VanEck New China ESG UCITS ETF

- Access China’s new economy

- Exposure to the sectors forecasted to lead future growth

- Diversified basket of companies

- Thorough screening from both a financial and ESG standpoint

China’s booming new economy is increasingly relevant in the global landscape. The VanEck China ETF captures this potential and focuses on the implications of what could become the largest middle class in the world.

Risk of a China ETF: You may lose money up to the total loss of your investment due to Emerging Markets Risk and Risk of investing in smaller companies as described in the Main Risk Factors, KID and prospectus.

With a population of over 1.4 billion people, China has a vast and diverse market, offering significant potential for investors. The country's young population, with a median age of just 38, is expected to drive economic growth and consumer spending for years to come. China's rapidly growing wealth presents additional opportunities for investors. Investing in VanEck's China ETF allows you to access this exciting growth potential. With a single investment, you can gain exposure to a diversified portfolio of companies that are uniquely positioned to capitalize on China's new economy and the country's dynamic population and expanding middle class.

According to some projections, China is expected to surpass the United States as the world's largest economy in the coming years. The country's impressive growth trajectory shows no signs of slowing down anytime soon. China has made significant investments in research and development, infrastructure, and emerging technologies like artificial intelligence and 5G. These efforts have enabled China to become a global leader in many key industries and positioned it to continue growing its economy well into the future. The VanEck China ETF allows to benefit from this accelerating growth.

Moreover, the following factors will be particularly crucial for Chinese economic growth:

China’s middle class is growing at a pace much faster than other major economies. It could soon have the largest middle class in the world. As a consequence, certain sectors are poised to benefit more than others, also thanks to the rising GDP per capita and overall welfare in the country.

The following graph displays the share of urban households by income. It is remarkable how, until the 80s, almost all households were classified as poor. After the first wave representing the growth of a lower middle class segment, the upper middle class becomes the largest social class. By 2025, almost 60% of Chinese urban households are forecasted to belong to the upper middle class.

Source: World Bank national accounts data and OECD National Accounts data files as of 2022.

Zhejiang Jiuzhou Pharmaceutical Co., Ltd. is a trailblazing innovative drug CDMO company founded in 1998, headquartered in Taizhou, Zhejiang. This global leader offers comprehensive, one-stop drug R&D and production solutions, serving global pharmaceutical companies from pre-clinical phases to commercial launch. With a commitment to green pharmaceutical innovation, Jiuzhou Pharmaceutical excels in cutting-edge technologies, boasting independent intellectual property rights and delivering industry-leading technical solutions. Their mission extends to empowering partners to accelerate the launch of innovative drugs worldwide, making a positive impact on global health. With 50 years of experience and a vast global presence, Jiuzhou Pharmaceutical is at the forefront of pharmaceutical development and innovation.

*Part of the portfolio as of 30 September 2023.

WuXi AppTec is a globally renowned company operating in Asia, Europe, and North America, redefining the pharmaceutical and healthcare industry through innovation. With a broad portfolio of R&D and manufacturing services, they provide one-stop solutions, from drug discovery and development to clinical research and manufacturing, helping pharmaceutical companies worldwide deliver groundbreaking treatments efficiently and cost-effectively. WuXi AppTec's cutting-edge business models and open-access platform enable them to serve over 6,000 customers in more than 30 countries. Their impressive journey, including receiving an AA ESG rating from MSCI in 2023, reflects their unwavering commitment to advancing healthcare innovation and realizing their vision of making every drug and disease treatable. With a rich history spanning several decades, WuXi AppTec is a trailblazer in the field of pharmaceutical development and innovation, poised to shape the future of global health.

*Part of the portfolio as of 30 September 2023.

