China Rebound – V-Shape?

31 January 2023

Read Time 2 MIN

China Growth Outlook

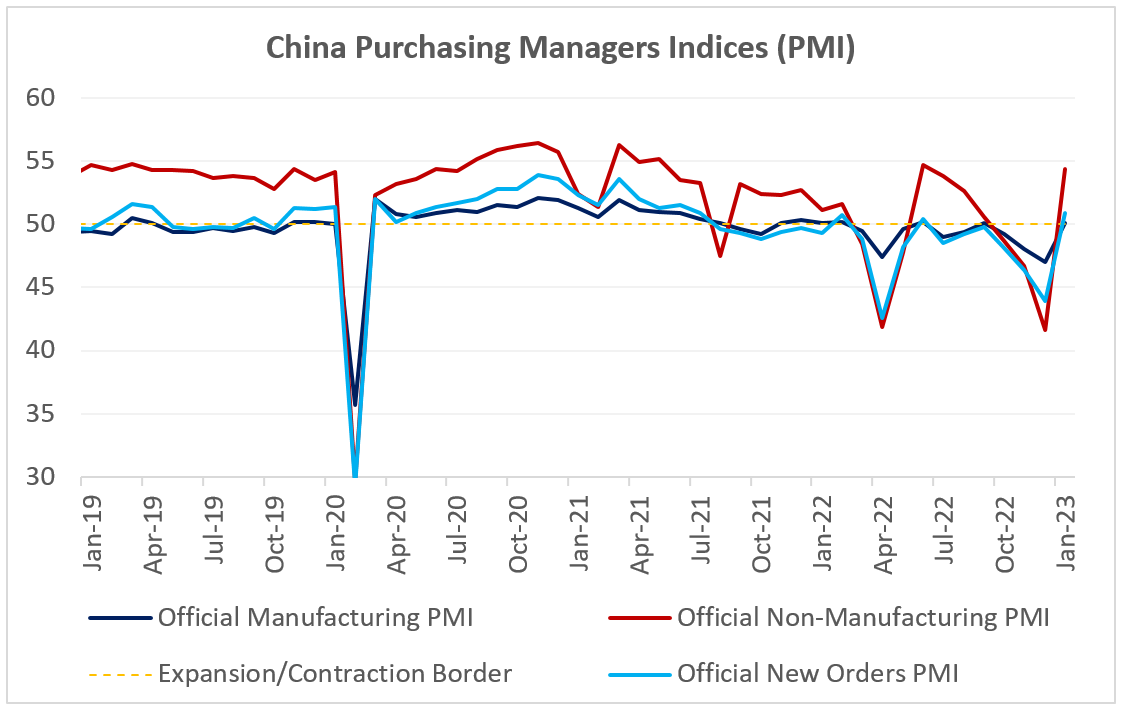

China’s rebound, which has boosted emerging markets (EM) asset prices, is real, and it is led by consumption – these are the main takeaways from the latest set of domestic activity gauges (Purchasing Managers Indices1). Both the manufacturing and the services PMIs moved back to expansion zone in January (respectively, 50.1 and 54.4 – see chart below), paving the way for further 2023 growth upgrades (currently 5.1%, according to the Bloomberg consensus forecast). Details show that China’s external environment remains challenging – the new export orders PMI is still contractionary (46.1) – and that small privately-owned companies are still struggling (47.2). These are good reasons to keep stimulus flowing for now. A sharp improvement in the services PMI (by nearly 13 points) is, however, an encouraging signal for those of us who have been complaining about China’s unbalanced growth since the onset of the pandemic. This is also a reason why the consensus sees higher inflation pressures in China down the road, expecting some policy tightening in the second half of the year.

China Rebound and EM

The market (both bonds and equities) has been anticipating improvements in China’s activity indicators for some time now – given the U-turn in the housing sector policies and the removal COVID restrictions. An important question now is what China’s growth rebound means for the rest of EM, which have been plagued by higher inflation and rising interest rates for most of 2022, but had a very good start to the year (so far). The TTC approach – China’s impact on trade (T), tourism (T) and commodity prices (C) – gives us a broad idea where to look for potential winners in 2023 (both in EM Asia and beyond). Thailand, South Korea and Indonesia are definitely on the list – as are commodity exporters (Chile).

Disinflation and Rate Cuts

It is not entirely clear, though, how China’s reopening will affect the pace of global disinflation and various central banks’ ability to cut rates in the coming months. Market expectations continue to price in H2 rate cuts across major EMs and in the U.S., setting a potentially positive stage for lower interest rates. But China-related growth tailwinds, as well as a new inflationary impulse, can potentially thwart these plans, leading to a longer pause rather than outright easing. If the U.S. Federal Reserve falls into this category, the market might become more discriminating in its assessment of the 2023 prospects for EM. Stay tuned!

Chart at a Glance: China Activity Gauges – A Nice Rebound

Source: Bloomberg LP.

1 We believe PMIs are a better indicator of the health of the Chinese economy than the gross domestic product (GDP) number, which is politicized and is a composite in any case. The manufacturing and non-manufacturing, or service, PMIs have been separated in order to understand the different sectors of the economy. These days, we believe the manufacturing PMI is the number to watch for cyclicality.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.