EM, Gold, Action!

30 January 2023

Read Time 2 MIN

EM and Gold Reserves

We try not to bother our readers with IMF research papers – especially when the market is preoccupied with China’s rebound (and the next batch of activity gauges) and the U.S. Federal Reserve’s (Fed’s) rate-setting meeting (the market expects a slower pace of hikes) – but this one was too good to ignore. The paper is about monetary gold. The report’s title is rather dramatic – Gold as International Reserves: A Barbarous Relic No More? – and it is a gold mine of data (no pun intended) on the subject. It also provides valuable insights into the impact of crises, geopolitical uncertainty and – pay attention! – sanctions on emerging markets (EM) reserve accumulation and diversification.

EM Sovereign Spread

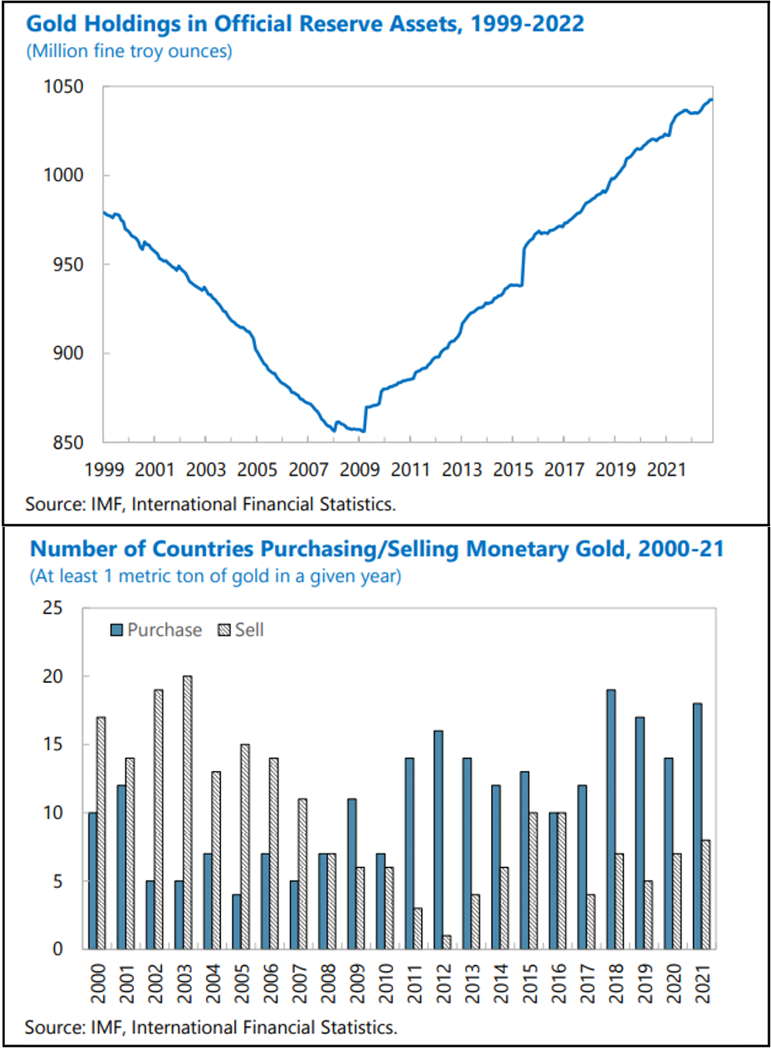

The 1997 global financial crisis was the turning point in EM’s approach to international reserves management. The proliferation of orthodox policies – especially inflation targeting, fiscal discipline and letting currencies float more freely – strengthened the external accounts, boosted reserves and led to major EM sovereign debt spread compression. This is behind Portfolio Manager Eric Fine’s long-standing argument that hard currency debt is particularly well-anchored in EMs with better fundamentals, providing a safer way for investors to express a positive EM view. And now EM central banks are taking the reserve accumulation one step further, being the only “active diversifiers” into gold, according to the IMF. How active? VanEck’s Deputy Portfolio Manager, Gold and Precious Metals, Imaru Casanova drew my attention to the fact that during the third quarter of 2022, central banks bought 400 tonnes of gold net – a quarterly record.

EM Reserves and Sanctions

So, why this sudden urge to buy even more gold now? Well, the IMF’s first argument is perfectly logical – “gold appeals … as a safe haven in periods of … volatility”. But the IMF also used some statistical techniques to demonstrate that “the imposition of financial sanctions by … the main reserve-issuing economies is associated with an increase in the share of central bank reserves held in the form of gold”. The IMF also presented “evidence that multilateral sanctions have a larger impact … on the share of reserves held in gold” than unilateral sanctions. Given that the world geopolitical landscape remains very fluid, the love affair between EMs and gold is unlikely to be over any time soon. Stay tuned!

Chart at a Glance: Central Banks’ Gold Purchases – No End in Sight?

Source: IMF’s Working Paper (WP/23/14) “Gold as International Reserves” A Barbarous Relic No More?

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.