When Big Stories Collide

10 March 2023

Read Time 2 MIN

Fed Policy Response

Geopolitics is moving to the forefront again, “colliding” with concerns about a mini bank crisis/moral hazard in the U.S. – but against the backdrop of a strong payrolls number. The market responded to this new “twist” with another risk-off episode and some retracement of expectations for the U.S. Federal Reserve’s (Fed’s) peak rate. Some emerging markets (EM), however, are trying to ignore today’s “gloom and doom” – including several major currencies and sovereign bonds. And this, of course, invites comments about EMs’ stronger structural and institutional frameworks (many countries did their homework after the 2008 global financial crisis – especially “EM Graduates”), as well as EM central banks’ timely and aggressive response to the post-pandemic inflation episode.

EM Disinflation

The latest data releases confirmed the EM disinflation story. A pause in the hiking cycle looks increasingly justified in many countries, but the bar for rate hikes is quite high due to concerns about the pace of disinflation (the progress is bumpy), significant distances from official targets and stickier core inflation. The first point (bumpy progress) was on full display today in Brazil, where headline inflation surprised to the upside, and the price diffusion index inched higher. Czech headline inflation eased in February, but many analysts drew attention to the fact that it was narrow-based. The Peruvian central bank confirmed the “wait-and-see” approach yesterday, in part due to geopolitical risks and uncertainties.

China Rebound

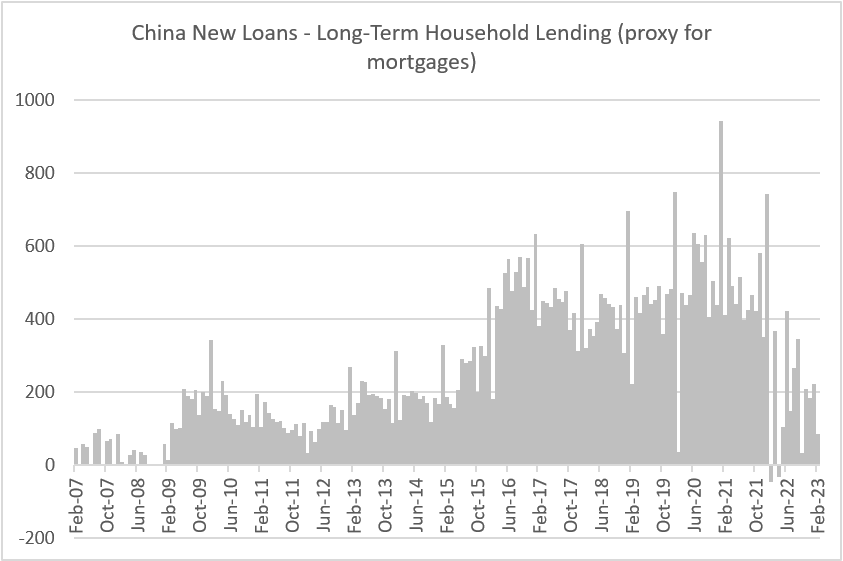

China featured prominently in the latest batch of global headlines, including renewed tensions with the U.S., the implications of President Xi Jinping’s third term and China’s reported role in rapprochement between two major energy players, Saudi Arabia and Iran. But today’s credit and monetary aggregates were just as important for the China rebound story. The headline numbers were stronger than expected – both total social financing and new yuan loans. However, details show that recovery is still in the initial stages and might take longer, especially as regards household consumption and housing sector/mortgages, which experienced a setback in February (see chart below). Stay tuned!

Chart at a Glance: China’s Mortgage Growth – Lower for Longer?

Source: Bloomberg LP

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.