AMX ETF

VanEck AMX UCITS ETF

AMX ETF

VanEck AMX UCITS ETF

Fund Description

The VanEck AMX UCITS ETF invests in Dutch securities that are traded on the Euronext Amsterdam and rank 26 – 50 based on their market capitalisation.

-

NAV€89.91

as of 19 Sep 2024 -

YTD RETURNS-0.32%

as of 19 Sep 2024 -

Total Net Assets€20.9 million

as of 19 Sep 2024 -

Total Expense Ratio0.35%

-

Inception Date14 Dec 2009

-

SFDR ClassificationArticle 6

Overview

Fund Description

The VanEck AMX UCITS ETF invests in Dutch securities that are traded on the Euronext Amsterdam and rank 26 – 50 based on their market capitalisation.

- Direct access to 25 listed medium-sized Dutch companies

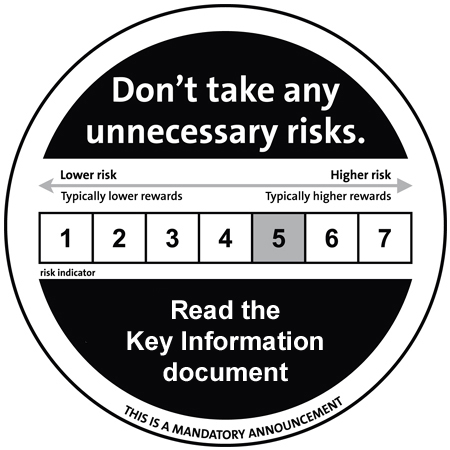

Risk Factors: Liquidity risk, equity market, limited diversification risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

AMX Index (RAMX)

Fund Highlights

- Direct access to 25 listed medium-sized Dutch companies

Risk Factors: Liquidity risk, equity market, limited diversification risk. Please refer to the

KIDand the Prospectus for other important information before investing.

Underlying Index

AMX Index (RAMX)

Capital Markets

VanEck partners with esteemed market makers to ensure the availability of our products for trading on the mentioned stock exchanges. Our Capital Markets team is committed to continuously monitoring and assessing spreads, sizes, and prices to ensure optimal trading conditions for our clients. Furthermore, VanEck ETFs are available on various trading platforms, and we collaborate with a wider range of reputable Authorized Participants (APs) to promote an efficient and fair trading environment. For more information about our APs and to contact our Capital Markets team, please visit factsheet capital markets.pdf.Performance

Holdings

Portfolio

Distributions

Literature

Index

Index Description

The AMX Index® is derived from Amsterdam Midkap Index. The index tracks the performance of the 25 most actively traded shares, after the AEX listed shares, listed on Euronext Amsterdam. The weight of a share within the AMX Index® is determined based on the market capitalisation: the larger the company, the greater its weight in the AMX Index®. The maximum weight per share is 15%.

Index Key Points

Underlying Index

AMX Index (RAMX)

Index composition

The index has the followings specifications:

• It is a weighted index based on free float-adjusted market capitalisation.

• At least once annually the index reviews the weight of the shares. This review takes place on the third Friday of March at the end of the trading day. The weight of a share within the AMX Index® is determined based on the market capitalisation: the larger the company, the greater its weight in the AMX Index®. The maximum weight per share is 15%.

• Further reviews may take place at the end of the trading day on the third Friday of June, September and December. Shares may then be added to the index or removed from the index.

Index Provider

Euronext

Download Index Methodology