Harnessing Growth: Trend Acceleration in Brazil’s Digitization Leaders

August 12, 2020

Read Time 5 MIN

Emerging markets have entered a “new normal.” While this shift comes with challenges, it is also bringing forth new and exciting opportunities across emerging markets equities. Digitization, telemedicine and video gaming are among the sectors and industries experiencing unprecedented growth acceleration and shortened disruption timelines. This acceleration trend spans across emerging markets and can be found in Brazil as well – home of MercadoLibre and Locaweb – some of the most exciting and fastest growing digitization companies in the world!

Brazil – Investing in Untapped Pockets of Alpha

Brazil has been incredible to watch, as the country is embracing, adopting and fully integrating technology at unprecedented levels, across households and corporates. Spiked by the global pandemic, the digitization trend has emerged across e-commerce, digital payments, software, telecommunications and online technology, making Brazil’s market ample of opportunity for demand-driven, forward-looking and structural growth companies to invest in.

In response to COVID-19, Brazilians are adopting technology at a faster pace than the rest of the world

Source: McKinsey, Morgan Stanley Research. Data as of July 1, 2020.

Based on Global Consumer Survey results.

As reflected in the graph below, local demand for e-commerce and digital payments exists in the world's 9thlargest economy, home to 210 million people, with young demographics and a strong cultural affinity for technology (i.e., users spend 9+ hours online per day vs. 6+ hours on average globally).1 In addition, supportive fiscal and monetary policies, coupled with layered easing of COVID-19 restrictions, suggest a sustainable opportunity for long-term, structural growth investing in digitization, among other sectors and industries, in Brazil. Given recent developments, we believe that Brazil’s digitization trend has not been fully captured, nor is it properly priced in, creating new and exciting opportunities for bottom-up, fundamental and research-driven emerging markets investors like us.

Brazil's untapped market creates ample opportunity for technology monetization

Source: IMF, MEF, Morgan Stanley Research. Data as of July 1, 2020.

Brazil 2019 ranking out of 49 countries in the MSCI ACWI Index.

MercadoLibre – Brazil’s Leading E-Commerce Channel

MercadoLibre (“MELI”) is Brazil’s leading e-commerce third party (3P) marketplace model (the company operates platforms for other businesses to sell its inventory) and digital payments operator (including online payments, offline payments, wallet and credit), with presence in 20 countries and user base of 37 million unique buyers.

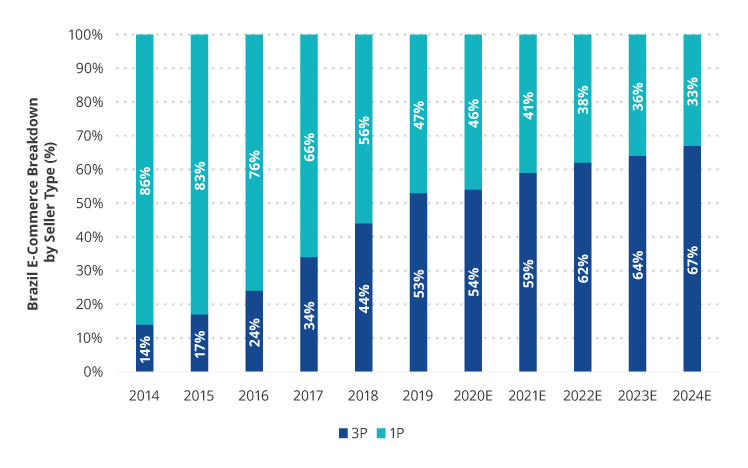

The 3P model is estimated to expand even further vs. the 1P model (the company sells its own inventory) and MELI is well positioned to benefit from the 3P growth through continuous consolidation of its market share (currently at 63%) within the e-commerce and digital payments space. In addition, diversified digital payments are viewed as a long-term value driver for this business.

3P marketplace share of Brazil's e-commerce has expanded and this trend is expected to continue

Source: Euromonitor, Company Data, Morgan Stanley Research. Data as of July 1, 2020. E=Estimates.

We came across MercadoLibre last fall. Senior Analyst Patricia Gonzalez uncovered the company and met with management many times when on research trips in Brazil prior to investing. Together with Analyst Dominic Jacobson, they did all the heavy due diligence on this name and presented it to the Emerging Markets Equity Investment Team in November 2019. MELI was approved, added to our EME Focus List and the first investment was made in May 2020. In addition to the above statements, the investment thesis also included our views on MELI’s resilience to withstand the global pandemic and its attractive valuation levels, which led to our buy recommendation.

