Welcome to VanEck

Select Investor Type

12 August 2025

Key Risks: Government policy shifts, defense budget cuts, export controls and sanctions, political risk in client nations, trade policy volatility, dependence on government contracts, project delays and cost overruns, subcontractor and supplier reliability, cybersecurity threats, technological obsolescence, R&D failures. These factors can lead to significant losses, and past rallies may not be repeated.

Deep in Donald Trump’s ‘big, beautiful bill’ are tens of billions of dollars earmarked for spending on drones. The sweeping legislation includes $150bn for the Department of Defense to spend on innovative drone systems, naval technology and the modernization of US nuclear deterrence2.

It underlines the lessons being learnt from combat in Ukraine’s grinding three-year war. In the white heat of combat, drones are changing the nature of warfare: $400 unmanned aerial vehicles (UAVs) are taking out $2m tanks3.

Just as World War II proved the importance of the tank, so the effectiveness of today’s drone technology in Ukraine is widely acknowledged as a turning point. Inexpensive, quickly produced drones and other new technology have proved their essential place in modern warfare.

At a time when NATO’s members, mainly in Europe, are committed to ramping up defense spending from 2% of national output to 5% by 2035, the focus of defense ministries is turning in the direction of these UAVs4. The technology is readily available and cheap. Not only can drones give more bang for the defense procurement buck but also they are quickly bolted onto existing armed forces.

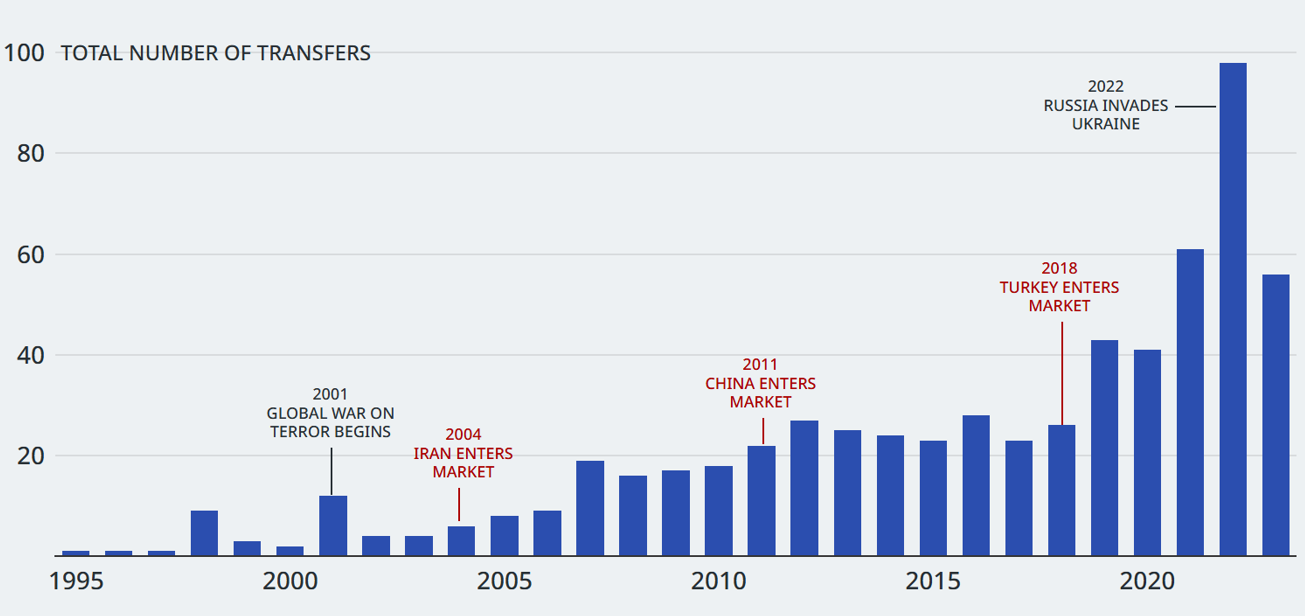

Over the past 20 years, the manufacture and sale of drones has proliferated. Notably, Turkey has emerged as a major supplier, as has China. Starting from a low base, the number of drone transfers – or sales and leases – has grown to total 633 between 1995 and 2023, according to research from the Center for New American Security (see chart)5. Roughly 40% of these went to Europe.

Source: CNAS, Drone Proliferation Dataset, September 2024.

Indeed, drones are part of a burst in innovation underway in what’s expected to be a boon for defense tech. Drones perform many tasks on the battlefield. They’re well known for bombing raids but they also resupply troops on the ground, conduct maritime covert operations and can even swarm satellites in space.

They are being used to devastating effect in Ukraine, where aerial drones such as Russia’s modified Iranian Shahed drones are striking cities daily6. For its part, Ukraine has deployed maritime UAVs to make much of the Black Sea a no-go zone for the Russian fleet7.

