Global Pressures – Pick a Direction

16 November 2022

Read Time 2 MIN

EMEA Political and Policy Risks

There was a global sigh of relief that yesterday’s missile incident in Poland did not result in the further escalation of the Russia/Ukraine war. Central European currencies used this occasion to celebrate, bouncing in the morning trade and topping the EMFX daily “league table”. Some global tension points might have eased lately – we are talking about China’s COVID restrictions and the housing sector support – but geopolitical risks in Europe remain elevated, dampening the growth outlook and slowing the process of disinflation. This is quite problematic, because domestic price pressures show few signs of abating. Today’s microscopic downside surprise in Poland’s core inflation is a case in point – the number might have been a touch lower than expected, but core inflation accelerated to 11% year-on-year in October (which explains why we are uneasy about the planned minimum wage increase and a high likelihood of higher pre-election spending). Against this backdrop, the central bank’s aversion to additional rate hikes makes local yields less attractive relative to peers.

Brazil Fiscal Outlook

A pre-election spending spree is a legitimate concern anywhere in the world, but in Brazil the market is fretting about the post-election’s fiscal largesse. President-elect Luiz Inácio Lula da Silva is lobbying for the removal of a major social program from the spending cap for a number of years, which might help to maintain decent fiscal “optics”, but it will still create extra stimulus in the economy. The central bank is watching the situation like a hawk, and the market thinks there is a chance of it delivering a “warning shot” in the form of a small rate hike in the next 3-4 months. Fiscal concerns are weighing on Brazil’s local bonds, which underperformed GBI-EM peers by a wide margin in the past week.

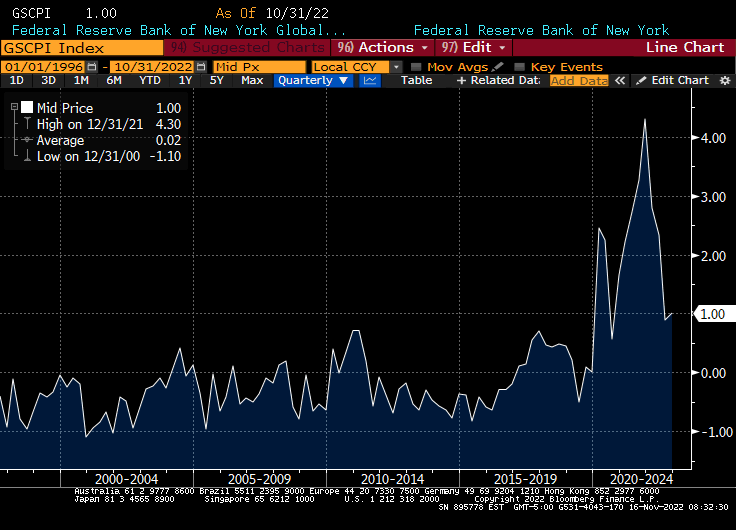

Global Supply Chains

One question that we have is whether EM (and DM) policy “offenders” can be saved by the rapidly easing global supply chain disruptions (see chart below). The latest reports suggest that the improvements are broad-based, which might be a tailwind for the growth outlook (including rebuilding inventories). Easing supply bottlenecks can also lower input prices and reduce some headline inflation pressures going forward. Stay tuned!

Chart at a Glance: Global Supply Chain Pressures? What Pressures?*

Source: Bloomberg LP.

* GSCPI Index: Global Supply Chain Pressure Index seeks to measure supply chain conditions, created by the Federal Reserve. The index combines variables from several indices in transportation and manufacturing.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.