To Blockchain or Not to Blockchain?

14 March 2023

February has been a month full of significant events, especially for Bitcoin and Ethereum, even though the market remained almost flat throughout the month. ETHDenver, the largest and oldest Ethereum building event, took place at the end of February. As someone who has attended similar events over the years, I can say that it provides investors with a new and interesting perspective on the industry as a whole. It is always exhilarating to see so many people get excited about the tough mathematical challenges that lie at the core of cryptocurrency. The main event at ETHDenver is the buidlathon, which is essentially a large hackathon.

Building Building Building… not just crypto native firms

While the ETHDenver community was busy building applications, it's important to note that crypto layoffs affected a significant number of employees in January alone. According to CoinGecko data, 2,806 crypto workers lost their jobs, which is a significant number considering that 6,820 crypto workers lost their jobs in all of 2022. In other words, in just one month, crypto layoffs in 2023 reached 41% of the total layoffs in 2022.

Interestingly, demand for blockchain developers seems to be on the rise. In fact, the demand has never been higher than it currently is, according to software industry insiders. Demand for blockchain programming skills increased by 552% in 2022, as per a report by DevSkiller, which compiled over 200,000 skills assessments. Tech firms can use these assessments as part of their hiring process to vet a developer's proficiency. A significant part of this demand comes from traditional firms looking to hire developers with real-world experience beyond test environments in the crypto space. Finance firms looking to build their own blockchains could be another key driver of demand for developers.

Financial Institutions’ Best Interest

Despite the ups and downs that cryptocurrency has experienced, traditional financial institutions are still bullish on crypto. This is evident from the bold statements made by several of the mainstays of traditional finance, such as Blackrock, in support of tokenization. They are essentially bringing stocks, bonds, and other traditional financial assets onto a blockchain network.

A notable highlight of the past month is that even after a group of U.S. senators, including Elizabeth Warren and Dick Durbin, urged Fidelity to reconsider its Bitcoin embrace, arguing that digital assets exposed retirement savers to unnecessary risk, Fidelity's offering still stands. Fidelity is just one of many sizable firms that have not backed away from crypto, and it continues to publicly declare that digital assets are rife with opportunity.

Ironically, Bitcoin was created to cut out financial middlemen and let people own their own money, yet traditional financial giants are adopting crypto steadily. However, this adoption is ultimately beneficial for the crypto itself. The treasuries of crypto projects, which are used to pay salaries to developers and founders, benefit greatly if demand for the token in which the treasury is denominated increases. Therefore, indirectly, bringing crypto closer to traditional investors benefits the crypto industry as a whole.

One might wonder if traditional financial institutions are digging their own grave by becoming middlemen for crypto. However, the truth is that they are simply following their clients' best interests. If offering crypto-based products is what clients want, then financial institutions will continue to offer them.

