About Us

What We Do

VanEck is a global investment manager offering active and passive investment strategies across ETFs, mutual funds, institutional strategies, model portfolios and private funds. Our investment solutions provide access to a wide range of asset classes, markets and themes, from core portfolio building blocks to more specialized exposures. We focus on thoughtful portfolio construction, disciplined risk management and delivering differentiated access.

Mission and History

CEO Jan van Eck on VanEck's creation, its business growth, and a mission of global, client-first vision

VanEck’s business has been shaped by identifying influential, persistent investment themes before they become mainstream.

1955

Post WWII recovery creates opportunities with international companies in Europe and Asia

1968

In anticipation of inflation, concentrated investment in gold

1993

Prominence of China puts focus on rising influence of emerging markets

2006

Investor desire for liquidity, diversification, efficiency leads to ETF industry expansion

2012

Launch wide moat equity strategy focused on companies with sustainable competitive advantages

2017

Identify the disruptive potential of bitcoin and digital assets on financial services and beyond

1955

Post WWII recovery creates opportunities with international companies in Europe and Asia

1968

In anticipation of inflation, concentrated investment in gold

1993

Prominence of China puts focus on rising influence of emerging markets

2006

Investor desire for liquidity, diversification, efficiency leads to ETF industry expansion

2012

Launch wide moat equity strategy focused on companies with sustainable competitive advantages

2017

Identify the disruptive potential of bitcoin and digital assets on financial services and beyond

VanEck Today

With $181.4 billion in assets under management as of December 31, 2025, VanEck offers a range of vehicles including exchange-traded funds (ETFs), mutual funds, institutional funds, separately managed accounts, model delivery SMAs/model portfolios, and UCITS funds and ETFs.

Global Presence

Headquartered in New York with offices and local product offerings spanning Europe, Australia, Asia, and Latin America.

487

Full-Time Employees

77

Investment Professionals

Assets Under Management of $181.4 Billion

As of December 31, 2025Approaching 60 Years of Gold Investing Leadership

VanEck’s leadership in gold investing extends nearly 60 years, encompassing gold stocks and bullion across ETFs and mutual funds. We launched the U.S’s first gold stock fund (INIVX) in 1968 and issued the first gold miners ETF (GDX) in 2006.

1955

John van Eck establishes firm with launch of international equity fund1968

Foreseeing inflation, fund objective converted, creating first gold equity fund in U.S.1983

Opened its first sub-advisory gold-related separately managed account1994

Launched first long-only natural resources equity mutual fund, including gold exposure2006

Gold mining ETF introduced; gold assets cross $1B level2009

Second gold mining ETF listed, focusing on juniors2012

Gold UCITS fund opened in Europe2015

Partners with Merk Investments LLC as marketing agent on bullion ETF2025

As of December 31, total firm wide gold-related assets of $43B1955

John van Eck establishes firm with launch of international equity fund1968

Foreseeing inflation, fund objective converted, creating first gold equity fund in U.S.1983

Opened its first sub-advisory gold-related separately managed account1994

Launched first long-only natural resources equity mutual fund, including gold exposure2006

Gold mining ETF introduced; gold assets cross $1B level2009

Second gold mining ETF listed, focusing on juniors2012

Gold UCITS fund opened in Europe2015

Partners with Merk Investments LLC as marketing agent on bullion ETF2025

As of December 31, total firm wide gold-related assets of $43BFund Development

At our core is an emphasis on solutions that meet the specific objectives of clients, which include individual investors and institutions, including endowments, foundations, pension plans and private banks.

We stress putting clients first in every step of the development process.

Identification

Think beyond the financial markets to identify the trends—including economic, technological, political and social—that will fuel investable opportunities before they become mainstream.Information

Determine what drives performance while being mindful of potential risks.

Ideas must offer lasting investment benefits.

Innovation

Focus on optimal access, whether by being first to market or by developing a more intelligent, efficient approach.Involvement

Provide solutions that are client-focused and competitively-priced.

We commit internal resources and participate in these strategies alongside our clients.

Insight

After launch, expect ongoing, fair and balanced perspectives.

Investment professionals continuously produce high level research and are always available for clients.

Strategies Available Across Structures

| U.S./ Global Equity | U.S./ Global Fixed Income | Emerging Markets Equity | Emerging Markets Fixed Income | Commodity/ Natural Resources | Gold/Precious Metals | Multi-Asset Strategies | Digital Assets | |

| U.S. ETF | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ |

| U.S. Mutual Fund | ■ | ■ | ■ | ■ | ■ | |||

| U.S. Insurance Trusts | ■ | ■ | ■ | ■ | ||||

| UCITS Fund & ETF | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ |

| Sub-Advisory Accounts | ■ | ■ | ■ | |||||

| Separate Accounts | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ |

| Commingled Fund | ■ | ■ | ||||||

| Private Fund | ■ | ■ | ||||||

| Model Delivery SMAs/Portfolios | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ |

VanEck at 70: Legacy, Progress, and Innovation

VanEck’s 70-year history is not just a story of the past; it’s a foundation for the future. Our vision, commitment to innovation, and strong culture have shaped our journey and continue to guide the path forward. With a clear focus on people and a philosophy rooted in long-term thinking, VanEck’s legacy is one of adaptability and forward-thinking—qualities that will define its next chapter in the ever-evolving world of investing.

