Welcome to VanEck

Select Investor Type

11 November 2025

When the US and China agreed a one-year trade truce at the end of October, a group of 17 metallic elements known as rare earths were at the heart of their settlement. China agreed to postpone export controls1 on these minerals that have become crucial for high-tech applications in electronics, green energy and defense.

Playing a characteristically long game, China has come to dominate the industry and commands more than 90% of production and processing. As long ago as 1987, then-Chinese leader Deng Xiaoping declared: “The Middle East has oil, China has rare earths”2.

In the decades since, rare earths have become essential for the evolving global economy. They are key for a range of applications such as electric vehicles EVs, wind turbines, robotics, drones and fighter jets3. It’s fair to say that they are at the heart of economic and military competition between nations.

The US and other major nations are keenly aware of this. The US is introducing increasingly radical steps to kick-start the production of rare earths outside China, sparking a rally in the share price of rare earth mining companies, a trend that was also evident4 in the VanEck Rare Earth and Strategic Metals UCITS ETF.

The name rare earth is a misnomer, as these lustrous silvery-white soft heavy metals are relatively abundant. But the 15 lanthanide elements, along with scandium and yttrium, are only found in compounds, rather than as pure metals, that are difficult to isolate and purify. Refining them is complex and environmentally sensitive.

While the US and Europe treated raw earths as an afterthought for many years, China’s low-cost processing industry quelled any competition. In recent years, that has become increasingly problematic for other countries as rare earths are essential for the growing electrification of the global economy associated with artificial intelligence and the energy transition.

Just as China has sought to weaponize rare earths for geopolitical means, so the US and others are urgently seeking to break the country’s stranglehold on supply. In 2025, China introduced new licensing rules on rare earth exports amid US controls on advanced semiconductor chips5. The October truce suspended these controls6 but not before the US, EU and others had begun introducing measures to stimulate supply from elsewhere.

Global appetite for investment in rare earths has surged because these metals now sit at the intersection of national security, clean energy and industrial policy. Governments in the US, Europe, Japan and Australia are moving quickly to secure supply chains through direct financing, tax incentives and procurement guarantees. For instance, the US Department of Defense in July acquired a 15% stake in MP Materials, the largest US producer of rare earths7.

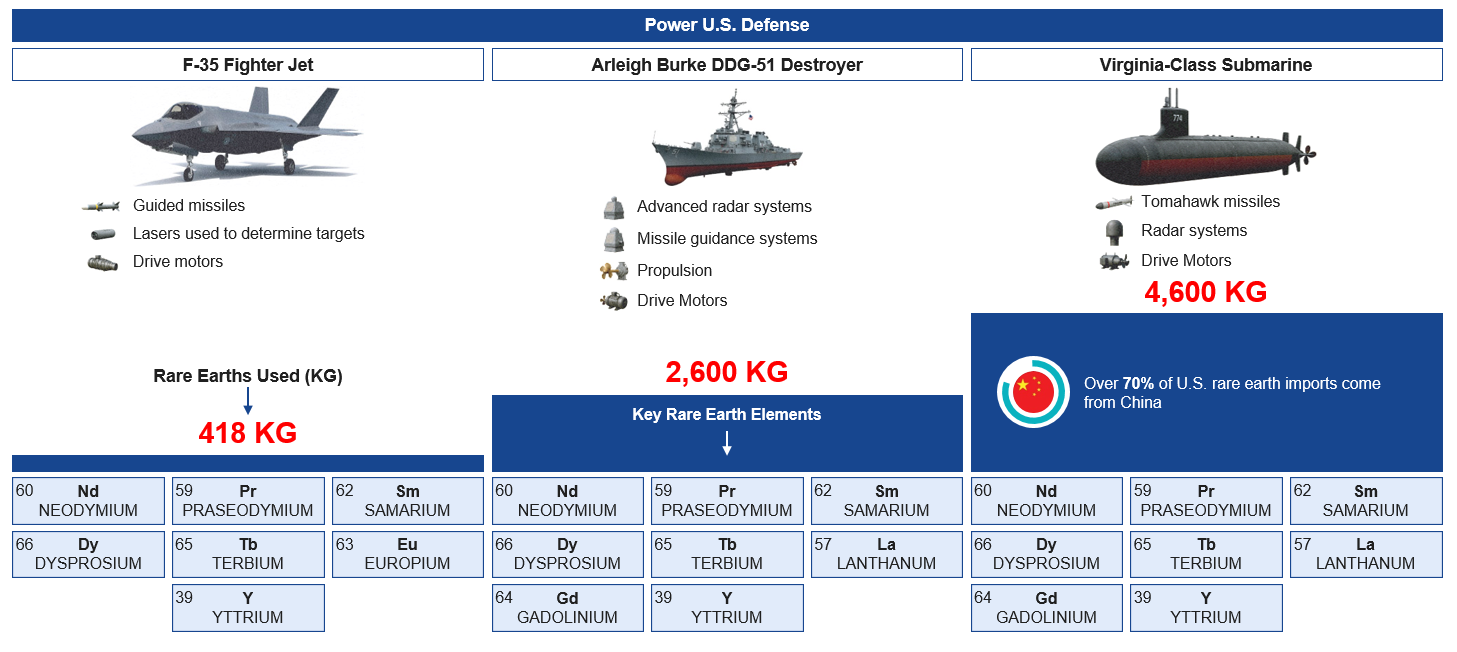

Investors see steadily growing demand for rare earths backed by government policy. They are an essential component of AI hardware and clean energy technologies such as grid storage, wind power, and electric vehicles (EVs), as well as advanced defense systems, including the F-35 fighter jet (see graphs below).