While the Ukrainians and Russians are necessarily at the forefront of drone warfare, some of the businesses pioneering drone design and manufacture in the West are private companies such as Anduril in the United States and Helsing in Germany. Increasingly, their drones are guided by artificial intelligence (AI) systems that can’t be jammed electronically8. However, as with all emerging technologies, rapid innovation in AI-driven systems also brings risks, such as unproven operational reliability and uncertain long-term adoption, which could affect the commercial success of these firms.

Additionally, though, the larger, publicly listed defense companies such as those within the VanEck Defense UCITS ETF also have drone businesses that they are scaling up. With its focus on technology, the US company Palantir provides AI software and solutions that enhance drone operations9. Others are more directly involved in drones, with a range of specialties.

For instance, the US defense giant Raytheon Technologies as well as producing its own Coyote Block 2 loitering drone is a leader in counter drone technologies10, a rapidly expanding field. Meanwhile, in France Thales Group makes tactical drones and command platforms11. Returning to the US, Huntington Ingalls Industries is a leader in unmanned maritime systems12. Despite the growing market, competition in the defense sector is intense, and contracts are often awarded through lengthy procurement cycles, which may delay revenue recognition and introduce business uncertainty.

None of this is to say that drones will replace other weapons systems. The lesson of Ukraine is that they complement the massive firepower required for a sustained military campaign. But they are an unexpected and fast-growing part of the armory, and one where the US military as well as those in Europe and elsewhere is keen to invest. Still, demand can fluctuate significantly depending on geopolitical developments, and future defense spending is subject to change based on shifting government priorities or economic conditions.

At the same time, investors should bear in mind that investing in equities is risky. You may lose money up to the total loss of your investment due to the Main Risk Factors such as Equity Market Risk, Liquidity Risks and Industry or Sector Concentration Risk described in the KID and in the sales prospectus. Market evolution is not guaranteed.

1 CSIS, July 2025.

2 How Donald Trump’s spending bill will boost Silicon Valley’s defence companies. FT.com. Aug 5, 2025.

3 The Week, July 2025.

4 SIPRI, June 2025.

5 https://www.cnas.org/publications/reports/drone-proliferation-dataset

6 FT, July 2025.

7 Navy Lookout, July 2025.

8 Helsing, February 2025.

9 Palantir, October 2024.

10 RTX, July 2025.

11 Thales, July 2025.

12 Huntington Ingalls Industries, July 2025.

IMPORTANT INFORMATION

This is marketing communication. Please refer to the prospectus of the UCITS and to the KID/KIID before making any final investment decisions. These documents are available in English and the KIDs/KIIDs in local languages and can be obtained free of charge at www.vaneck.com, from VanEck Asset Management B.V. (the “Management Company”) or, where applicable, from the relevant appointed facility agent for your country.

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Neustadtgasse 1a, 8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from a financial intermediary for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as financial intermediaries and Wealth Managers.

This information originates from VanEck (Europe) GmbH, which is authorized as an EEA investment firm under MiFID under the Markets in Financial Instruments Directive (“MiFiD). VanEck (Europe) GmbH has its registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the Management Company. The Management Company is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

This material is only intended for general and preliminary information and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed.

VanEck Defense UCITS ETF (the "ETF") is a sub-fund of VanEck UCITS ETFs plc, an open-ended variable capital umbrella investment company with limited liability between sub-funds. The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. The product described herein aligns to Article 6 Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. Information on sustainability-related aspects pursuant to that regulation can be found on www.vaneck.com. Investors must consider all the fund's characteristics or objectives as detailed in the prospectus or related documents before making an investment decision.

The indicative net asset value (iNAV) of the UCITS is available on Bloomberg. For details on the regulated markets where the ETF is listed, please refer to the Trading Information section on the ETF page at www.vaneck.com. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown. Performance data for the Irish domiciled ETFs is displayed on a Net Asset Value basis, in Base Currency terms, with net income reinvested, net of fees. Returns may increase or decrease as a result of currency fluctuations. Investors must be aware that, due to market fluctuations and other factors, the performance of the ETFs may vary over time and should consider a medium/long-term perspective when evaluating the performance of ETFs.

Investing is subject to risk, including the possible loss of principal. Investors must buy and sell units of the UCITS on the secondary market via an intermediary (e.g. a broker) and cannot usually be sold directly back to the UCITS. Brokerage fees may incur. The buying price may exceed, or the selling price may be lower than the current net asset value. The Management Company may terminate the marketing of the UCITS in one or more jurisdictions. The summary of the investor rights is available in English at: complaints-procedure.pdf (vaneck.com). For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

07 January 2019

Investors can bet on future trends. The European ETF market in particular promises enormous growth potential. Special areas such as e-sports, ESG and cryptocurrencies as well as smart beta offer investors interesting investment opportunities.