Chinese Bonds Offer Yield Pickup

September 29, 2020

Read Time 2 MIN

Global bond investors have shown increasing appetite this year for Chinese bonds, particularly those denominated in local currency. They currently offer attractive yield advantage over U.S. and other developed markets bonds. Further, we believe the potential for currency appreciation, relative stability and diversification potential provide support for an allocation to Chinese domestic bonds within a global fixed income portfolio.

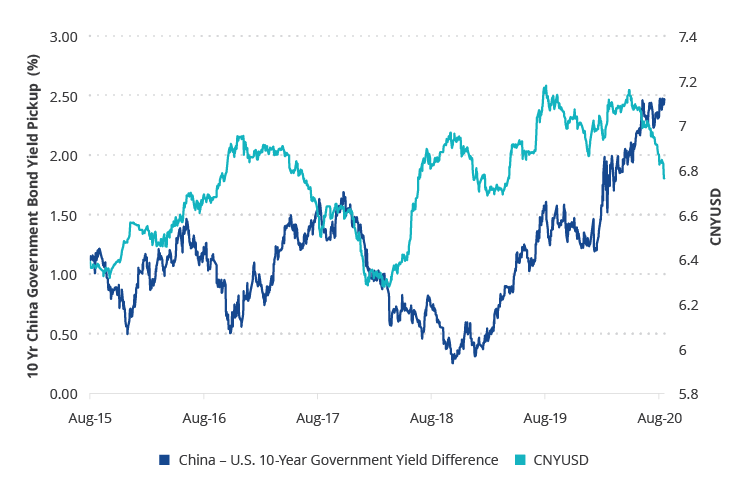

Currently, 10-year Chinese government bonds are yielding nearly 250 basis points above the 10-year U.S. Treasury, a differential that has increased sharply over the past two years.1 Local yields have increased over the past three months amid an impressive economic recovery and a muted monetary and fiscal policy response. However, the growing yield advantage has been driven primarily by the plunge in U.S. yields from over 3% to the current levels below 0.70%. This yield advantage is perhaps even more striking when considering China’s single-A credit rating and that it has the world’s second largest bond market behind only the U.S.

China Yield Pickup and FX Rate

Source: Bloomberg. Data as of 9/17/2020.

Beyond the attractive yield potential, the RMB has recently appreciated and provided additional return to investors, driven by some of the same factors behind the recent move in rates. Policymakers in China closely manage the currency’s value, which is one reason it has not historically experienced the same level of volatility of other emerging markets currencies. Further, there is a massive local investor base that can provide liquidity and funding, even in stressed periods. These attributes have made China local bonds a relatively more stable part of the emerging markets debt landscape.

With gradual inclusion in local bond indices continuing, including the ongoing addition to the J.P. Morgan GBI-EM suite of indices and recently announced inclusion in the FTSE World Government Bond Index, inflows from foreign investors are expected to continue and may reach $300 billion as passively managed funds adjust their allocations. This amount will likely be higher as actively managed portfolios also increase exposure. In addition to the yield advantage, currency appreciation potential and stability provided, we believe onshore bonds have also exhibited attractive diversification benefits. They have very low correlation to U.S. Treasuries and investment grade bonds, lower correlation to other emerging markets bonds (both local and hard currency) than U.S. high yield, and a lower correlation to U.S. equity than emerging markets bonds and U.S. high yield.2

DISCLOSURE

1 Source: Bloomberg. Data as of 9/17/2020.

2 Source: Bloomberg. Data as of 8/31/2020. Based on 5-year monthly return correlation of the ChinaBond China High Quality Bond Index (China bonds), Bloomberg Barclays U.S. Treasury Index (U.S. Treasuries), Bloomberg Barclays U.S. Aggregate Bond Index (investment grade bonds), J.P. Morgan EMBI Global Diversified Index (hard currency emerging markets bonds), J.P. Morgan GBI-EM Global Diversified Index (local currency emerging markets bonds), ICE BofA US High Yield Index (U.S. high yield) and S&P 500 (U.S. equity).

Please note that Van Eck Associates Corporation serves as investment advisor to investment products that invest in the asset class(es) included herein.

J.P. Morgan GBI-EM Global Core Index tracks local currency denominated EM government debt.

FTSE World Government Bond Index tracks the performance of fixed-rate, local currency, investment-grade sovereign bonds.

ChinaBond China High Quality Bond Index comprised of fixed-rate, Renminbi-denominated bonds issued in the People's Republic of China by Chinese credit, governmental and quasi-governmental (e.g., policy banks) issuers.

Bloomberg Barclays U.S. Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury.

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

J.P. Morgan EMBI Global Diversified Index is a market-capitalization weighted, total-return index tracking the traded market for U.S.-dollar-denominated Brady bonds, Eurobonds, traded loans, and local market debt instruments issued by sovereign and quasi-sovereign entities.

J.P. Morgan GBI-EM Global Diversified Index tracks emerging markets local government bonds that are accessible by most foreign investors. The weighting scheme provides additional diversification by more evenly distributing weights among the countries in the index. Countries are capped at 10%.

ICE BofA US High Yield Index tracks the performance of below-investment-grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market.

S&P 500 Index consists of 500 widely held common stocks covering industrial, utility, financial and transportation sector.

ICE Data Indices, LLC and its affiliates (“ICE Data”) indices and related information, the name "ICE Data", and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data's prior written approval. The licensee's products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by ICE Data. ICE Data MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS).

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed in this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURE

1 Source: Bloomberg. Data as of 9/17/2020.

2 Source: Bloomberg. Data as of 8/31/2020. Based on 5-year monthly return correlation of the ChinaBond China High Quality Bond Index (China bonds), Bloomberg Barclays U.S. Treasury Index (U.S. Treasuries), Bloomberg Barclays U.S. Aggregate Bond Index (investment grade bonds), J.P. Morgan EMBI Global Diversified Index (hard currency emerging markets bonds), J.P. Morgan GBI-EM Global Diversified Index (local currency emerging markets bonds), ICE BofA US High Yield Index (U.S. high yield) and S&P 500 (U.S. equity).

Please note that Van Eck Associates Corporation serves as investment advisor to investment products that invest in the asset class(es) included herein.

J.P. Morgan GBI-EM Global Core Index tracks local currency denominated EM government debt.

FTSE World Government Bond Index tracks the performance of fixed-rate, local currency, investment-grade sovereign bonds.

ChinaBond China High Quality Bond Index comprised of fixed-rate, Renminbi-denominated bonds issued in the People's Republic of China by Chinese credit, governmental and quasi-governmental (e.g., policy banks) issuers.

Bloomberg Barclays U.S. Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury.

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

J.P. Morgan EMBI Global Diversified Index is a market-capitalization weighted, total-return index tracking the traded market for U.S.-dollar-denominated Brady bonds, Eurobonds, traded loans, and local market debt instruments issued by sovereign and quasi-sovereign entities.

J.P. Morgan GBI-EM Global Diversified Index tracks emerging markets local government bonds that are accessible by most foreign investors. The weighting scheme provides additional diversification by more evenly distributing weights among the countries in the index. Countries are capped at 10%.

ICE BofA US High Yield Index tracks the performance of below-investment-grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market.

S&P 500 Index consists of 500 widely held common stocks covering industrial, utility, financial and transportation sector.

ICE Data Indices, LLC and its affiliates (“ICE Data”) indices and related information, the name "ICE Data", and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data's prior written approval. The licensee's products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by ICE Data. ICE Data MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS).

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed in this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.