Rate Hikes – The End Is Nigh?

01 February 2023

Read Time 2 MIN

Fed Rate Cuts

The focus of the day is the U.S. Federal Reserve’s (Fed’s) rate-setting meeting. The U.S. data-flow – including below-consensus ADP employment change and the ISM survey – are supportive of a smaller +25bps move, but the main “attraction” will be the Fed’s guidance. The market continues to price in rate cuts in 2023 (around 44bps), despite the fact that the Fed’s message has been more hawkish. The market expectation of policy easing in emerging markets (EM) and developed markets (DM) set a potentially positive stage for lower interest rates, driving EM performance at the end of 2022, and so far this year. And this is the reason why the EM folks will be glued to their Bloomberg screens this afternoon.

EM Disinflation

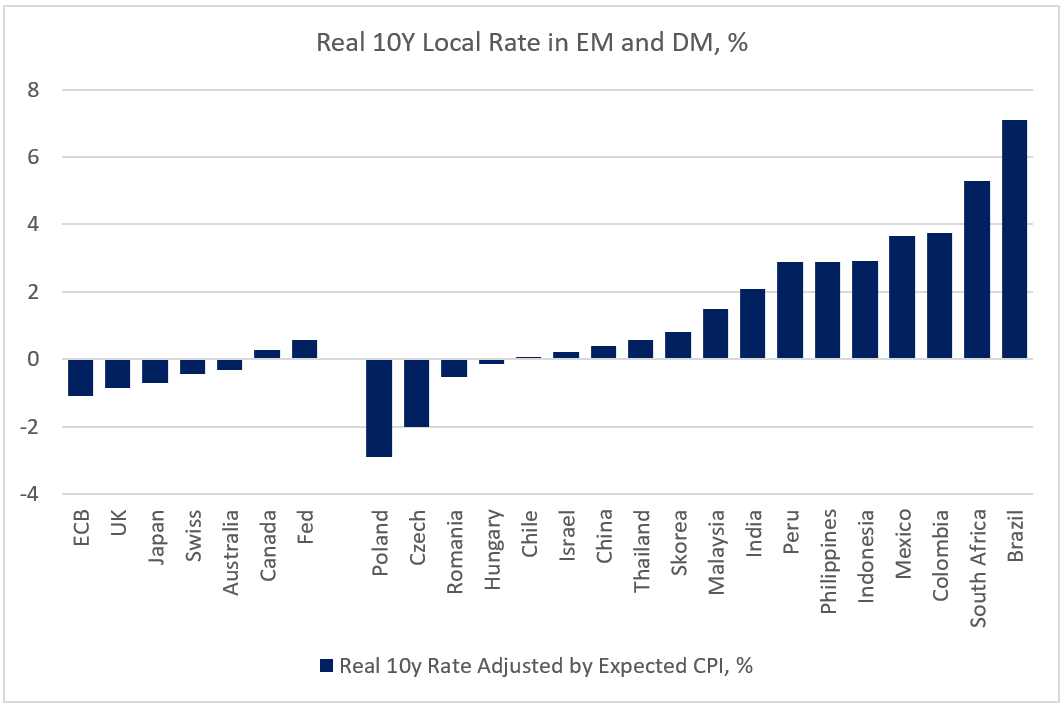

Some fundamental developments in EM argue in favor of ending the tightening cycles. Peak inflation is already behind in most countries – today’s downside surprises in Indonesia and Peru are good examples. A high base effect will also help to drive inflation down in the coming months – as will lower energy prices. The latter will have a particularly strong impact in Central Europe, where headline inflation can decline to single digits in Q4. Lower inflation is a boon for EM real yields, which already look attractive compared to their DM peers (see chart below).

China and EM Growth Tailwinds

There are risks though – and this is why many EM central banks are not in a hurry to open the door for rate cuts. Inflation is still far from the official targets in most places. Fiscal stimulus might still be positive in several EMs (due to a more populist policy agenda like in Brazil or an election cycle like in Poland). China might rebound at a faster pace – a potential upside risk for commodity prices, but also a major tailwind for EM growth, especially in countries with strong trade/tourism connections with China. Today’s stronger than expected activity gauges (Purchasing Managers Indices) in Thailand, Indonesia and the Philippines gave some food for thought in this regard. In Europe, the manufacturing PMIs in Poland and the Czech Republic continued to bounce from low levels. If the growth outlook continues to improve, EM central banks might feel comfortable staying on the sidelines for longer. Stay tuned!

Chart at a Glance: EM Real Local Rates – Nice Lineup!

Source: VanEck Research; Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.