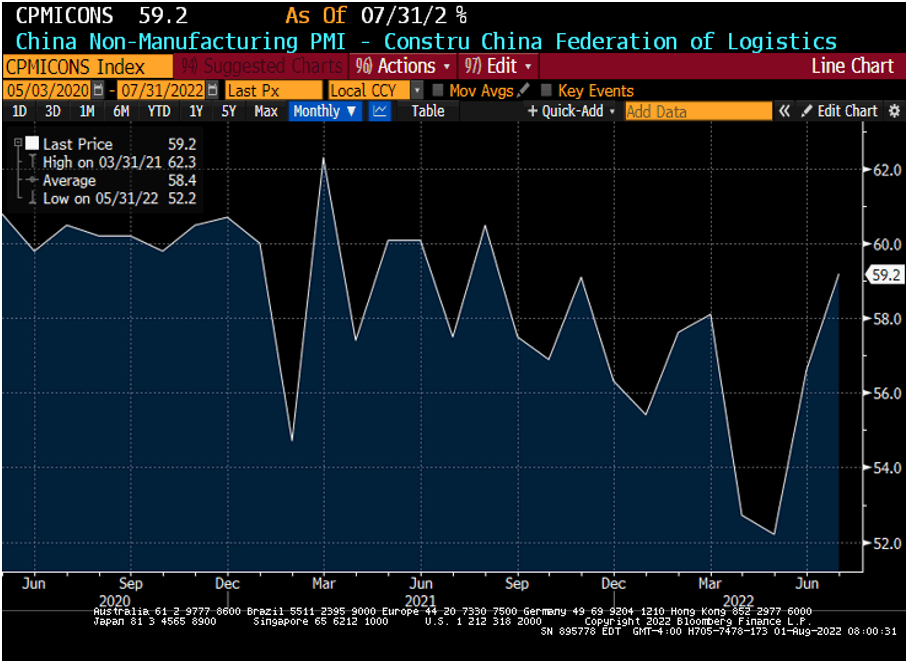

One – by now traditional - question to ask when China’s activity surprises to the downside is whether we are going to see additional policy stimulus. The latest signal from the Politburo is “not necessarily”. The numerical growth target (of around 5.5%) is being replaced by “a reasonable” growth range, with a seemingly different set of priorities (the zero-COVID policy topping the list). Another consideration here is that the infrastructure package might be bringing results – the construction PMI surged from 52.2 in May to 56.6 in June and further to 59.2 in July (see chart below). This might not generate a stratospheric rebound in H2, but we can easily see stronger growth that will be less balanced (i.e. driven by investments/infrastructure rather than consumption), but nevertheless no longer heading south. Stay tuned!

Chart at a Glance: China Growth – Construction to the Rescue?

Source: Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.