Visualizing Investor Conditions

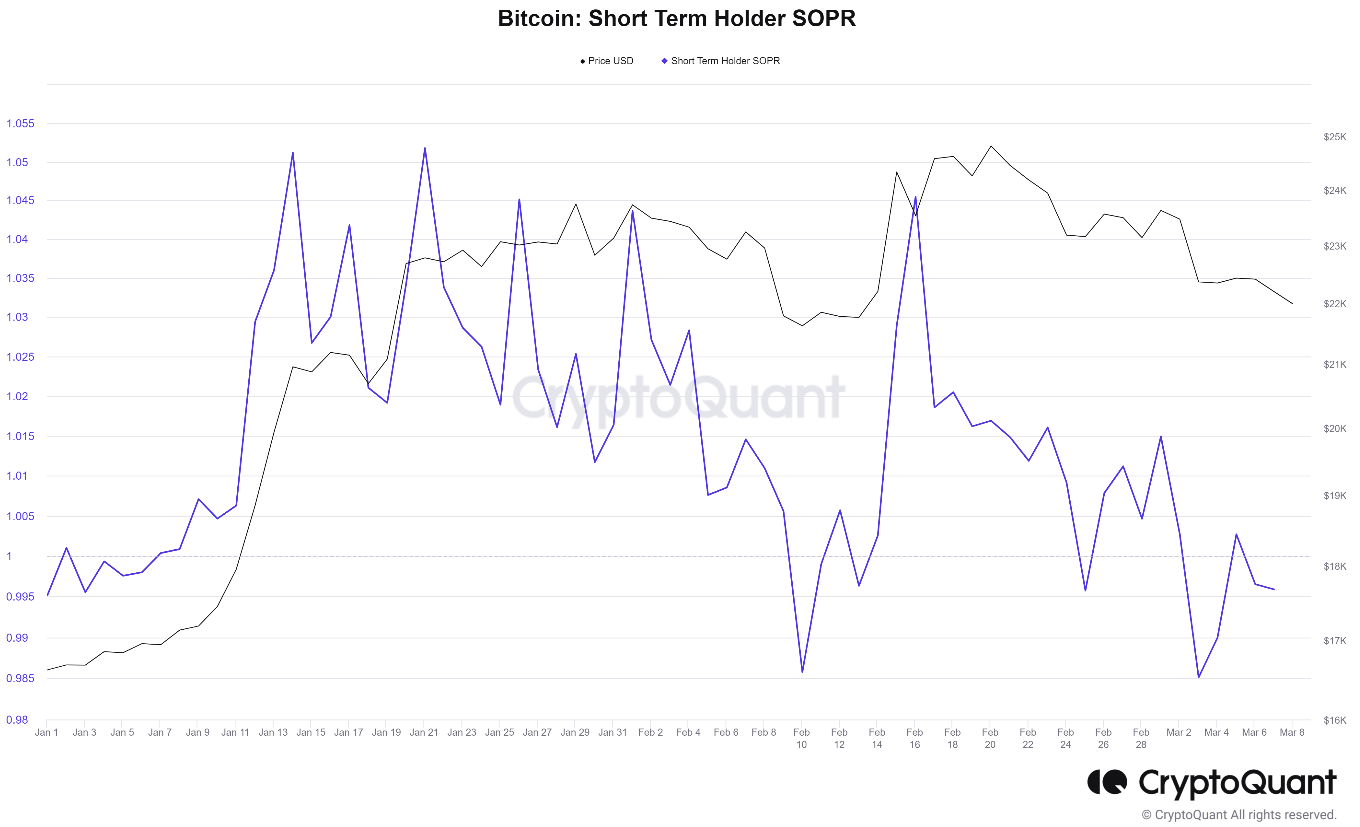

February has been month mostly flat in terms of price performance, but what do other indicators show? We can try to categorize the UTXOs based on how long ago the coins have been spent. We can classify Bitcoin holders based on the average time in days of coins being spent. If this value is low, coins are spent quickly after acquisition and the investor can be classified as a short-term holder (STH). If the value is high we can classify the investor as a long-term holder (LTH). More specifically, we can look at whether STHs and LTHs are selling at a profit. Currently, we see that LTHs are still selling at a loss despite the market recovery. How about STHs? STHs were actually making profits in mid-January and mid-February, but the STH-SOPR ratio has dropped below 1 again at the end of February.

*Short Term Output Profit Ratio (STH-SOPR) is a ratio of spent outputs (alive more than 1 hour and less than 155 days) in profit at the time of the window. It is calculated as the USD value of spent outputs at the spent time (realized value) divided by the USD value of spent outputs at the created time (value at creation).

*Source: CryptoQuant.com

Important Information

We publish this newsletter to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

ETN Disclaimer

Important information

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Straße 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MarketVector Indexes GmbH, which has contracted with CryptoCompare Data Limited to maintain and calculate the Index. CryptoCompare Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector Indexes GmbH, CryptoCompare Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com. Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. '1st year' shows the most recent of these 12-month periods and '2nd year' shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Important Disclosure

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

Related Insights

Related Insights

11 October 2024

07 November 2024

05 November 2024

11 October 2024

11 October 2024