Growth, Prices, Rates – Slower Pace?

28 November 2022

Read Time 2 MIN

Fed Policy Rate Path

Recession concerns and nascent disinflation explain why the market is comfortable pricing in smaller rate hikes and even some rate cuts going forward. The Fed Funds Futures show a 50bps U.S. Federal Reserve (Fed) hike in December, and a total of 38bps of rate cuts in the second half of 2023. It would be interesting to see whether Fed Chairman Powell’s presentation on Wednesday will change these expectations. As regards emerging markets (EM), Chile leads the “easing” pack with around 545bps of rate cuts priced in for the next year. The outlook for other EMs is much less aggressive, but even disinflation laggards like Mexico are expected to make room for rate cuts (to the tune of 90bps) in H2-2023.

China Reopening

The latest China headlines – the anti-lockdown protests and a spike in the number of new COVID cases – led to confusion about the pace of re-opening, weighing on near-term growth expectations. The consensus thinks that China’s domestic activity gauges will show further deterioration in November. This would explain Friday’s pre-emptive cut in the reserve requirements for banks (albeit many observers are skeptical that the move would make a big difference for funding costs, given that the cut was very small – only 25bps). One possible outcome is that the protests might lead to more policy stimulus to compensate for the re-opening setbacks. Market participants reacted positively to reports of further support for real estate developers, including low interest loans to buy developers’ onshore bonds.

Brazil Fiscal Debates

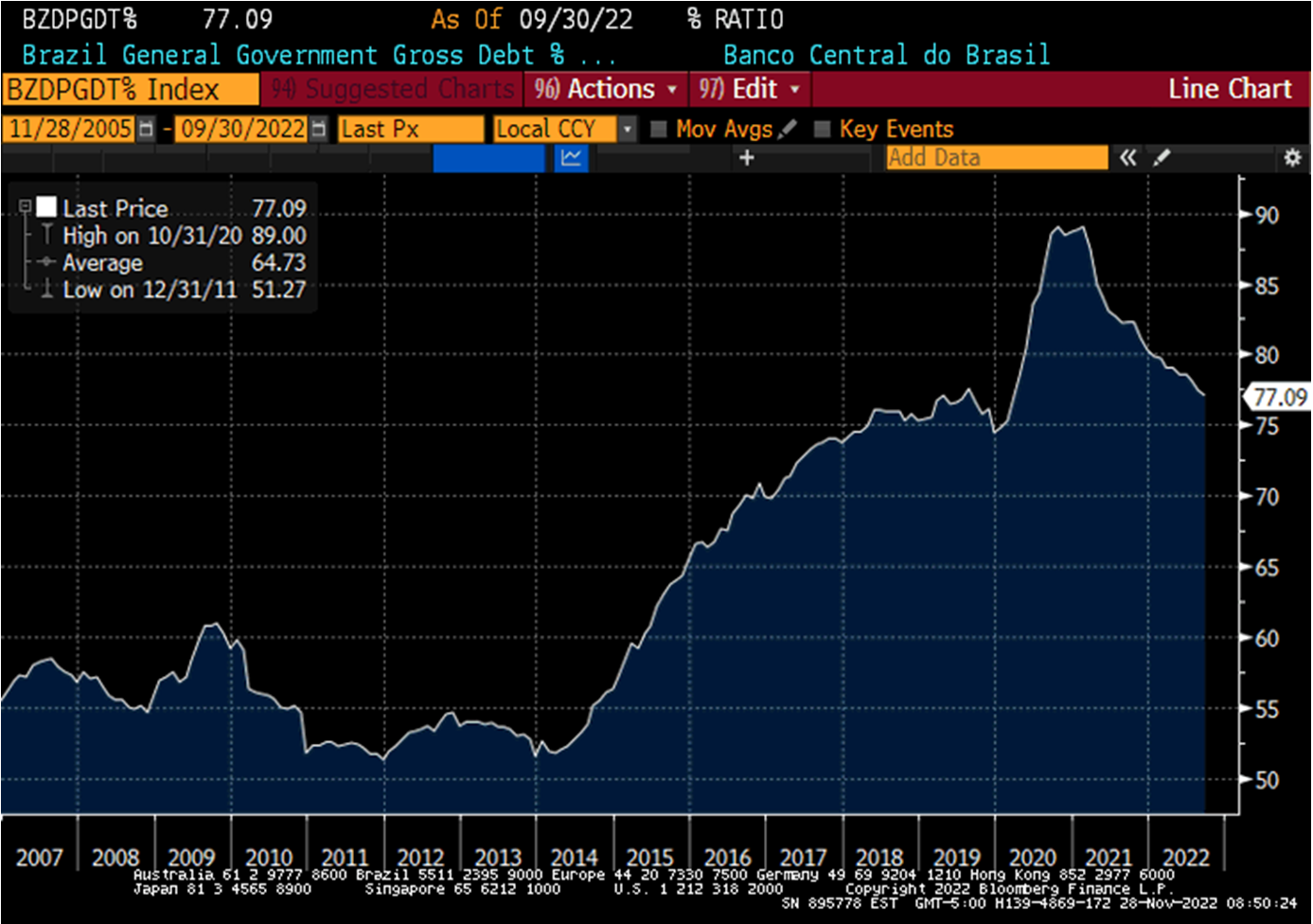

Brazil is among very few countries where the market continues to price in additional rate hikes – after pricing in a decent number of rate cuts going into the presidential elections. The local swap curve added at least one more hike for the next six months (a total of 101bps). This might look excessive/too hawkish, but these expectations reflect concerns about the new administration’s spending plans for the next four years, which can reverse the post-pandemic decline in Brazil’s debt-to-GDP ratio (see chart below). Fiscal/policy continuity concerns had a major impact on Brazil’s local debt performance in November (the only negative total return among all GBI-EM constituents). The damage can be undone, but it would require more certainty and less controversy about the fiscal outlook. Stay tuned!

Chart at a Glance: Brazil Debt/GDP Ratio – Lower But Still Very High

Source: Bloomberg LP.

BZDPGDT% Index – Brazil General Government Gross Debt Percentage. Represents Brazil’s debt-to-GDP ratio.

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.