What Are the Benefits of Investing in Gold?

As a unique asset, gold may enhance portfolio diversification, acts as store of value and hedges against systemic financial and geopolitical risk.

Enhanced Portfolio Diversification

Gold moves independently of traditional assets like stocks and bonds, especially during market downturns. This low correlation helps reduce overall portfolio risk and volatility.

Acts as a Store of Value

Gold maintains its purchasing power over time, especially during periods of currency depreciation or economic instability. Unlike paper money, gold is a tangible asset with intrinsic value that is not directly affected by central bank policies or inflation.

Hedges Against Financial and Geopolitical Risk

Gold prices often increase in times of geopolitical unrest. These adjustments due to changing global political dynamics have contributed to gold’s status as a “safe haven” asset. In the current market environment gold should benefit from these heightened levels of risk across the global economy.

3-Year Cumulative Total Return: Gold vs. S&P 500

Source: FactSet. Data as of January 31, 2026. Past performance is not indicative of future results. “S&P 500” represented by the S&P 500 Index.

Visit the fund page for the fact sheet, holdings, performance and more.

Investing in Gold ETFs: What Investors Should Know

While gold is often overlooked in prosperous times, investors turn to gold as a “safe haven” in times of economic duress.

Investing in Gold ETFs vs Physical Gold: What’s the Difference?

- Gold miners ETFs invest in shares of companies that mine gold, offering leveraged exposure to gold prices but with added equity market risk.

- Physical gold ETFs hold actual gold bullion, closely tracking the spot price of gold and offering direct exposure to the metal without investors having to handle gold storage.

- Gold is a tangible asset that serves as a store of value, inflation hedge, and portfolio diversifier, independent of financial markets.

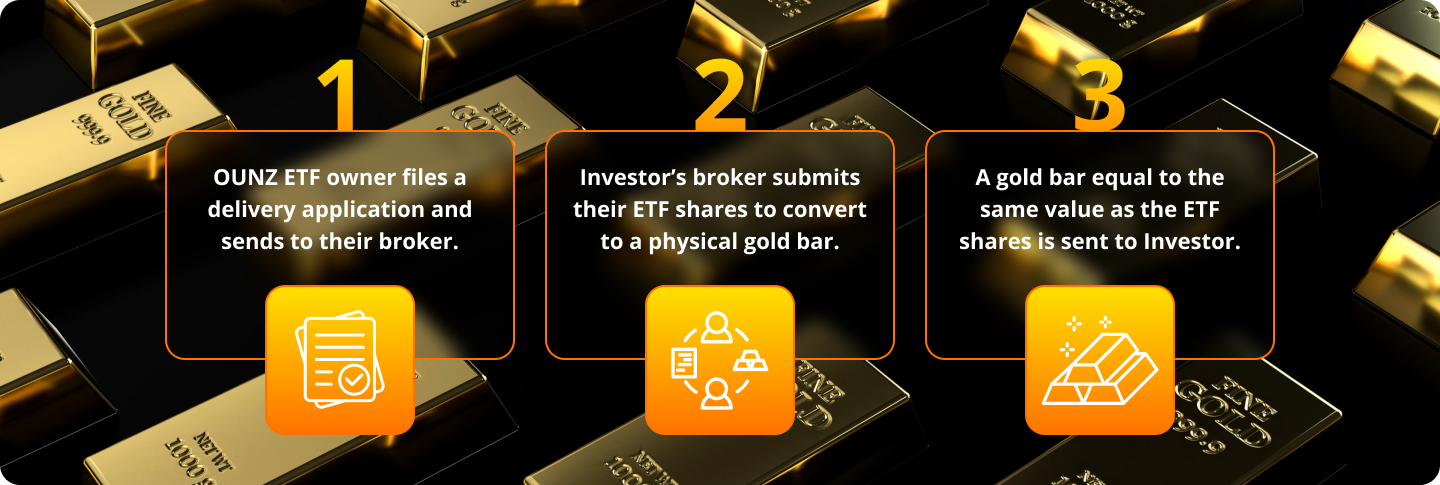

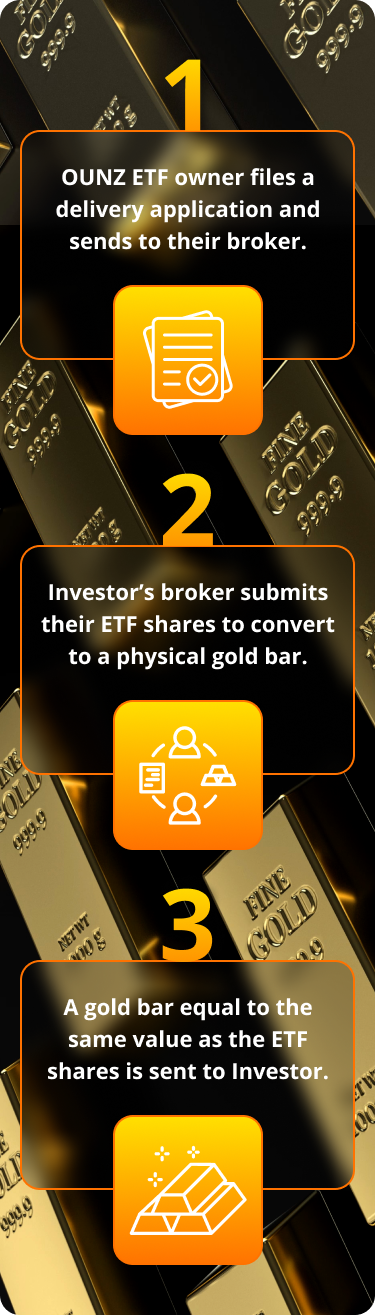

Can Gold ETFs be Converted to Physical Gold?

