Red Hot Year for Green Bonds

January 28, 2020

Read Time 4 MIN

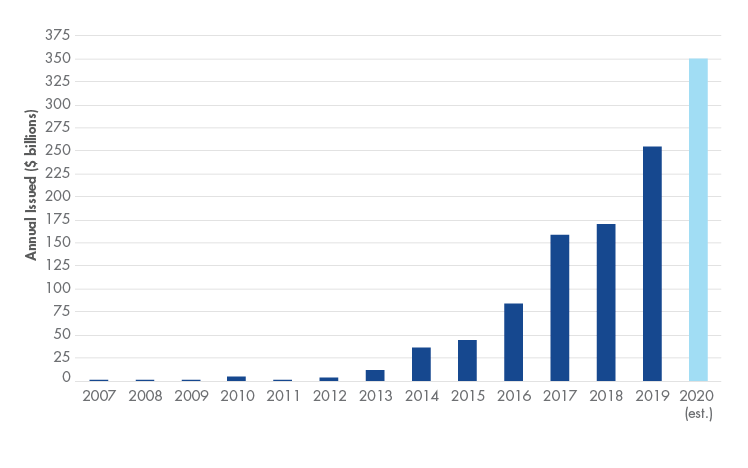

Signs currently point to a record year for green bond issuance in 2020, after another record year in 2019. Over the course of 2019, $255 billion of bonds were issued that were aligned with the Climate Bonds Initiative’s green bond taxonomy, a 49% increase over 2018.1

To achieve the targets set out under the Paris Agreement, massive financing is needed, and given the lack of progress to date in meeting the sustainability targets, it’s clear that a massive scaling up of green bonds and other sustainable financing tools will be needed. Fortunately, investor, policy and public opinion trends all favor further growth in the surging green bond market.

Green Bond Issuance: The Hot Streak Continues

Source: Climate Bonds Initiative. Data as of 1/16/2020.

Last year’s issuance was characterized by higher non-financial corporate issuance than years past, with $54 billion issued versus $29 billion in 2018. Sovereign issuance also continues to increase, with $26 billion issued – an impressive figure given that a sovereign green bond market did not exist prior to 2016.

Europe continues to dominate the market, with a total of $110 billion issued.2 The U.S. was the largest in terms of country of issuer, but still lags the global market relative to its size and significance in the global debt market. However, U.S. dollar denominated green bond issuance was strong, with $76 billion issued, or 32% of total 2019 issuance, adding further size and diversification to this segment of the market.3 Euro denominated green bonds make up approximately 65% of the investable market.4

The extremely low, or negative, yields in that market have been a headwind to growth among U.S. dollar-based investors. Even those who appreciate the positive impact and ability to address climate risk within their bond portfolios have had difficulty justifying the currency risk given these low yields. Currency hedging offers one alternative, but in our view can be costly, complicated and result in unanticipated tax consequences.

The investable U.S. dollar denominated green bond market has grown significantly and now stands at $122 billion, based on the S&P Green Bond U.S. Dollar Select Index.5 It is also a diverse universe of 137 issuers across government, agency, corporate, financial and asset-backed securities issuers. Five years ago, the market only stood at $17 billion, but it is now large enough to build a liquid, diversified green bond strategy.

