Can EM Rates Defy the U.S. Fed?

08 March 2023

Read Time 2 MIN

U.S. Fed Rate Hikes

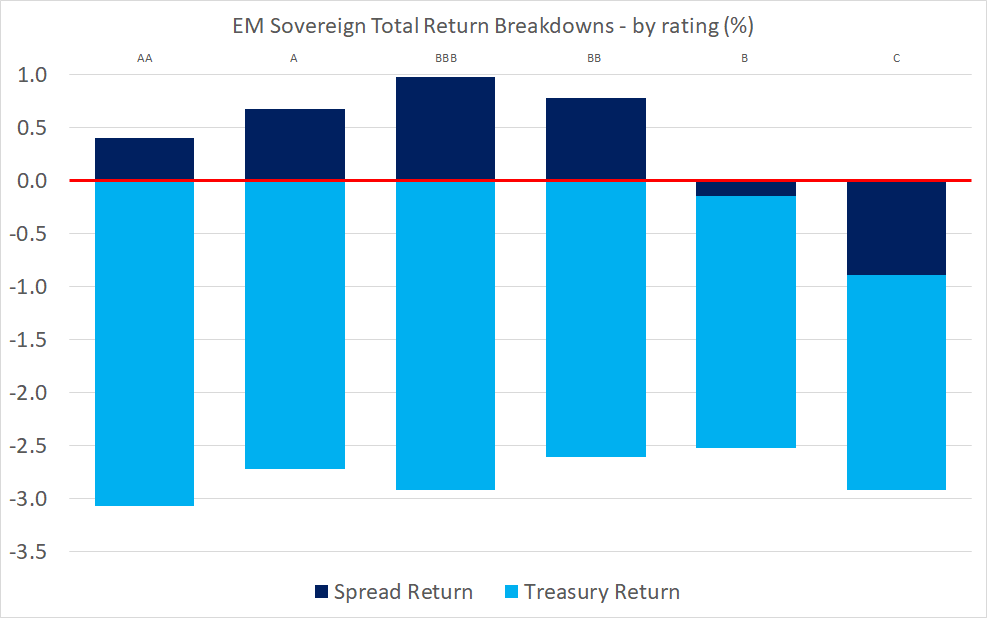

The U.S. Federal Reserve Chairman’s testimony scared the market into pricing even more rate hikes. The peak rate implied by the Fed Funds Futures reached 5.65%, the implied probability of June’s hike is now above 80%, and the market thinks that the Fed might opt for a larger 50bps hike this month. Today’s above-consensus ADP employment print (242k) did little to dissuade the market hawks. So, we are waiting for the Fed’s Beige Book this afternoon with some trepidation. What does it all mean for emerging markets (EM) bonds? The chart below shows that the rising “risk-free” rate was the main factor that affected sovereign returns in February and March – across all rating categories. In addition, the rising volatility of “risk-free” rates pushed down spread returns on lower-rated EMs – in part due to concerns about their structural and institutional ability to handle higher global rates.

EM Disinflation

What we find quite interesting though is that the market continues to price in – still cautiously – policy rate cuts in various EMs, despite the rising expectations for the U.S. peak rate. Why? Because many EMs tightened early and aggressively in response to rising price pressures (=high real rates), and inflation is clearly moderating (albeit sometimes in a “bumpy” manner). This week’s big inflation data dump in EM looks promising so far – we had good results in EM Asia yesterday (Philippines and Thailand), which were followed by another downside surprise in LATAM (Chile). If everything goes according to plan, inflation prints in Mexico (Thursday) and Brazil (Friday) should reaffirm the EM disinflation trend.

EM Fiscal Outlook

One potential headwind for EM doves is fiscal slippage. Brazil is a great example to illustrate this point. Brazil’s real policy rate based on expected inflation is super-high (around 8%), but the uncertainty about new administration’s spending plans kept the market and the central bank on defensive for quite some time. The recent reduction in political noise and a promise of decent tax reform did wonders for the rate cut expectations though – and there is definitely more to come if the administration stays fiscally responsible. Another example is Hungary, where a surprising fiscal splurge (around 50% of the annual deficit target in the first two months of the year) raised questions about the easing timeline, even though headline inflation finally peaked and food/core services pressures are moderating. Stay tuned!

Chart at a Glance: U.S. Fed Hawks and EM Sovereign Bonds

Source: Bloomberg LP. Data from 1/31/2023 to 3/7/2023.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.