Brace for Impact

22 March 2023

Read Time 2 MIN

Fed Rate Hikes

The focus of the day is the U.S. Federal Reserve (Fed) ’s rate-setting meeting, and the market expectations are very much in line with a Citi report reminding us that the Fed does not always stop hiking, when “something breaks”. The Fed Funds Futures almost fully price in a 25bps increase in the target rate this afternoon, with a 70% probability that it will be followed by another hike in May. However, the market expectations also reflect a perception that growth headwinds could multiply if financial conditions and lending standards tighten in the wake of the banking mini-crisis. This scenario, however, might not necessarily lead to materially lower inflation pressures, which clouds the outlook for long duration trades.

EM Policy Rates

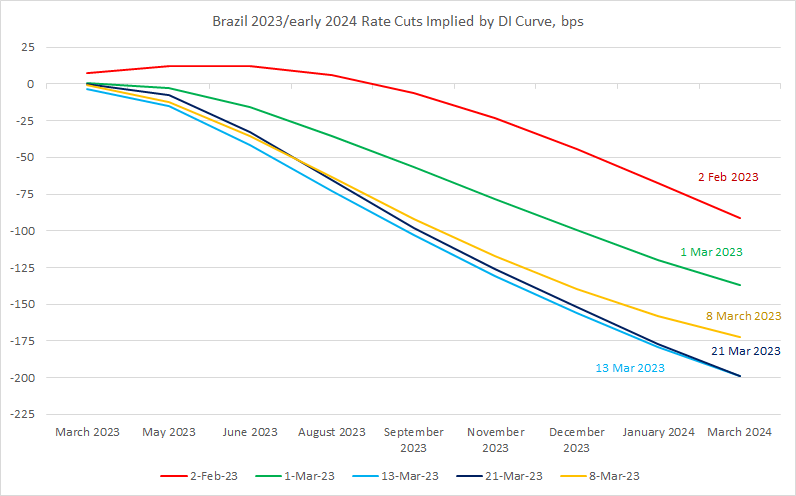

EM watchers keep a close eye on the Fed – and its peers in developed markets (DM)– but the current cycle showed that various EM central banks are no longer joined at the hip with the Fed, and their monetary policy decisions are increasingly driven by local economic and policy developments. Most EMs started hiking earlier and more aggressively than the Fed after the pandemic, and the latest jumps in the market expectations for the Fed’s also had a limited impact on EM. Brazil’s example is very telling. The chart below shows the evolution of Brazil’s implied policy rate trajectory in the past month and a half. The big shifts down reflected the disinflation progress and hopes that the new fiscal framework would be more reasonable than feared. The changes in Brazilian expectations for 2023 between March 8 and March 21 were barely detectable.

Geopolitics

The Fed might be stealing the limelight today, but the importance of certain geopolitical developments – like Chinese President Xi’s “change is coming” visit to Russia – should not be underestimated. Our long-standing argument is that new geopolitical alignments can favor many EMs – especially as regards energy re-orientation and commodity prices. A longer-term prospect of EMs playing China against the U.S. is another important angle, which echoes discussions about the rise of the renminbi and the eventual descent of the petro-dollar. The renminbi’s potential role in payments between Russia and countries in Asia, Africa and LATAM even made it into official communiques issued after the China/Russia talks. Stay tuned!

Chart at a Glance: Brazil’s Rate Expectations – U.S. Fed Is A Side-Show For Now

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.