Pivot-Ready?

27 January 2023

Read Time 2 MIN

EM Tightening Cycles

One of this week’s lessons is that many emerging markets (EM) central banks do not act as pivot-ready as the market expects – even in places where disinflation is already underway and growth is clearly slowing. South Africa’s split decision yesterday (with two out of three board members voting for a 50bps hike) is a good example. Thailand’s central bank also sent a hawkish message earlier this week (as a backdrop for a 25bps rate hike). Hungary’s central bank raised the reserve requirements for banks (as the effective policy rate is already around 16%). The Chilean central bank stayed on hold yesterday, but its statement drew attention to a wide gap between inflation and the target. Today’s rate-setting meeting in Colombia and the next week’s policy rate decision in Brazil will also be closely watched (these countries account for about 14% of the J.P. Morgan’s EM local bond index). Brazil’s policy uncertainty (especially on the fiscal front) and unhelpful comments about the central bank’s independence keep many investors on the sidelines.

FED Rate Expectations

So, the best way to describe EM central banks’ policy stance is “prudent” rather than “pivot-ready”. What about their developed markets (DM) counterparts? We do not have to wait for much longer – both the U.S. Federal Reserve and the ECB are meeting next week, and today’s Personal Consumption Expenditure prints in the U.S. looked consistent with the market expectation of a slower pace of hikes (+25bps). But as long as DM hikes continue, EM’s policy cushion (the policy rate differential with DMs) will be getting smaller. The differential between EM local rates and U.S. Treasuries is also narrowing, especially in Asia (J.P. Morgan’s GBI-EM Asia yield-to-maturity is mere 3.95%). One can argue that this reflects China’s reopening, but the trend is not very new and it might signal that the region is truly re-rating – with more “EM Graduates”, orthodox policies, and, yes, tighter spreads.

EM Inflows

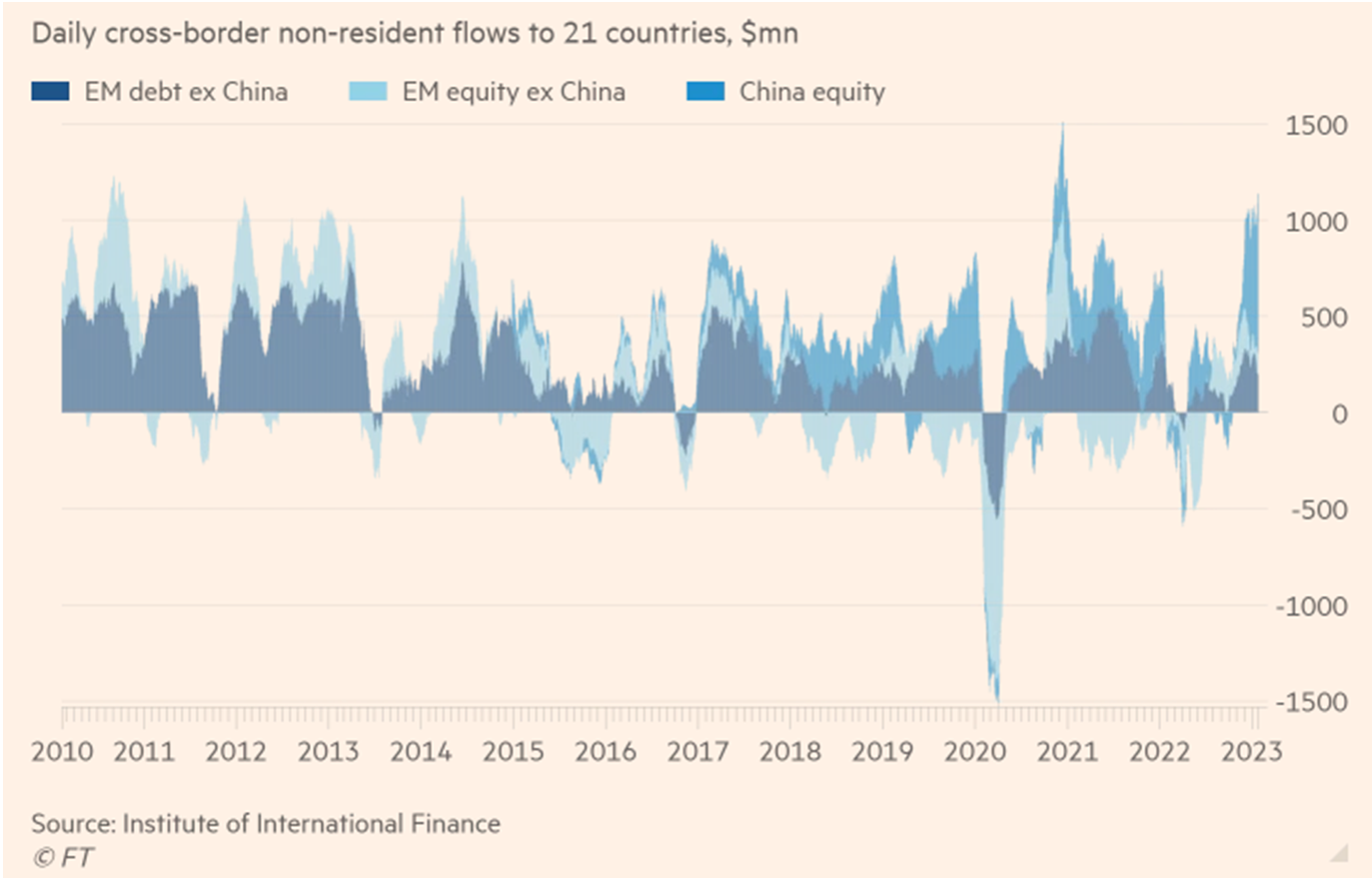

Massive inflows into EM assets so far this year show that investors are not deterred by the narrowing rate differentials – the China’s reopening/disinflation/softer landing stories being powerful sentiment “boosters” (see chart below). Sell-side surveys show that cash balances are still significant, albeit we are mindful of high EM bond issuance, with many governments using this opportunity to pre-finance their 2023 issuance needs. High EM inflows also reflect expectations of the Fed’s eventual pivot. The Fed does not seem eager to fall in line with this view – would next week be different? Stay tuned!

Chart at a Glance: Huge Pickup in Inflows into EM Assets

Source: Financial Times

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.