Market Reversals – Hopes, Concerns, Uncertainty

21 November 2022

Read Time 2 MIN

Brazil Fiscal Policy

The U.S. Dollar regained some ground in the risk-off morning trade, with the Brazilian real being the only major emerging market (EM) currency bucking this trend and rallying by 69bps against the greenback (according to Bloomberg LP, as of 10:07am). Why? Brazilian assets took a beating last week as the market got disappointed by President-elect Luiz Inacio Lula da Silva's spending plans (to the tune of 1.7-2% of GDP). The weekend’s newswires, however, brought some hope that Lula-the-pragmatist might be back. Lula acknowledged the market’s negative reaction and suggested that he might follow orthodox economic advice – provided it is good (whatever “good” means). Brazil’s central bank governor Campos Neto is not in a forgiving mood, though – he said he watches the fiscal proposals very closely – and the local swap curve is priced in additional rate hikes for December-March 2023 (73bps).

China Growth Outlook

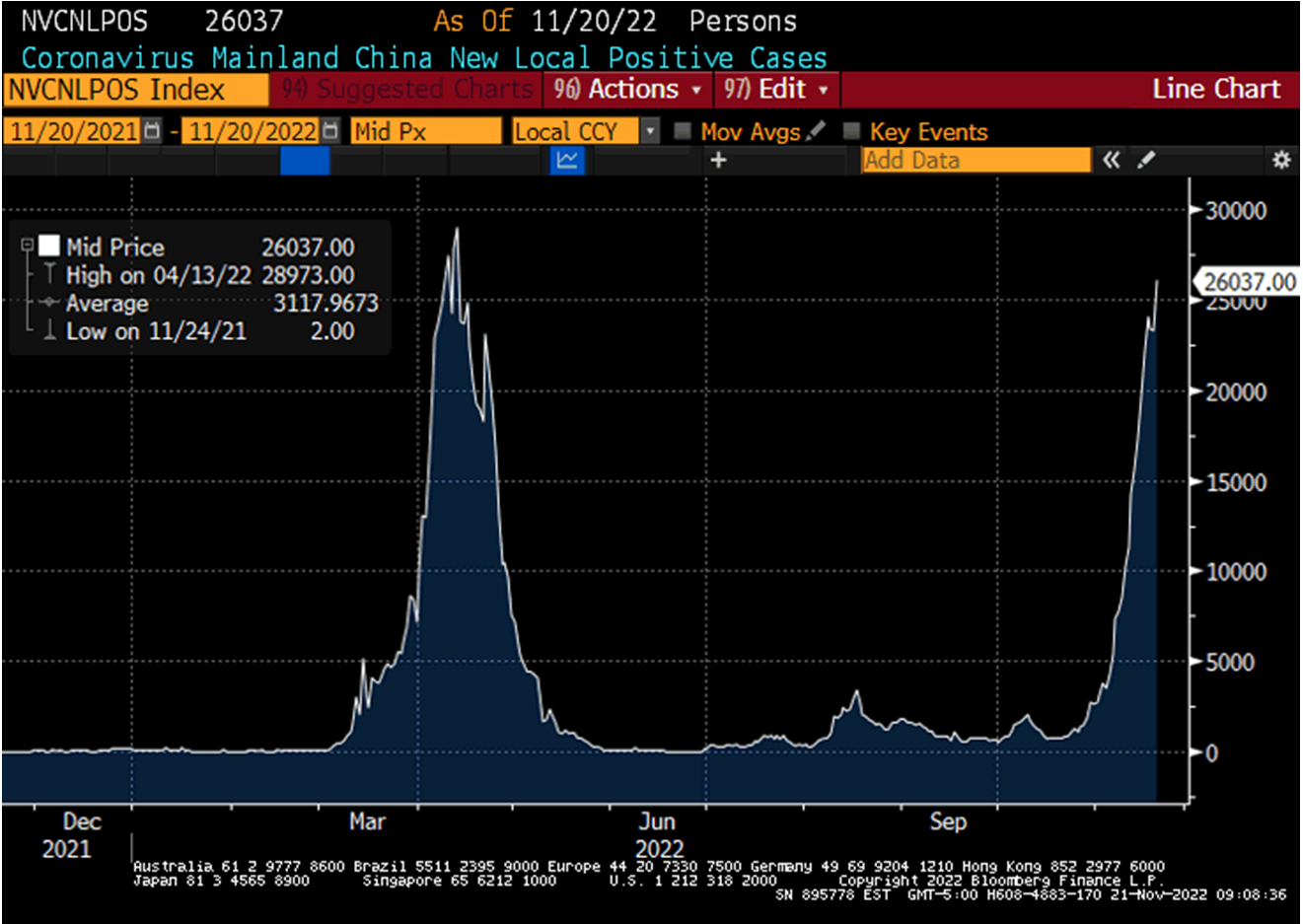

The sentiment reversal in China reflected growing concerns about the COVID flareups (see chart below) and their impact on the government’s re-opening plans. South Korea’s 20-day export numbers – which showed that the decline in exports to China accelerated to -28.3% year-on-year – did not add much optimism either (even though the print is backward-looking). It remains to be seen whether these developments will have a meaningful impact on the next batch of China’s activity gauges (out on November 29). In the meantime, the central bank is nudging local banks to provide more property loans – the housing sector accounts for a large portion of GDP and is key to consumer sentiment and financial stability.

EM Asia Policy Tightening

Policy uncertainty is back in Malaysia, where the weekend’s general elections unexpectedly resulted in a hung parliament. Malaysia is a big liquid market for EM bonds – it accounts for nearly 10% of the J.P. Morgan’s GBI-EM Global Diversified Index – and this explains why we care about local politics. The issue at hand is that Malaysia’s budget deficit got stuck around 6% of GDP since the pandemic, and the expected decline to 5.4% of GDP in 2023 is now less certain. A good thing is that the central bank has been proactively hiking to cap inflation pressures – but it might need to do more if the government would be slow to adjust its fiscal accounts. Stay tuned!

Chart at a Glance: China New COVID Cases – Spiking Again

Source: Bloomberg LP.

Related Insights

IMPORTANT DEFINITIONS & DISCLOSURES

This material may only be used outside of the United States.

This is not an offer to buy or sell, or a recommendation of any offer to buy or sell any of the securities mentioned herein. Fund holdings will vary. For a complete list of holdings in VanEck Mutual Funds and VanEck ETFs, please visit our website at www.vaneck.com.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third-party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this communication and are subject to change without notice. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from Van Eck Associates Corporation or its subsidiaries to participate in any transactions in any companies mentioned herein. This content is published in the United States. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed herein.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.