Bienvenue chez VanEck

Sélectionnez le type d’investisseur

20 August 2019

Although the creation and redemption of ETF shares takes place largely behind the scenes for most investors, the process is a defining feature of the ETF structure.

ETF 101: Understanding the Basics

ETF 102: The Inner Workings of ETF Creations and Redemptions

ETF 103: Is This ETF Right for Your Portfolio?

ETF 104: Getting the Most Out of Your ETF Trades

ETF 105: Gaining Efficient Access to Bond Markets with Fixed Income ETFs

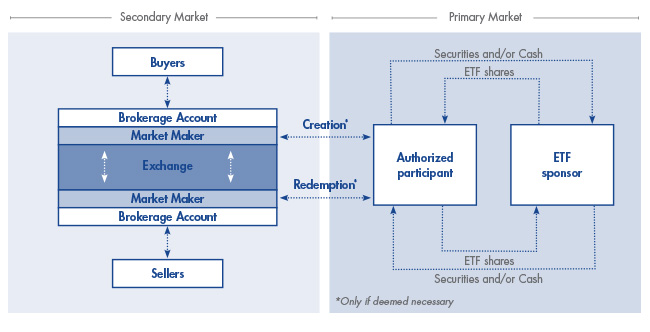

As a starting point, let’s discuss the differences between the secondary and primary markets for ETF shares.

The secondary market, which includes the widely recognised securities exchanges, is where investors buy and sell existing shares of ETFs. For example, if you wish to buy 2,000 shares of an ETF, you typically place an order through your brokerage account and purchase those shares at market price from other sellers in the secondary market.

The primary market refers to where ETF share creations and redemptions take place in large specified units. It provides an additional “layer”, or source, of liquidity that can be accessed for large orders or when demand exceeds supply, or vice versa, on the secondary market. Typically, large financial institutions, authorised participants, and market makers1 transact in the primary market. Market makers buy and sell ETF shares in the secondary market to provide liquidity and may also serve as authorised participants.

Authorised participants (APs) are an important part of the creation and redemption process. To create new passively managed ETF shares, the AP generally acquires shares in all of the underlying securities that compose the ETF, in the same proportions as the fund’s index. To create new ETF shares the AP will deliver all of the underlying securities that compose the ETF or the equivalent cash amount and in exchange, receives shares of the ETF in blocks known as creation units. The AP then sells these ETF shares in the secondary market. The additional supply of shares tends to bring the ETF’s price back in line with its NAV2.

When there are not enough ETF shares available on the secondary market to satisfy demand, an ETF may begin trading at a premium (its current market price is higher than its NAV). When this happens, an AP may step in and create new shares.

To create new passively managed ETF shares, the AP generally acquires shares in all of the underlying securities that compose the ETF, in the same proportions as the fund’s index. On the primary market, the AP then delivers this basket of securities to the ETF issuer, and in exchange, receives shares of the ETF in blocks known as creation units3. The AP then sells these ETF shares in the secondary market. The additional supply of shares tends to bring the ETF’s price back in line with its NAV.

The process described above also works in reverse when demand is low. For example, let us imagine that an ETF begins trading at a discount (its current market price is lower than its NAV). The AP leaps into action, buying shares of the discounted ETF on the secondary market and tendering these shares to the issuer for shares of the ETF’s underlying securities.

Redemptions reduce the number of ETF shares available on the secondary market. As a result, the discount shrinks or disappears as the ETF share price moves closer in line with its NAV.

So, there are actually two primary sources of ETF liquidity: the secondary or open market, consisting of shares bought and sold throughout the day, and the primary market managed by APs. Most ETF investors rely on secondary market liquidity.

Primary market liquidity draws on the liquidity of the underlying securities comprising the ETF. Very large trades can tap into the deeper liquidity source of the primary market, where large blocks of ETF shares can be either created or redeemed.

Creations and redemptions are critical to the structure and liquidity of ETFs. Through this mechanism the supply of ETF shares in the open market can be brought in line with demand, thus fairly pricing ETFs.

-----------------------------------------------------------------------

1Market makers: Specialised traders who seek liquidity for a set of securities on an exchange.À des fins d’information et de publicité uniquement.

Ces informations proviennent de VanEck (Europe) GmbH qui a été désignée comme distributeur des produits VanEck en Europe par la société de gestion VanEck Asset Management B.V., de droit néerlandais et enregistrée auprès de l’Autorité néerlandaise des marchés financiers (AFM). VanEck (Europe) GmbH, dont le siège social est situé Kreuznacher Str. 30, 60486 Francfort, Allemagne, est un prestataire de services financiers réglementé par l’Autorité fédérale de surveillance financière en Allemagne (BaFin). Les informations sont uniquement destinées à fournir des informations générales et préliminaires aux investisseurs et ne doivent pas être interprétées comme des conseils d’investissement, juridiques ou fiscaux. VanEck (Europe) GmbH et ses sociétés associées et affiliées (ensemble « VanEck ») n’assument aucune responsabilité en ce qui concerne toute décision d’investissement, de cession ou de rétention prise par l’investisseur sur la base de ces informations. Les points de vue et opinions exprimés sont ceux du ou des auteurs, mais pas nécessairement ceux de VanEck. Les avis sont à jour à la date de publication et sont susceptibles d’être modifiés en fonction des conditions du marché. Certains énoncés contenus dans les présentes peuvent constituer des projections, des prévisions et d’autres énoncés prospectifs qui ne reflètent pas les résultats réels. Les informations fournies par des sources tierces sont considérées comme fiables et n’ont pas été vérifiées de manière indépendante pour leur exactitude ou leur exhaustivité et ne peuvent être garanties. Tous les indices mentionnés sont des mesures des secteurs et des performances du marché commun. Il n’est pas possible d’investir directement dans un indice.

Toutes les informations sur le rendement sont historiques et ne garantissent pas les résultats futurs. L’investissement est soumis à des risques, y compris la perte possible du capital. Vous devez lire le Prospectus et le DICI avant d’investir.

Aucune partie de ce matériel ne peut être reproduite sous quelque forme que ce soit, ou mentionnée dans toute autre publication, sans l’autorisation écrite expresse de VanEck.

© VanEck (Europe) GmbH

S'inscrire à notre lettre d'information sur les ETF

17 février 2026

20 janvier 2026

15 janvier 2026

17 février 2026

20 janvier 2026

15 janvier 2026

16 décembre 2025

15 décembre 2025