“Agnostic” Fed = Bullish EM?

February 02, 2023

Read Time 2 MIN

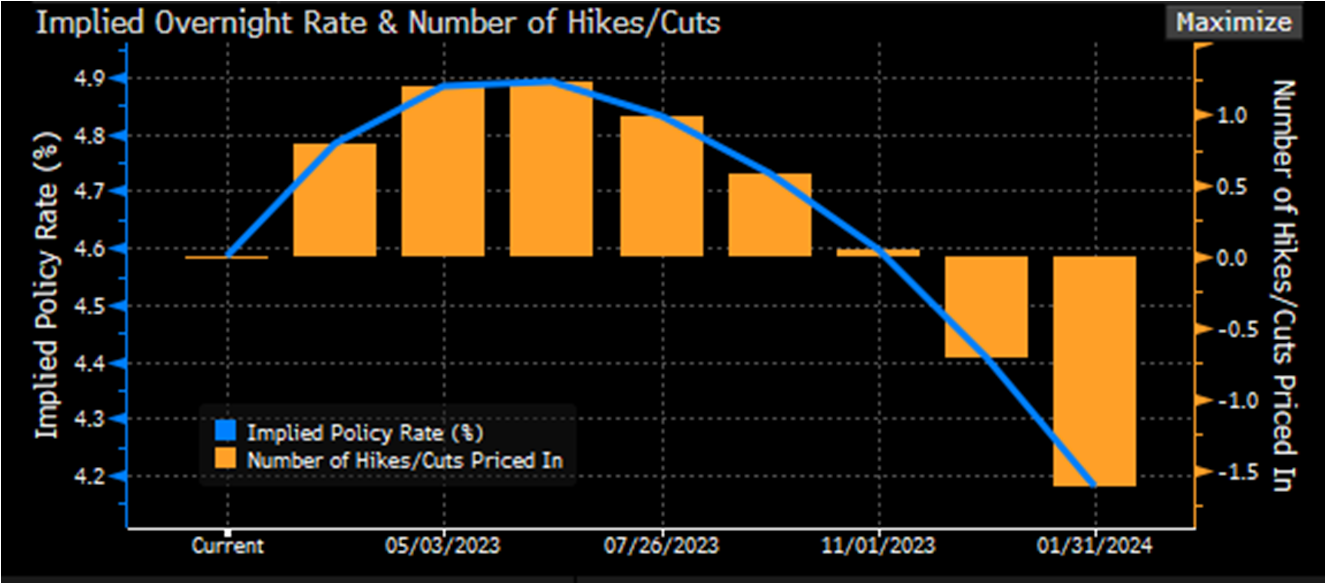

Fed Policy Outlook

U.S. Federal Reserve (Fed) Chairman Jerome Powell’s defense against the market’s dovish expectations and easing monetary conditions at yesterday’s press conference was not particularly convincing. The Fed’s “data-dependent” message – and the mention of disinflation – pushed the implied peak rate below 4.9% and reaffirmed the expectation of rate cuts (about 50bps – see chart below) already this year, further supporting emerging markets (EM) assets. There are potential risks on both sides – a nasty recession in the U.S. could be risk-negative despite lower interest rates and slower disinflation would argue against rate cuts – but these scenarios might not disturb the status quo for some time.

Risk-On Fed

The “everything rally” lifts many boats, but a specific set of policies in EM can make a difference as well. The Brazilian central bank kept the policy rate on hold yesterday and issued a stark warning against the “heightened uncertainty” on the fiscal framework, which is pushing inflation projections away from the target (“no rate cuts for you!”). A combination of high carry, the hawkish (=credible) central bank, and the “agnostic” Fed lifted the Brazilian real to the top of the global FX “league table” in the morning trade. The Czech national bank also sounded cautious today, saying that the policy rate path might be higher than the market expects.

Global Disinflation

EMs’ bumpy and noisy disinflation (especially in core prices) is a reason why various central banks are choosing to stay on the sidelines instead of rushing into rate cuts. The Czech national bank assumed a big inflation increase in January. South Korean inflation surprised to the upside in January, re-accelerating to 5.2% year-on-year. The forthcoming inflation releases in Thailand, Colombia and the Philippines will also be closely watched. These countries are well positioned to benefit from China’s growth rebound – a major driver for EM assets in the coming months – but domestic policy agendas will determine whether this potential can be fully realized. Stay tuned!

Chart at a Glance: Implied U.S. Federal Reserve Rate Cuts – EMs Are Watching

Source: Bloomberg LP.

Related Topics

Related Insights

February 26, 2024

January 04, 2024

October 27, 2023

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan's index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG - JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan's index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG - JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.