Global Rates – Approaching the Endgame?

21 March 2023

Read Time 2 MIN

Fed Policy Rate Outlook

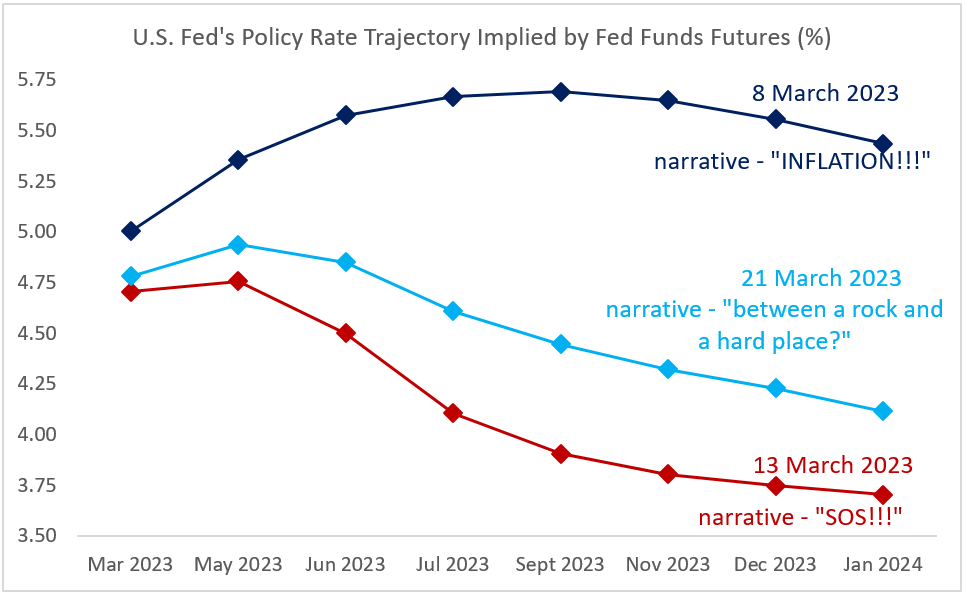

The market is in a risk-on mood going into tomorrow's U.S. Federal Reserve (Fed) meeting. The Fed’s (and the Swiss National Bank’s) response to the banking debacle was deemed effective enough to leave the “OMG/SOS” narrative behind (see chart below) and even resurrect one remaining 25bps rate hike as a nod to price stability issues. The emerging new story also features stronger developed markets (DM) growth headwinds stemming from tighter financial and lending conditions, which might necessitate rate cuts before year-end. We’ll find out tomorrow whether the market is reading the situation correctly, but a small hike and/or weaker growth prospects might not alleviate all inflation concerns, and this clouds the outlook for duration trades both in emerging markets (EM) and developed markets.

EM Rate Cuts

EM reaction to banking turbulence in DM has been orderly so far, with stresses concentrated mainly in sovereign frontier bonds, which are the most sensitive to higher interest rate volatility. The implied policy reaction by EM central banks also looks quite detached from the Fed. Policy rates in many had already peaked – a consequence of early and aggressive post-pandemic rate hikes and generally more orthodox policy frameworks, which allow currencies to act as effective shock absorbers, while easing pressure on international reserves. If anything, the latest DM shock led to lower – not higher! – expected peak rates in EM Asia, as well as South Africa, Mexico, and Colombia.

China Rebound

The mini-crisis also provided more evidence that some EMs are now more correlated with China than the Fed – and the latest activity indicators give reasons to be optimistic about the pace of recovery. China’s economic surprise index jumped to the highest level since 2006, outpacing both EM peers and DM counterparts. Suggestions from some Chinese officials to step up support for consumers – including a direct stimulus package – show understanding that consumption might continue to lag behind if the housing sector recovery is too slow/timid to boost consumer confidence. Stay tuned!

Chart at a Glance: Fed Expectations – Rapidly Changing Narratives

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.