Defi Tokens Rebound Amid Wide Valuation Dispersion

January 07, 2022

Read Time 4 MIN

Please note that VanEck may have a position(s) in the digital asset(s) described below.

Bitcoin's share of the total crypto market fell below 40% in January for the first time since 2018.1 Three years ago, Bitcoin's underperformance heralded a year-long crypto bear market as the ICO (initial coin offering) boom succumbed to a regulatory crackdown and global equities ended the year down for the only time in the last six years. Recall that the MSCI All-Country World Index fell 11% in 2018.2

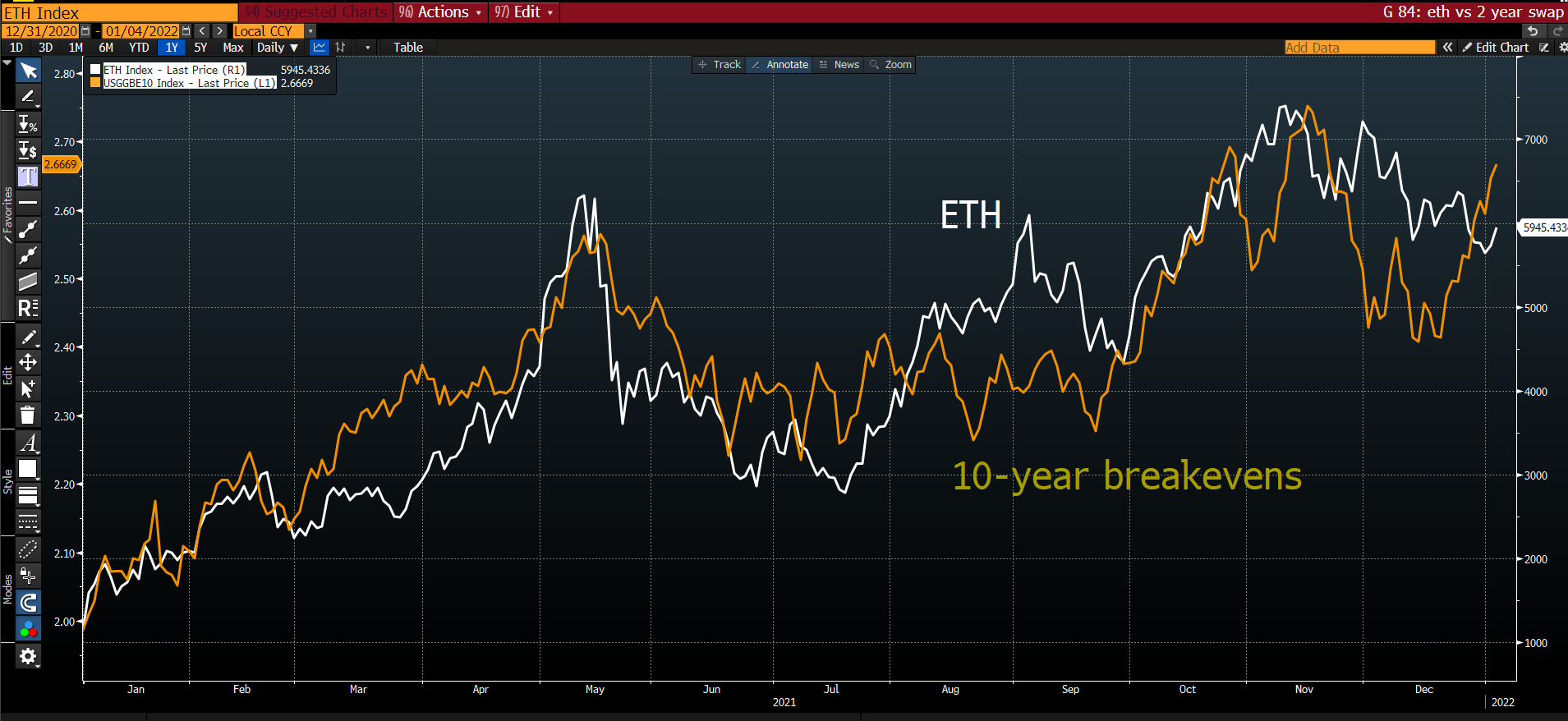

Today, the situation appears very different. While crypto generally and Bitcoin more specifically remain positively correlated to risk assets such as stocks (fig 1), recently rising inflation expectations appear to be providing some support to digital assets (figs 2 and 3). Indeed, layer 1 smart contract platforms, of which Ethereum is the largest, now comprise $600B+ in market cap with 2022 revenues expected to surpass $30B.3 Meanwhile, as venture capitalists pumped $30B+ into blockchain and crypto startups in 2021 vs. a total of $10B in 2017 and 2018 combined4, crypto entrepreneurs have used those funds to build new open-source products that are now driving further adoption: total addresses on the Ethereum blockchain rose 2.6% m/m in December to 141M, while Bitcoin addresses grew 1.4% m/m to 923M. This is as total transactions on Ethereum now surpass Bitcoin by a multiple of 4.5x (1.2M daily for ETH vs 261K daily for BTC).5 Clearly, the on-chain data continue to indicate strong demand for the rules-based monetary policies of open-source blockchain protocols with smart contract capabilities.

Bitcoin/Nasdaq Correlation

Source: Bloomberg as of 1/4/2022.

Bitcoin/20+ Year Treasury Bond Correlation

Source: Bloomberg as of 1/4/2022.

Ethereum vs. 10-Year Breakeven Rates

Source: Bloomberg as of 1/4/2022. 10-Year Breakeven Inflation Rate is a measure of expected inflation based on the difference between 10-Year Bond and Treasury Inflation Protected Securities.

But while 2021 saw massive outperformance from smart contract platforms, DeFi protocols struggled mightily as competitive pressures drove multiple forks of popular automated market makers (AMMs), such as Uniswap, with the result being fee pressure and commoditization leading to underperformance. Thus, the MVIS CryptoCompare Smart Contract Leaders Index rose 294% in 2021 vs. a 13% decline for the MVIS CryptoCompare Decentralized Finance Leaders Index6, opening up an enormous discrepancy between token valuations. Indeed, six of the top smart contract platforms trade at an average of 5,450x protocol sales, while six of the top DeFi platforms trade at an average of 9x sales (figs 4 & 5).7