Traditional gold ETFs invest in gold miners and cannot be converted to physical gold. OUNZ is a trust (or ETP) that holds London Bars and allows investors to take delivery of physical gold in exchange for their shares.

Latest Gold Investing Insights

Who’s Buying Gold? with Axel Merk

Ed Lopez meets with Axel Merk to explore the gold demand of central banks and trends in gold markets.

Approaching 60 Years of Gold Investing Leadership

VanEck’s leadership in gold investing extends nearly 60 years, encompassing gold stocks and bullion across ETFs and mutual funds. We launched the U.S’s first gold stock fund (INIVX) in 1968 and issued the first gold miners ETF (GDX) in 2006.

1955

John van Eck establishes firm with launch of international equity fund1968

Foreseeing inflation, fund objective converted, creating first gold equity fund in U.S.1983

Opened its first sub-advisory gold-related separately managed account1994

Launched first long-only natural resources equity mutual fund, including gold exposure2006

Gold mining ETF introduced; gold assets cross $1B level2009

Second gold mining ETF listed, focusing on juniors2012

Gold UCITS fund opened in Europe2015

Partners with Merk Investments LLC as marketing agent on bullion ETF2025

As of December 31, total firm wide gold-related assets of $43B1955

John van Eck establishes firm with launch of international equity fund1968

Foreseeing inflation, fund objective converted, creating first gold equity fund in U.S.1983

Opened its first sub-advisory gold-related separately managed account1994

Launched first long-only natural resources equity mutual fund, including gold exposure2006

Gold mining ETF introduced; gold assets cross $1B level2009

Second gold mining ETF listed, focusing on juniors2012

Gold UCITS fund opened in Europe2015

Partners with Merk Investments LLC as marketing agent on bullion ETF2025

As of December 31, total firm wide gold-related assets of $43BOUNZ | VanEck Merk Gold ETF Prospectus

Important Disclosures

Index Definition: The S&P 500 Tracks the 500 leading companies and covers approximately 80% of market share.

VanEck Merk Gold ETF

The material must be preceded or accompanied by a prospectus. Before investing you should carefully consider the VanEck Merk Gold ETF's (the “Trust") investment objectives, risks, charges and expenses. Please read the prospectus carefully before investing.

Investing involves significant risk, including possible loss of principal. The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity pool for the purposes of the Commodity Exchange Act. Shares of the Trust are not subject to the same regulatory requirements as mutual funds. Because shares of the Trust are intended to reflect the price of the gold held in the Trust, the market price of the shares is subject to fluctuations similar to those affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value (“NAV”). Brokerage commissions will reduce returns.

The request for redemption of shares for gold is subject to a number of risks including but not limited to the potential for the price of gold to decline during the time between the submission of the request and delivery. Delivery may take a considerable amount of time depending on your location.

Commodities and commodity-index linked securities may be affected by changes in overall market movements and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities.

Trust shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of Trust shares relates directly to the value of the gold held by the Trust (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. The Trust does not generate any income, and as the Trust regularly issues shares to pay for the Sponsor’s ongoing expenses, the amount of gold represented by each Share will decline over time. Investing involves risk, and you could lose money on an investment in the Trust. For a more complete discussion of the risk factors relative to the Trust, carefully read the prospectus.

VanEck International Investors Gold Fund

You can lose money by investing in the Fund. Any investment in the Fund should be part of an overall investment program, not a complete program. The Fund is subject to risks which may include, but are not limited to, risks associated with active management, commodities and commodity-linked instruments, commodities and commodity-linked instruments tax, derivatives, direct investments, emerging market issuers, ESG investing strategy, foreign currency, foreign securities, gold and silver mining companies, market, non-diversified, operational, regulatory, investing in other funds, small- and medium-capitalization companies, special risk considerations of investing in Australian and Canadian issuers, subsidiary investment risk, and tax risks (with respect to investments in the Subsidiary), all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks. Derivatives may involve certain costs and risks such as liquidity, interest rate, and the risk that a position could not be closed when most advantageous. Investments in the gold industry can be significantly affected by international economic, monetary and political developments. The Fund’s overall portfolio may decline in value due to developments specific to the gold industry.

VanEck Gold Miners ETF and VanEck Junior Gold Miners ETF

An investment in the Funds may be subject to risks which include, but are not limited to, risks related to investments in gold and silver mining companies, special risk considerations of investing in Australian and Canadian issuers, foreign securities, emerging market issuers, foreign currency, depositary receipts, micro-, small- and medium-capitalization companies, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified, and index-related concentration risks, all of which may adversely affect the Funds. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Micro-, small- and medium-capitalization companies may be subject to elevated risks.

Diversification does not assure a profit or protect against loss.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider a Fund's investment objective, risks, charges and expenses carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck ETFs, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus for VanEck Funds and VanEck ETFs carefully before investing.

© 2026 Merk Investments LLC. © 2025 VanEck. All trademarks, service marks or registered trademarks are the property of their respective owners.

Van Eck Securities Corporation, Distributor of VanEck International Investors Gold Fund, VanEck Gold Miners ETF, and VanEck Junior Gold Miners ETF.