Harnessing Growth: A Bright Future for Healthcare in China

February 21, 2020

Read Time 4 MIN

The coronavirus outbreak has put a spotlight on global healthcare, particularly in China. Although it has dominated recent headlines, we believe investors instead should focus on long-term opportunities for exposure to visible and persistent growth trends, or structural growth, in emerging markets. As the country overhauls its healthcare system, China’s healthcare industry presents an area of long-term transformative growth. We highlight two companies here that exemplify that structural growth story: Ping An Good Doctor and BeiGene.

Healthcare in China – on the Edge of Innovation and Disruption

Companies driven by domestic demand and local consumer trends represent the future of emerging markets and global economic growth. Often times, these types of growth companies are concentrated in certain sectors and countries, such as the healthcare space in China.

The healthcare sector in China is driven by local demographics, technological advancement and a rising middle class. China is the world’s second largest pharma market, with growing unmet medical needs and patient resources, and regulators are actively supporting quality innovators in this space. The large volume of patients allows for lower prices outside of the U.S. high pricing drug model.

These trends help make this space prime for innovation and disruption, and we are optimistic on healthcare in China, as the country’s overhaul of this sector creates significant opportunities.

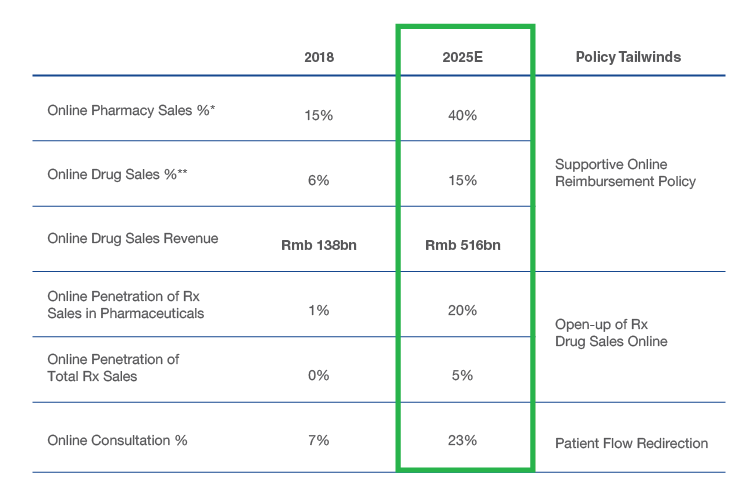

Overhaul of Dysfunctional Rx Market Creates Significant Opportunities in China

Source: Citi Research Estimates, Ministry of Commerce. Data as of December 31, 2018 and 2025E. *Online Pharmacy Sales % equals online pharmacy sales as % of online and offline pharmacy sales. **Online Drug Sales % equals online drug sales as % of total drug sales in China.

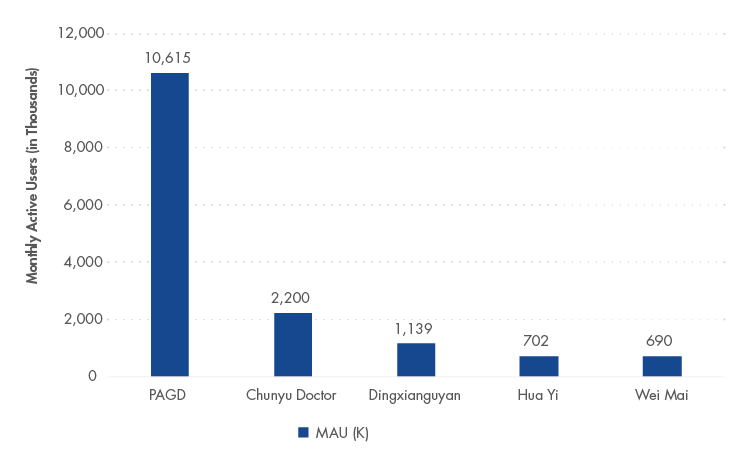

Emerging Markets Equity Company in Focus: Ping An Good Doctor

One of our portfolio companies is Ping An Good Doctor (PAGD), an exciting structural growth HealthTech name at the intersection of healthcare and technology. The company’s healthcare technology platform is the largest by users globally. As of December 31, 2019, PAGD had 269 million registered users and 66.9 million monthly active users (MAU) on their platform. The platform uses the internet + AI to solve for medical resources and unmet demand for family doctors in China, providing 24x7 access to quality healthcare with minimal waiting time through a phone app and also lowering patients’ overall medical costs.

The investment opportunity is driven by domestic demand and consumer led trends, as Ping An Good Doctor was created to directly address China’s immediate needs in the healthcare space, such as:

1) Availability and more equal distribution of medical resources.

2) Improved medical service experience (on average, the wait time to see a doctor is about three hours for only eight minutes of doctor consultation time).

3) Current and future access to basic medical insurance coverage.

Ping An Good Doctor - Leader in HealthTech in China

Source: PAGD Company Data, Macquarie Estimates.

