EM Asia - Signals on Growth, Inflation

21 October 2022

Read Time 2 MIN

Global Growth Headwinds

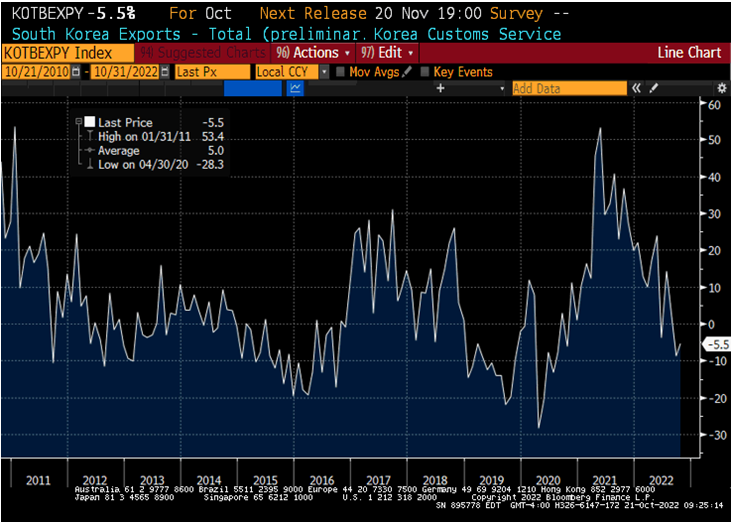

South Korea’s sluggish early-October exports added to concerns about the global growth outlook. South Korean trade numbers are often used as a gauge for global activity, so a 5.5% annual decline in 20-day exports (see chart below) did not go unnoticed. The fact that exports to China fell by 16.3% raised further questions about the policy response in the aftermath of the communist party congress. Today’s 40bps cut in the margin refinancing rates by the China Securities Finance Corporation suggests that the “targeted” approach is still the preferred one, but the new lineup of the Politburo Standing Committee (to be announced tomorrow) should signal whether this will still be the case going forward.

Asia Policy Tightening

Another reason we keep an eye on emerging markets (EM) Asia is that the region might actually be able to avoid the high inflation “curse” that plagued Emerging Europe and LATAM (as well as developed markets (DM)) for most of the year. Malaysia’s below-consensus headline inflation print comes on the heels of a downside inflation surprise in Indonesia – and it is also quite low in a global context (“mere” 4.5% year-on-year). Still, communications from the Indonesian central bank show that sticky core inflation is a risk – similar to Malaysia – and it warrants additional policy tightening (especially against the backdrop of solid domestic activity and the U.S. Dollar strength).

Inflation Pressures In LATAM

Weaker than expected retail sales in Mexico suggest that some domestic inflation pressures might be easing in that part of the world, but we’ll get a more definitive answer on Monday, after the release of bi-weekly inflation. The consensus sees tentative moderation in headline inflation, but not yet in core prices – and this means that another 75bps rate hike (to 10%) might still be on the table in early November. The latest market expectations see double-digit terminal rates in most LATAM economies – and there are still questions whether some countries (Chile) can stop tightening safely, and whether others (Colombia) would be under increasing pressure to accelerate hikes (Colombia). Stay tuned!

Chart at a Glance: Global Activity Gauge – Still Heading South

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.