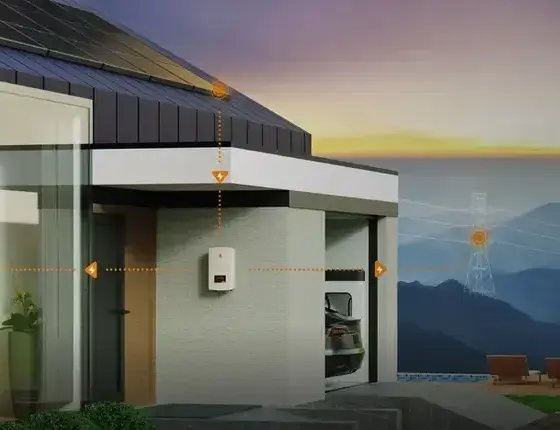

Jinlang Technology Co., Ltd. is a renowned high-tech enterprise that has taken the global new energy industry by storm since its founding in 2005. As one of the world's largest inverter manufacturers, they specialize in research, development, production, sales, and service of string inverters for photovoltaic power generation systems. Notably, they made history as the first A-share listed company with string inverters as its core business and the first to receive reliability testing from PVEL, a highly regarded third-party organization in the inverter sector. Jinlang Technology's unwavering commitment to innovation is reflected in their significant R&D investments, partnerships with esteemed research institutions, and pioneering role in setting national and industry standards. With a rapidly growing global presence and a strong focus on clean energy, Jinlang Technology is shaping the future as a leading manufacturer of energy storage and photovoltaic inverters.

*Part of the portfolio as of 30 September 2023.

Hisense Group, a Chinese multinational appliance and electronics manufacturer based in Qingdao, Shandong Province, has been a pioneer in the global consumer electronics industry. It is renowned for being China's largest TV manufacturer since 2004 and is a major player in white goods, including televisions, set-top boxes, and digital TV broadcasting equipment. Hisense has consistently innovated and expanded its product portfolio, acquiring brands like Toshiba and Sharp, and making technological breakthroughs like inventing transparent 3D television and launching the world's first true 8K 10-bit HDR screen TV based on an AI-powered HDR algorithm. With a commitment to quality and a strong global presence, Hisense continues to be a prominent name in the electronics and consumer technology sector.

*Part of the portfolio as of 30 September 2023.

Chang'an Automobile Co., Ltd., founded in 1862, holds a prominent place in the history of the Chinese automotive industry as the country's oldest car manufacturer. Despite being the smallest of China's "Big Four" state-owned car manufacturers, Chang'an has demonstrated impressive achievements and innovative strategies. The company's forward-thinking commitment to environmentally-friendly transportation is commendable, as it plans to cease production of internal combustion engine (ICE) vehicles by 2025 and shift focus to hybrid and electric vehicles to meet China's emissions standards and tackle air pollution issues. With its diverse portfolio of brands and products, including Changan, Oshan, Kaicene, and its electric vehicle brand Deepal, Chang'an is poised for a promising future in China's ever-evolving automotive landscape.

*Part of the portfolio as of 30 September 2023.

The VanEck China Fund enables an investment in the growing new economy of the country. After careful analysis of demographic and macroeconomic trends shaping China and the rest of Asia, it targets specific sectors expected to lead the growth in the next decades. In the wake of a rising upper middle class and disposable income, sectors like consumer discretionary and staples, information technology and healthcare are expected to outperform.

Click on following buttons for more info:

The China ETF by VanEck adopts a detailed approach to filter the companies included in the investment strategy. Both fundamental and ESG related factors are taken into account.

The VanEck China ETF tracks the MarketGrader New China ESG index which applies a sound fundamental evaluation of the companies that are included in the portfolio. The process starts by screening their financial statements and measuring if these businesses present the characteristics necessary to generate long term sustainable returns. Afterward, several indicators are grouped into a single score from 0 to 100, where a value larger than 60 stands for a BUY rating. This way, a uniform, and standardized approach is adopted to identify good investment opportunities.

Coherent with the overall efforts of offering investors a sustainable and responsible investment solution, VanEck leverages the expertise of Owl Analytics. Owl utilizes the largest ESG data set in the industry based on corporate disclosures, filings, news sources and research firms.

Performance of the China ETF by VanEck

Because all or a portion of the Fund are being invested in securities denominated in foreign currencies, the Fund's exposure to foreign currencies and changes in the value of foreign currencies versus the base currency may result in reduced returns for the Fund, and the value of certain foreign currencies may be subject to a high degree of fluctuation.

Investments in emerging market countries are subject to specific risks and securities are generally less liquid and less efficient and securities markets may be less well regulated. Specific risks may be heightened by currency fluctuations and exchange control; imposition of restrictions on the repatriation of funds or other assets; governmental interference; higher inflation; social, economic and political uncertainties. A further risk of investing in this ETF is that the assessment of Chinese financial reports by relevant regulators may not be adequate.

The securities of smaller companies may be more volatile and less liquid than the securities of large companies. Smaller companies, when compared with larger companies, may have a shorter history of operations, fewer financial resources, less competitive strength, may have a less diversified product line, may be more susceptible to market pressure and may have a smaller market for their securities. This is another factor to take into consideration before investing in a China ETF.