Locaweb – Helping Small Businesses Go Digital

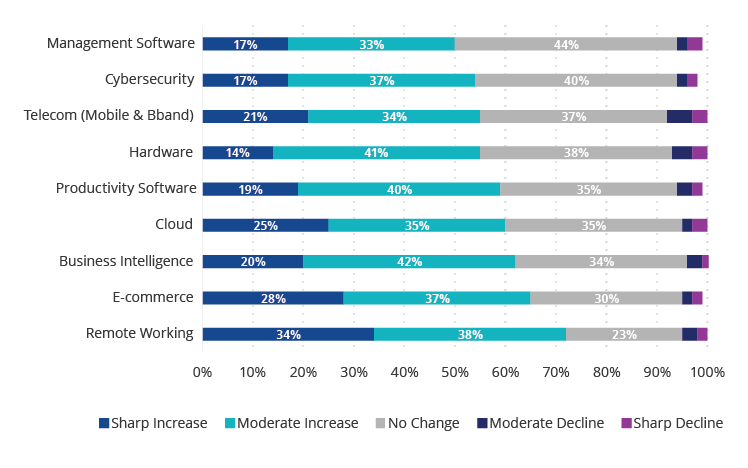

Locaweb (“LWSA”) is another leading digitization name out of Brazil that the VanEck Emerging Markets Equity Strategy current holds. The company operates across three innovative lines of business and stands to benefit from the highest increase in tech spending commitment in a post-COVID environment, strong interest and level of engagement from small and medium business enterprises (“SMEs”) and solid potential for margin expansion:

- E-commerce (20% of earnings) – utilizing its large base of web developers (~19K), LWSA helps SMEs create online presence in Brazil.

- SaaS (20% of earnings) – LWSA has developed standardized and affordable SaaS solutions for SMEs in Brazil. Products include email, marketing and customer service, among others.

- BeOnline (60% of earnings) – web hosting – this is LWSA’s legacy business. The company is the dominant player in Brazil with 21% market share. It derives a significant amount of value from a) its 300,000 strong customer base which they cross sell and upsell to; and b) its strong network of ~19K web developers which they have built over the last 20 years.

Our Investment Team came across this name last year. Patricia sourced the idea, met with company management in person when in Brazil before they filed for an IPO and had many conference calls with management in the post COVID world. Together with Dominic, they did extensive due diligence on this name and presented their structural growth thesis to the Investment Team in January 2020. Locaweb filed for an IPO in February 2020 and we made our first investment in LWSA in April 2020.

Locaweb's focus on small businesses adds to increased digitization in Brazil

Source: AlphaWise, Morgan Stanley Research. Data as of June 2020.

Based on B2 Survey: Spending intention by product (firms with up to 50 employees).

Conclusion

Overall, trend acceleration has been quite positive for the VanEck Emerging Markets Equity Strategy, as we focused primarily on many of these structural growth areas that enabled us to uncover MercadoLibre and Locaweb. MELI and LWSA are showing strong growth potential and Q2 earnings results further solidify our conviction in these names. Investment in these companies also aligns with a broader focus on trend acceleration within the portfolio—we have reduced “social” consumption based around travel and other “out-of-home” activities, while further boosting our exposure to “remote” consumption implicit in e.g., e-commerce and digital payments. As a result, we currently approach the second half of the year with an optimistic outlook, despite the current challenges.

Related Insights

February 29, 2024

February 21, 2024

DISCLOSURES

1Morgan Stanley Research.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities mentioned herein. Strategy holdings will vary.

Emerging Market securities are subject to greater risks than U.S. domestic investments. These additional risks may include exchange rate fluctuations and exchange controls; less publicly available information; more volatile or less liquid securities markets; and the possibility of arbitrary action by foreign governments, or political, economic or social instability.

The MSCI All Country World Index (ACWI) is a free float‐adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets (DM) and emerging markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURES

1Morgan Stanley Research.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities mentioned herein. Strategy holdings will vary.

Emerging Market securities are subject to greater risks than U.S. domestic investments. These additional risks may include exchange rate fluctuations and exchange controls; less publicly available information; more volatile or less liquid securities markets; and the possibility of arbitrary action by foreign governments, or political, economic or social instability.

The MSCI All Country World Index (ACWI) is a free float‐adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets (DM) and emerging markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.