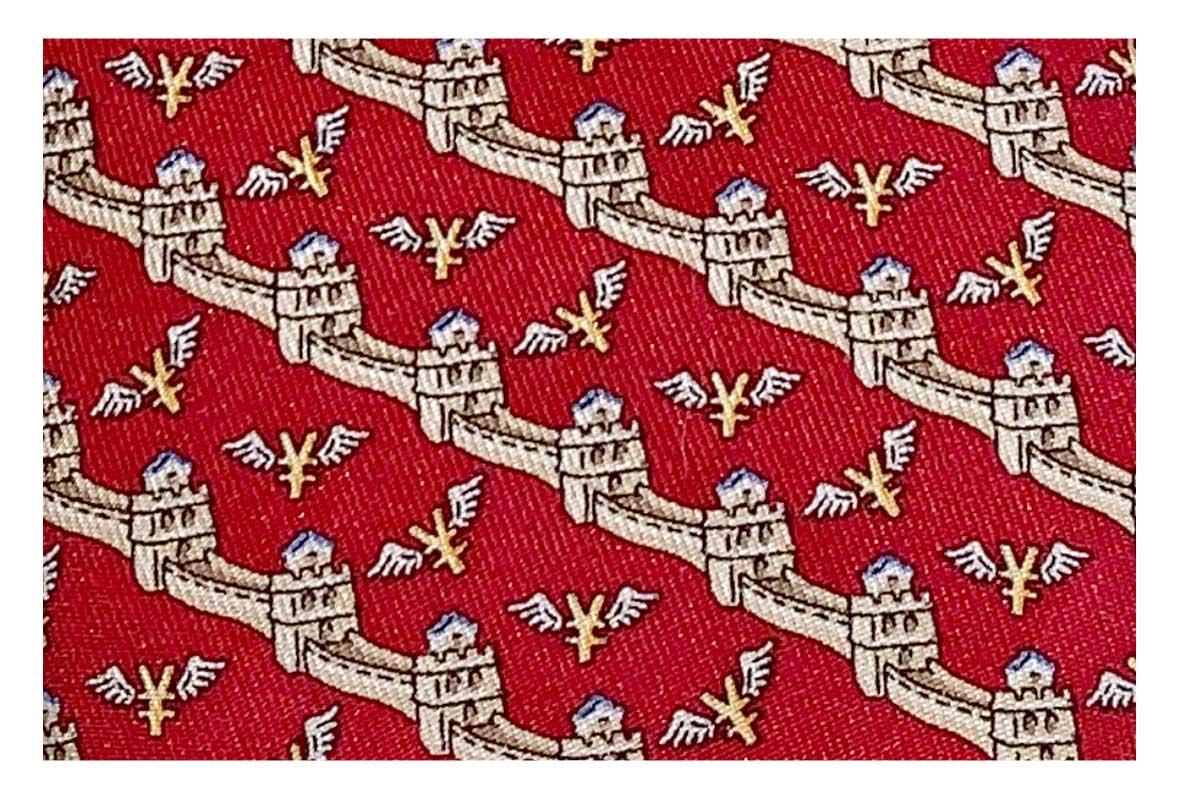

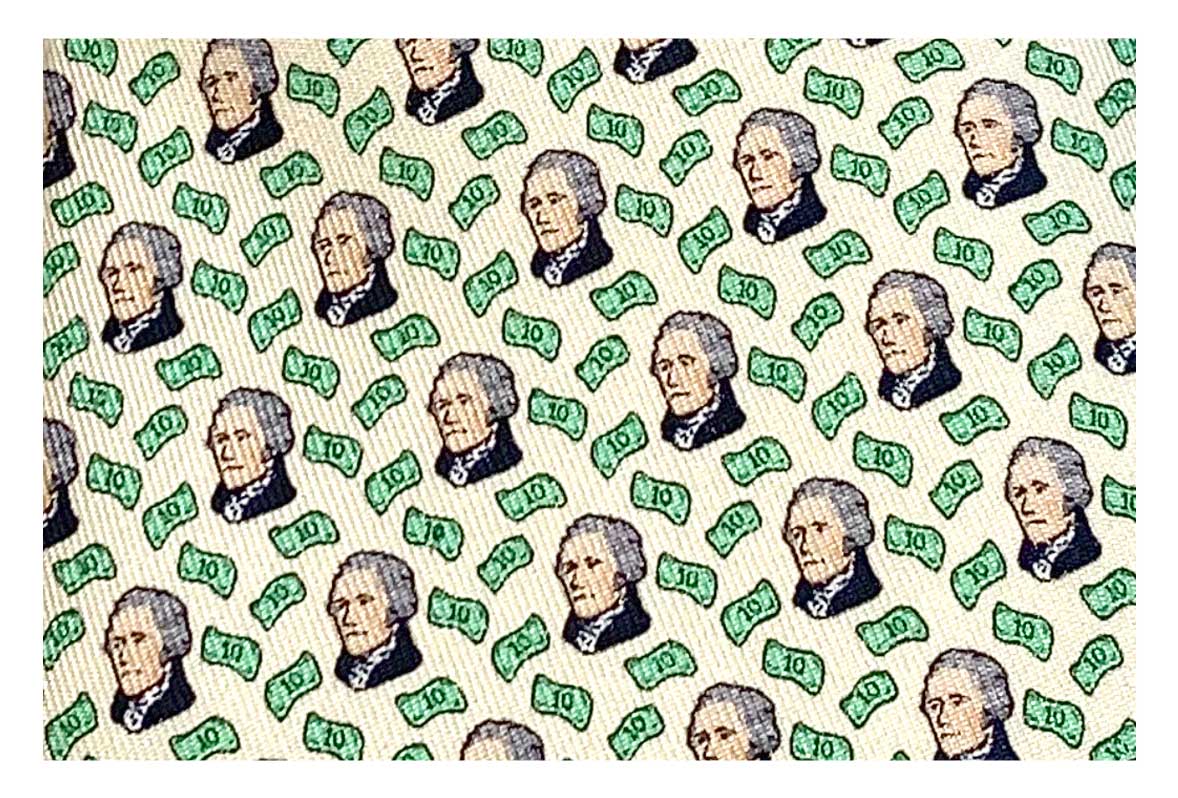

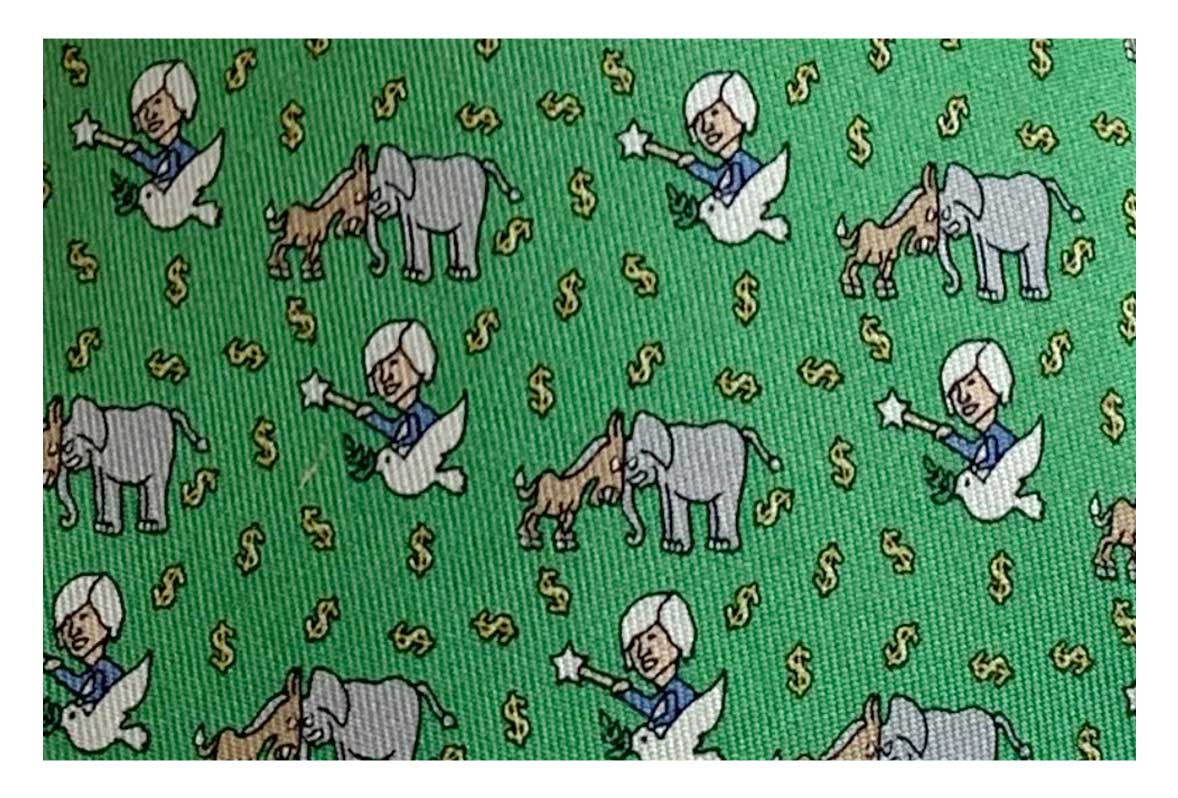

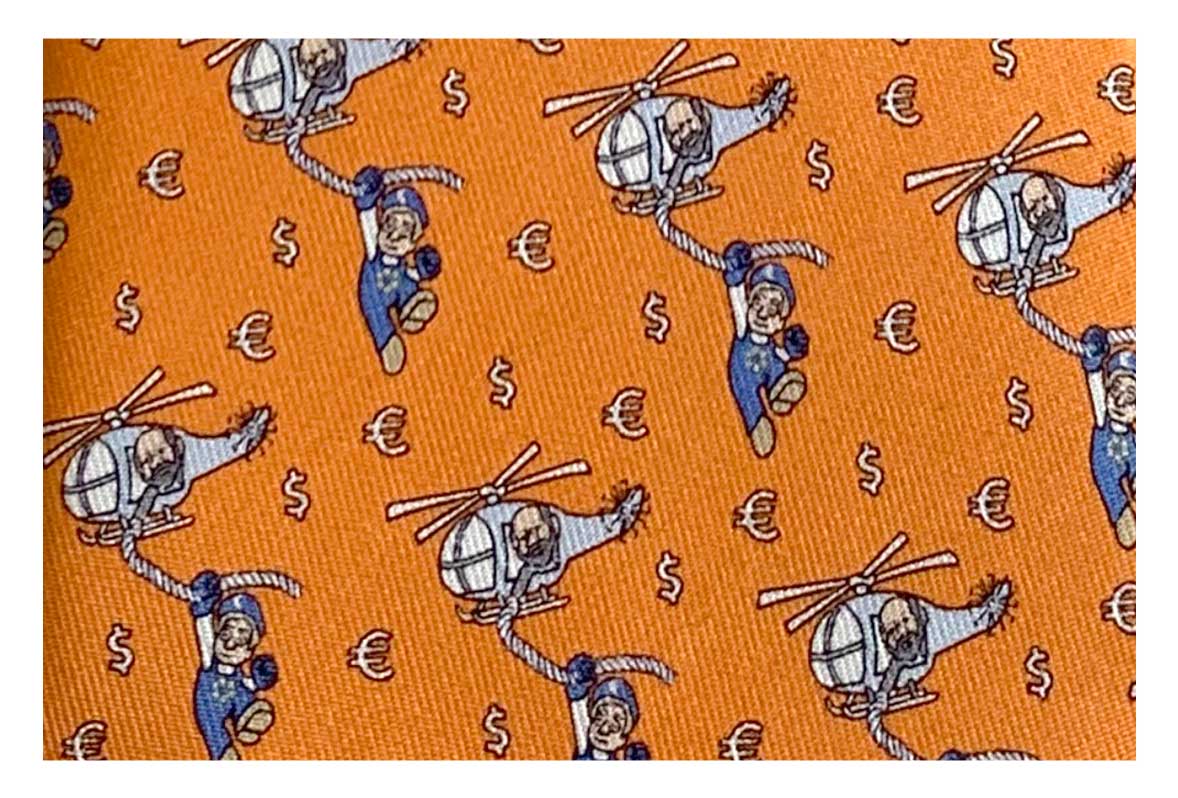

Each year, our signature silk ties feature a whimsical depiction of a forward-looking investment trend.

Our 2026 tie honors the United States’ 250th anniversary, celebrating the resilience and evolution of the nation’s financial legacy with three icons of the U.S. financial system. Alexander Hamilton built it. Franklin D. Roosevelt saved it. Landmark stablecoin legislation is reshaping it.

Previous designs have included the dynamic world of nuclear energy and power, the provocative impact of semiconductors and AI on the human experience, Fed actions on financial markets and traditional asset allocation, work-from-home themes, an eagle and a panda locked in a tug-of-war, bitcoin represented as “digital gold”, a QE3 ship sailing into the sunset and a dovish Janet Yellen bringing peace to donkeys and elephants. In 2015, we also issued a special batch of Alexander Hamilton ties in defense of keeping the U.S.'s first Treasury Secretary on the $10 bill.

We are always interested in new ideas. Please send your suggestions to our CEO, Jan van Eck.

Visit the VanEck Corporate Store, where we offer a wide range of quality items, including apparel and various accessories to suit your business and leisure needs.