China Recovery – Seeing Is Believing

01 March 2023

Read Time 2 MIN

China Reopening

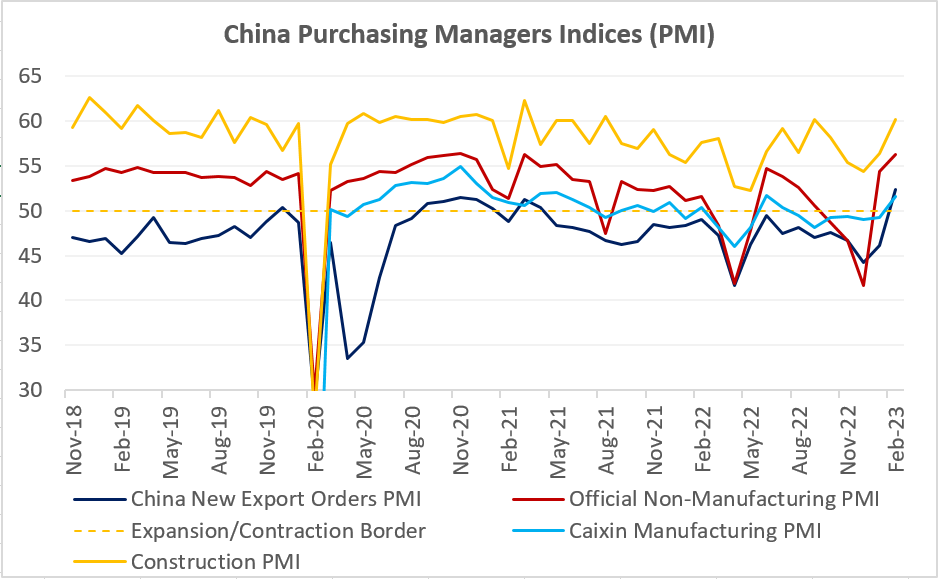

China’s faster recovery thesis got some major support from February’s activity gauges. All PMIs (Purchasing Managers Indices) improved significantly last month, with the vast majority in the expansion zone now – not only services and manufacturing, but also the new export orders and small companies PMIs (see chart below). Importantly, the construction PMI shot above 60.0, pointing to the ongoing infrastructure push but also a signal that the housing sector might be getting more “alive.” China’s equities and FX – as well as many risky assets - had a very good day today. China’s credit aggregates would be the next important dataset to watch – especially proxies for mortgage lending, which are vital for consumer confidence and the consumption-led recovery (in addition to the stronger employment PMI).

EM Growth Outlook

China’s new export orders gains (up from 46.1 to 52.4) sent a positive signal regarding the state of global demand, albeit the growth “landscape” looks more mixed on a country level. Emerging markets (EM) Asia mostly stayed in the expansion zone (including Thailand’s “upgrade”), but Central Europe continued to struggle deep in the contraction zone. We were also concerned by a sharp deterioration in two major African economies – South Africa and Nigeria – where February’s PMIs unexpectedly plunged below 50.0. LATAM’s high-frequency growth indicators have shown more signs of life lately – including today’s economic activity proxy in Chile and Brazil’s PMI – but this is an uphill struggle as high real interest rates – and political noise - continue to bite.

DM Rates And Inflation

Even though a recession is no longer the base-case scenario for most developed markets (DMs) this year, the “bumpy” activity dataflow in the U.S. – including February’s surprisingly weak consumer confidence index - raised questions about further growth upgrades. Today’s mixed ISM survey showed that these concerns might be justified. There were improvements, but one of the strongest upside surprises came in the “prices paid” category. And this helps to explain why the market continues to price in the higher peak rate in the U.S. and a 74% probability of a rate hike in June. Will China’s V-shaped comeback prove a more important global driver for EMs than higher for longer U.S. rates? We this that this is indeed the case for some EMs, especially in EM Asia. Stay tuned!

Chart at a Glance: China Recovery – V-Shape After All?

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.