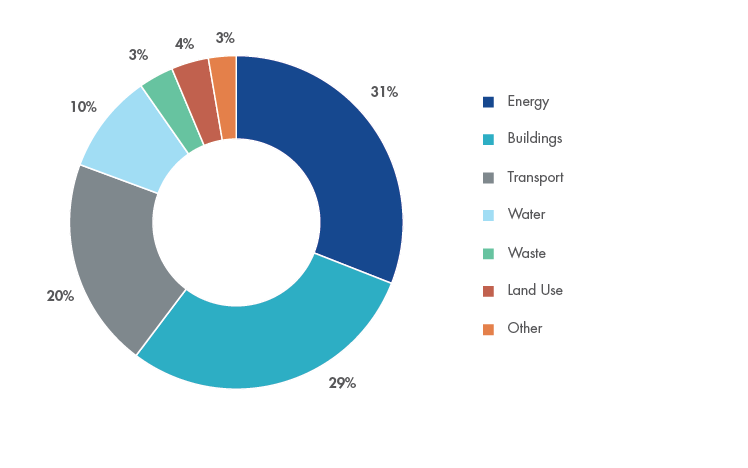

Green bonds are issued to finance environmentally friendly projects, but are generally backed by the full balance sheet of the issuer and rank pari passu with other debt of the same seniority. In terms of the types of projects financed by green bonds issued in 2019, renewable energy and green buildings continued to have the largest share of total issuance, at 31% and 29%, respectively. Clean transport projects have steadily increased over the years as a percentage of issuance, and that trend continued in 2019. Adaptation projects still represent only a very small portion of overall projects at 1% of total issuance, as do projects related to land use at 4%.

Green Bonds Issued by Use of Proceeds

Source: Climate Bonds Initiative as of 1/16/2020. See important disclosures at the end of this presentation.

High Profile Green Bond Issuers Entering the Market

There were several notable first time issuers in the market last year. Owens Corning was the first U.S. industrial issuer to issue a green bond, which will finance renewable energy, energy efficiency and recycling projects, and hopefully signals the beginning of a trend in that sector. Verizon was another high profile issuer, with its $1 billion inaugural issuance that will finance projects across a wide variety of categories, including the deployment of 5G wireless technologies that allow for real-time response to energy demand. According to Sustainalytics, these projects have the potential to support significant energy savings across many industrial sectors.

Boston Properties issued its first green bond, which helped finance Salesforce Tower, San Francisco’s tallest building. The property is LEED Platinum certified and is expected to reduce emissions equivalent to 1,300 cars annually. On the sovereign side, Republic of Chile’s first green bond will help the country to finance projects that will help it achieve its commitments under the Paris Agreement, including a 30% reduction in greenhouse gas emissions by 2030, and its target to become a net zero emitter by 2050.

We believe many green bond issuers have become repeat issuers due to the benefits offered by the market, including investor base diversification and the ability to demonstrate to the market that it is proactively investing in climate solutions. Apple was one such repeat issuer, along with MidAmerican Energy and Duke Energy, which continue to fund their transition to low carbon energy production. Fannie Mae was once again the largest single issuer of green bonds, with approximately $19 billion of new bonds issued, which will fund energy and water efficiency retrofits to multifamily properties across the U.S.6

For fixed income investors, green bonds offer a way to add sustainable fixed income exposure to their portfolios, without necessarily compromising on risk and return objectives. As awareness grows of how climate risk may impact investment portfolios, we believe demand for sustainable fixed income investments, such as green bonds, will persist.

Follow Us

IMPORTANT DISCLOSURES

1Source: Climate Bonds Initiative. Data as of 1/16/2019.

2Ibid.

3Ibid.

4Ibid.

5Source: S&P Dow Jones Indices. Data as of 12/31/2019.

6Source: Climate Bonds Initiative. Data as of 1/16/2020.

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) or industries discussed herein.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful.

ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within the Fund’s investment objective, inclusion of this statement does not imply that the Fund has an ESG-aligned investment objective, but rather describes how ESG information is integrated into the overall investment process.

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

IMPORTANT DISCLOSURES

1Source: Climate Bonds Initiative. Data as of 1/16/2019.

2Ibid.

3Ibid.

4Ibid.

5Source: S&P Dow Jones Indices. Data as of 12/31/2019.

6Source: Climate Bonds Initiative. Data as of 1/16/2020.

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) or industries discussed herein.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by VanEck or any judgment exercised by VanEck will reflect the opinions of any particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and VanEck is dependent on such information to evaluate a company’s commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful.

ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights alongside traditional measures into the investment decision process to improve long term financial outcomes of portfolios. Unless otherwise stated within the Fund’s investment objective, inclusion of this statement does not imply that the Fund has an ESG-aligned investment objective, but rather describes how ESG information is integrated into the overall investment process.

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.