Sustainable Moat Investing: Assessing ESG Risk

13 April 2022

Share with a Friend

All fields required where indicated (*)Morningstar® US Sustainability Moat Focus IndexSM combines Morningstar’s proven equity research process of identifying companies with long-lasting competitive advantages and attractive valuations with Sustainalytics’ industry-leading ESG research. The Index focuses on three proprietary ESG criteria when selecting companies for inclusion: ESG Risk, Controversy, and Carbon Risk. Here we will explore the Sustainalytics ESG Risk Rating.

Morningstar US Sustainability Moat Focus Index Methodology

Source: VanEck

- ESG RISK: Companies must have an ESG Risk Rating categorized as medium, low or negligible

- Controversity: A company´s controversy score must be 4 (out of 5) or lower throughout the trailing three years

- Carbon Risk: A company´s carbon risk score cannot be high or severe

- Product Involvement: A company must not be involved in tobacco, controversial weapons, civilian firearms, thermal coal

- Wide Moats: Only those companies that Morningstar equity research analyst have assigned a wide economic moat rating are eligible for inclusion

- Attractive Valuations: Select the most attractively priced wide moat companies based on a companies current price relative to its Morningstar analyst-assigned fai value estimate

Sustainalytics ESG Risk Rating

The Sustainalytics ESG Risk Rating is Morningstar’s broad-based, flagship ESG risk assessment. It is forward-looking in nature and identifies a company’s financial exposure to material ESG risks that are specific to its industry and that company itself. Sustainalytics then determines how successfully a company has managed those ESG risks. The remaining unmanaged ESG risks form the basis for its ESG Risk Rating, which spans from Negligible to Severe.

ESG Risk Rating Building Blocks

Three considerations form the foundation of Sustainalytics’ ESG Risk Rating: Corporate Governance, Material ESG Issues and Idiosyncratic Issues.

Corporate Governance impacts all companies and is a foundational element of the Sustainalytics framework. It reflects their conviction that poor Corporate Governance poses material risks for companies that can have negative financial consequences.

Material ESG Issues are focused on a topic, or set of related topics, that require a common set of management initiatives or a similar type of oversight. Human Capital issues, for example, revolve around the management of human resources. Business Ethics focuses on the management of general professional ethics from taxation and accounting to anti-competitive practices. Another example of a Material ESG Issue is Emissions, Effluents and Waste which focuses on the management of a company’s impact to air, water and land from their own operations. There are approximately 20 Material ESG Issues identified by Sustainalytics and each is considered, if applicable to a company’s business model, in their ESG Risk Rating.

Idiosyncratic Issues are those additional risks that are considered unpredictable or unexpected. Examples of Idiosyncratic Issues are accounting scandals, bribery scandals, or other “black swan” events.

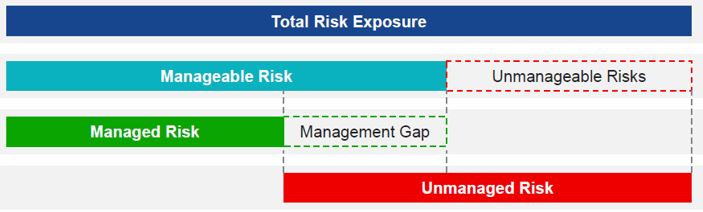

Identify Manageable vs. Unmanageable Risks to Measure Unmanaged Risk

The ESG Risk Rating is predicated on identifying the level of a company’s unmanaged ESG risk. To that end, Sustainalytics identifies the manageable and unmanageable risks applicable to each company and their respective industry. Of a company’s total ESG risk, some portion simply cannot be addressed by management practices. For example, an oil and gas exploration and production company cannot eliminate the carbon emissions risks associated with its business practices. Those companies can manage other ESG risks such as employee safety and human rights issues, among others.

Once manageable ESG risks are identified, Sustainalytics assesses the extent to which those risks have been managed. The “management gap,” reflecting manageable risks that have not been managed, are combined with unmanageable ESG risks to form a company’s total unmanaged risks which are represented by its ESG Risk Rating.

Measuring Unmanaged ESG Risk

Source: VanEck

- Starting point is a company´s exposure to material ESG issues

- Some companies have unmanageable risks, e.g. an oil company will always face risks related to carbon until it changess its business model

- Of the manageable risk, a portion is managed through a company´s policies, programs, management systems, etc.; the remainder is considered unmanaged (Management Gap)

- The ESG Risk Rating evaluates unmanaged ESG risk

Absolute Rating System

The ESG Risk Rating is absolute, meaning that a company operating in the energy sector can be compared to a company in the consumer discretionary sector. ESG Risk Ratings place companies in five risk categories ranging from Negligible to Severe. The Morningstar US Sustainability Moat Focus Index will include only those companies with ESG Risk Ratings of Negligible, Low or Medium.

ESG Risk Rating Categories

Source: VanEck

A Sustainable Approach to Moat Investing

Many of the most popular sustainable investment strategies seek to offer broad exposure to market indexes while applying some level of exclusionary or inclusionary ESG screens. This may reduce ESG risk in a portfolio, but does not address other performance drivers. The Morningstar US Sustainability Moat Focus Index’s unique combination of forward-looking equity research and ESG screening offers investors a U.S. equity strategy that seeks to provide investors with attractive risk-adjusted returns while mitigating ESG risks.

VanEck Morningstar US Sustainable Wide Moat UCITS ETF seeks to replicate as closely as possible, before fees and expenses the price and yield performance of the Morningstar US Sustainability Moat Focus Index.

Important Disclosure

This is a marketing communication for professional investors only. Please refer to the UCITS prospectus and to the Key Investor Information Document (KIID) before making any final investment decisions.

This is a marketing communication for professional investors only. Please refer to the UCITS prospectus and to the Key Investor Information Document (KIID) before making any final investment decisions. This information originates from VanEck Securities UK Limited (FRN: 1002854), an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), who is authorised and regulated by the Financial Conduct Authority in the UK. The information is intended only to provide general and preliminary information to FCA regulated firms such as Independent Financial Advisors (IFAs) and Wealth Managers. Retail clients should not rely on any of the information provided and should seek assistance from an IFA for all investment guidance and advice. VanEck Securities UK Limited and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Brokerage or transaction fees may apply.

VanEck Asset Management B.V., the management company of VanEck Morningstar US Sustainable Wide Moat UCITS ETF (the "ETF"), a sub-fund of VanEck UCITS ETFs plc, is a UCITS management company under Dutch law registered with the Dutch Authority for the Financial Markets (AFM). The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets. Investors must read the sales prospectus and key investor information before investing in a fund. These can be obtained free of charge at www.vaneck.com, from the local information agent Computershare Investor Services PLC or from the Management Company.

Morningstar® US Sustainability Moat Focus Index is a trade mark of Morningstar Inc. and has been licensed for use for certain purposes by VanEck. VanEck Morningstar US Sustainable Wide Moat UCITS ETF is not sponsored, endorsed, sold or promoted by Morningstar and Morningstar makes no representation regarding the advisability in VanEck Morningstar US Sustainable Wide Moat UCITS ETF.

Effective December 17, 2021 the Morningstar® Wide Moat Focus IndexTM has been replaced with the Morningstar® US Sustainability Moat Focus Index.

Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

It is not possible to invest directly in an index.

All performance information is based on historical data and does not predict future returns. Investing is subject to risk, including the possible loss of principal.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck Securities UK Limited

Sign-up for our ETF newsletter

Related Insights

Related Insights

11 March 2024

23 April 2024

15 March 2024

11 March 2024

20 February 2024

19 February 2024