Slower Growth Forever?

28 March 2023

Read Time 2 MIN

Hard Landing Concerns

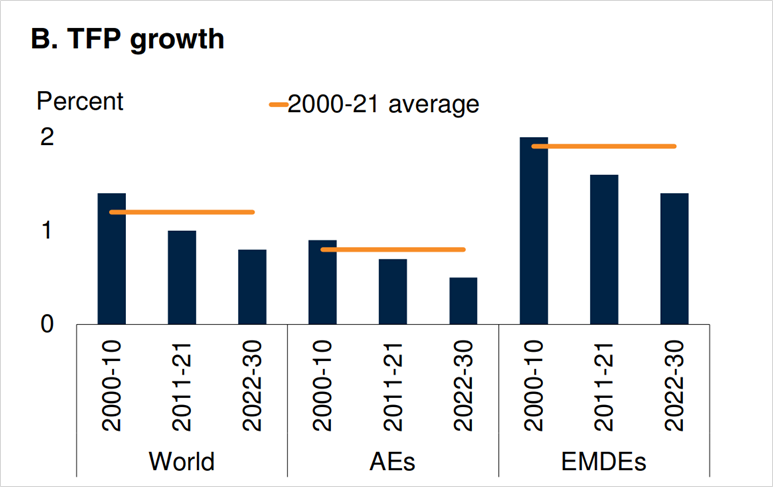

Financial stability jitters appear to be subsiding for now, but the hard landing concerns in developed markets (DM) refuse to go away – the impact of the banking mini-crisis on lending conditions (which have been tightening for some time now) and the deposit flight are partly to blame. One thing that is often obscured by near-term considerations (like the next rate hike or cut) and data noise is the impact of policy decisions on productivity and long-term growth potential. The World Bank issued a very interesting report, which argues (among other things) that policy uncertainty depressed global investments and productivity in the past 10 years (see chart below), dragging potential growth down with it – both in DM and emerging markets (EM). And it’s not just lower potential output per se, it’s a slower rate “at which an economy can grow without igniting inflation”.

EM Productivity Growth

The World Bank expects these trends to continue in the current decade, but we think that EMs might have a fighting chance to escape the negative feedback loop. First, EM policy framework improved a lot since the 2008-09 global financial crisis, arguably reducing policy uncertainty. EMs are also less “allergic” to the very idea of structural reforms. Second, a higher (and stable) share of the working-age population in EM point to a relatively more favorable outlook for domestic savings that can support both investments and productivity growth, potentially compensating for falling savings in aging DMs. “Getting old before getting rich” China adds an element of suspense in the EM case, but India’s growing population and a better demographic profile create a potential counterpoint.

Room for EM Rate Cuts

Back to the present and a near-term policy impact on growth, we have several important central bank meetings in EM this week. Mexico is on the brink of a pause – aided by the more convincing disinflation progress – but “sticky” inflation components signal that a 25bps could be a good idea. The Czech national bank is often considered a testing ground for the anti-inflation battle, with the rapidly slowing domestic demand, a strong currency, and the improving global price backdrop. The market sees Czech rate cuts within the next 3 months – would the central bank indeed turn dovish or confirm that the bar for cuts is high despite weakening growth, just as its Hungarian counterpart did earlier today? EM’s disinflation poster kid – Brazil – is also staying put, with minutes revealing ongoing concerns about the fiscal outlook and its impact on inflation expectations. Stay tuned!

Chart at a Glance: Global Productivity Growth – Can EMs Reverse the Trend?

Source: World Bank.

Note: (AEs) – advanced economies; (EMDEs) – emerging and developing economies.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.