Data. (2025). Critical Minerals Dataset - Data product - IEA.

Source: Venditti, B. (2025, July 20). Visualizing how rare earths power U.S. defense. Visual Capitalist.

But investing in rare earth miners and other companies in the supply chain remains subject to a range of risks, whether from geopolitics, trade disruptions, renewed export restrictions or political instability in key producing countries. What’s more, there is project execution risk, as some companies in the sector may depend on unproven technologies, complex permitting processes and sustained government support.

For that reason, diversification across companies is key. Our VanEck Rare Earth and Strategic Metals UCITS ETF has 20+ holdings spread across nine countries. Rare earth elements, comprising 17 metallic elements, have become a focal point of geopolitical and economic attention as countries seek to strengthen their strategic positions. Even without government intervention, these materials remain fundamental building blocks for much of today’s technology and will continue to be essential to the innovations of the future.

1 Jackson, L. (2025, October 30). US gets rare earth reprieve from China, but not rollback. Reuters from https://www.reuters.com/sustainability/climate-energy/china-agrees-one-year-rare-earth-export-deal-issue-settled-says-trump-2025-10-30/

2 Financial Times. (2023, September 19). Can Europe go green without China’s rare earths? Retrieved from https://ig.ft.com/rare-earths/

3 SFA (Oxford). Critical minerals and magnets 2025, from https://www.sfa-oxford.com/knowledge-and-insights/critical-minerals-in-low-carbon-and-future-technologies/critical-minerals-in-magnets/

4 VanEck. VanEck Rare Earth and Strategic Metals UCITS ETF – Performance. Retrieved from https://www.vaneck.com/ucits/investments/rare-earth-etf/performance/

5 Baskaran, G. 2025,China’s new rare earth and magnet restrictions threaten U.S. defense supply chains. Centre for Strategic & International Studies. https://www.csis.org/analysis/chinas-new-rare-earth-and-magnet-restrictions-threaten-us-defense-supply-chains

6 CNBC. (2025, October 30). Rare-earths stocks: China delays export controls after Trump-Xi summit. https://www.cnbc.com/2025/10/30/rare-earths-stocks-china-delays-export-controls-after-trump-xi-summit.html

7 MP Materials Corp. (2025, July 10). MP Materials announces transformational public-private partnership with the Department of Defense to accelerate U.S. rare earth magnet independence. Retrieved from https://mpmaterials.com/news/mp-materials-announces-transformational-public-private-partnership-with-the-department-of-defense-to-accelerate-u-s-rare-earth-magnet-independence/

IMPORTANT INFORMATION

This is marketing communication.

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company VanEck Asset Management B.V. (“ManCo”). A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Stadthausstrasse 14, CH-8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from a financial intermediary for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as financial intermediaries and Wealth Managers.

This information originates from VanEck (Europe) GmbH, which is authorized as an EEA investment firm under the Markets in Financial Instruments Directive (“MiFiD”). VanEck (Europe) GmbH has its registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the ManCo, which is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

This material is only intended for general and preliminary information and does not constitute an investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. All relevant documentation must be first consulted.

The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and has not been independently verified for accuracy or completeness and cannot be guaranteed.

Please refer to the Prospectus – in English language - and the KID/KIID - in local language - before making any final investment decisions and for full information on risks. These documents can be obtained free of charge at www.vaneck.com, from the ManCo or from the appointed facility agent.

VanEck Rare Earth and Strategic Metals UCITS ETF ("ETF") is a sub-fund of VanEck UCITS ETFs plc, a UCITS umbrella investment company, registered with the Central Bank of Ireland and tracking an equity index.

The value of the ETF may fluctuate significantly as a result of the investment strategy. The indicative net asset value (iNAV) of the ETF is available on Bloomberg. For details on the regulated markets where the ETF is listed, please refer to the Trading Information section on the ETF page at www.vaneck.com. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets. Tax treatment depends on the personal circumstances of each investor and may vary over time. The ManCo may terminate the marketing of the ETF in one or more jurisdictions. The summary of the investor rights is available in English at: summary-of-investor-rights.pdf.

MVIS® Global Rare Earth/Strategic Metals Index is the exclusive property of MarketVector Indexes GmbH (a wholly owned subsidiary of Van Eck Associates Corporation), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards MarketVector Indexes GmbH (“MarketVector”), Solactive AG has no obligation to point out errors in the Index to third parties. VanEck’s ETF is not sponsored, endorsed, sold or promoted by MarketVector and MarketVector makes no representation regarding the advisability of investing in the ETF. It is not possible to invest directly in an index.

Source: VanEck.

Performance quoted represents past performance. Current performance may be lower or higher than average annual returns shown. Performance data for the Irish domiciled ETFs is displayed on a Net Asset Value basis, in Base Currency terms, with net income reinvested, net of fees. Returns may increase or decrease as a result of currency fluctuations. Performance should be assessed over a medium- to long-term.

Investing is subject to risk, including the possible loss of principal. For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KID before making any final investment decisions.

This information originates from VanEck (Europe) GmbH, which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin).

The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice VanEck (Europe) GmbH, VanEck Switzerland AG, VanEck Securities UK Limited and their associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / VanEck Asset Management B.V.

Sign-up for our ETF newsletter

17 February 2026

17 February 2026

20 January 2026

15 January 2026

16 December 2025

15 December 2025