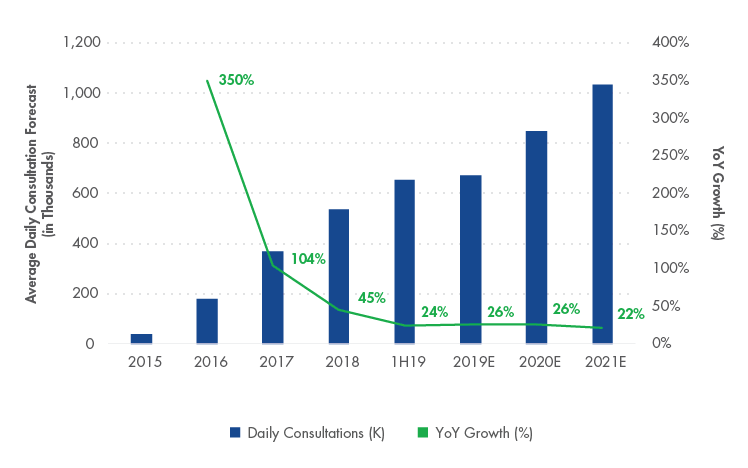

PAGD’s Daily Consultations Have a Long and Sustainable Growth Trajectory

Source: PAGD Company Data, Macquarie Estimates.

Emerging Markets Equity Company in Focus: BeiGene

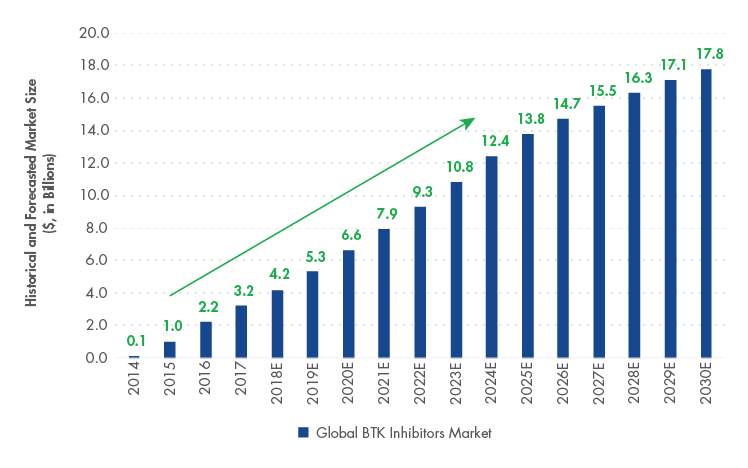

Another structural growth name in our portfolio is BeiGene, China’s first globally competitive biopharma company. BeiGene is focused on developing the next generation of cancer treatments – one that expands the highest quality therapies to billions more people around the world – through persistent innovation and by challenging the status quo. It is currently working on a robust pipeline of innovative oncology drugs, which we estimate will generate approximately $6.6 billion in peak sales by the end of the decade.

This company is truly an exciting structural growth name, as it represents themes that are shaping the future of emerging markets today, including local demographics, technological advancement and a rising middle class. We strongly believe that companies like BeiGene are the front and center – and the potential future – of emerging markets economies and global growth. As a result, we have been invested in this company since August 2019.

Global BTK* Inhibitors Market is Estimated to Grow ~15% from 2020 through 2026, Creating Growth Opportunities for BeiGene

Source: Company Data. As of January 13, 2020. Market size forecasts are from Frost & Sullivan analysis. *Bruton’s Tyrosine Kinase (BTK) is a part of the B-cell receptor (BCR) signaling pathway and plays a central role in B-cell proliferation and survival, making it an important therapeutic target in the treatment of B-cell malignancies.

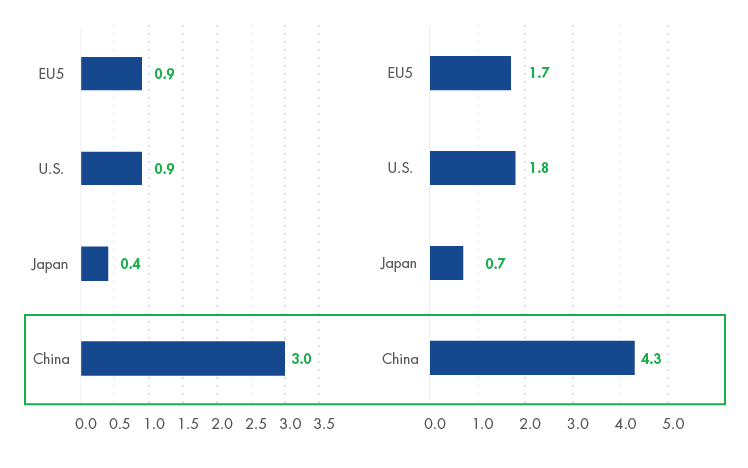

Incidence of Top 10 PD-1* Responsive Tumors (Left) and Total Tumor Incidence (Right) by Region (in Million)

*Data of top 10 PD-1 responsive tumors are from Frost & Sullivan analysis and include melanoma, lung cancer, liver cancer, gastric cancer, renal cancer, urothelial carcinoma, esophageal cancer, Hodgkin’s lymphoma, lip and oral cancer, and cervical cancer.

Finding Structural Growth in Emerging Markets

We believe that next generation structural growth companies, like Ping An Good Doctor and BeiGene, can be found in emerging market countries. Our Emerging Markets Equity Investment Team combines on-the-ground research and direct interactions with company management to identify these opportunities. The team brings global and local perspective, years of industry experience and expertise to finding structural growth opportunities in emerging markets that might not be captured in clients’ existing portfolios otherwise.

Learn more about our Emerging Markets Equity Strategy and our approach to harnessing structural growth.

DISCLOSURES

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. The reader should not assume that an investment in the securities identified was or will be profitable. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Emerging Market securities are subject to greater risks than U.S. domestic investments. These additional risks may include exchange rate fluctuations and exchange controls; less publicly available information; more volatile or less liquid securities markets; and the possibility of arbitrary action by foreign governments, or political, economic or social instability.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.