Disinflation Narrative - Very Much Intact

12 January 2023

Read Time 2 MIN

Global Disinflation

The U.S. inflation print dominated the newswires this morning, and perhaps the most surprising aspect of the release was the absence of any surprises (albeit many commentators noted that inflation ex-shelter was lower than expected, and that this is a dovish signal). The U.S. disinflation story remains intact, and the disinflation process in emerging markets (EM) looks just as established, despite occasional bumps on the road and some notable exceptions (Hungary, Colombia). India’s inflation was fully in line with this argument – it eased more than expected in December (to 5.72% year-on-year) and stayed within the official target band of 2-6%. Regarding the latter point, India is still in a minority, and inflation in most EMs is well above the respective targets. However, the consensus forecasts are gradually grinding down, and some countries might hit the targets sooner than initially thought (the consensus has been quite excited about Hungary lately, placing it ahead of presumably more “orthodox” regional peers).

China Reopening

China’s inflation releases are still flying under the radar – nobody seem to care about them because the reopening caused a surge in infections, temporarily weighing on domestic activity. However, we should be paying attention for a number of reasons. Authorities surprised the market with the faster and more comprehensive removal of the COVID restrictions, and there is huge domestic pent-up demand for goods and services. So, even though China’s inflation looks benign now (mere 1.8% year-on-year in December), it should accelerate in the coming months. This scenario should lead to higher rates and the improvement of the interest rate differential with the U.S. in favor of China, strengthening the fundamental support for the renminbi, which is an anchor for a number of EM currencies.

EM Easing Expectations

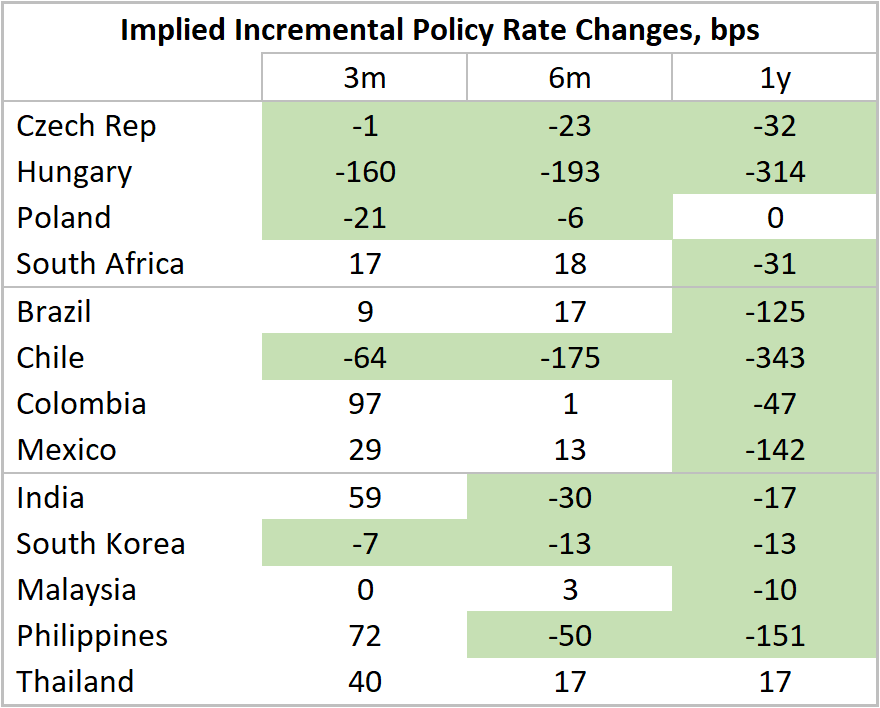

China’s rebound and EM (global?) rate cuts should be powerful drivers for EM assets – especially EM debt – this year. The question is whether the market is getting ahead of itself in pricing in very sizable EM policy easing in the coming months (see chart below). EMs’ conservative monetary policy stance in 2021-2022 suggests that central banks (well, most of them) will cut only when it is safe to do so, and they will not necessarily be driven by actions of the U.S. Federal Reserve (Fed). For example, the Governor of the Philippine central bank alluded to rate cuts only in 2024 in his recent comments. Room for rate cuts in Brazil might be affected by the new government’s policy agenda (especially as regards the budget). Stay tuned!

Chart at a Glance: Market Expectations for EM Rate Cuts - Wow!

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.