Smart Contract Protocols (Layer 1): Price-to-Sales Ratio

Source: TokenTerminal, as of 1/4/2022.

DeFi Protocols: Price-to-Sales Ratio

Source: TokenTerminal, as of 1/4/2022.

Markets often exhibit mean reversion tendencies around year-end, and the snap-back in DeFi performance since late November has been substantial, with the MVIS CryptoCompare Decentralized Finance Leaders Index returning 25% in the last 30 days vs. the MVIS CryptoCompare Smart Contract Leaders Index and MVIS CryptoCompare Media & Entertainment Leaders Index, both flat.8 The catalyst for the re-rating appears to be a number of protocol-specific restructuring and M&A actions, including xDai’s hostile bid for Gnosis, a $2B TVL (total value locked) merger between Rari Capital and Fei, and the likely restructuring of Uniswap fork SushiSwap at the request of institutional investors Arca and Frog Nation. With valuations so low in DeFi, investors should expect additional event-driven catalysts in the sector, though making money from them can be quite labor intensive given the lack of standardized information dissemination processes in crypto. Over the last 30-days, some notable DeFi returns include Curve +74%, yearn.finance +61%, Sushiswap +53% and Aave +37%. Contrast these positive marks to the negative returns from some notable smart contract platform tokens: Solana -13%, Ethereum -9%, and Algorand -3%. For perspective, Bitcoin fell 9%.9

On the topic of uneven information dissemination, we should highlight one important method for evaluating blockchain protocols, in addition to measuring on-chain activity such as address and transaction growth. That is, to track the number and commitment of software developers working on any given blockchain. Github, the cloud-based repository that helps developers store and manage their code, serves as a convenient measuring stick, given its ~85% market share in source-code management.10 Evaluating projects based on the number of Github software commits in the last 30 days, we notice that Solana and Bitcoin have fallen out of the top 5, replaced by Fei (an algorithmic stablecoin governed by the TRIBE governance token, which recently announced a merger with DeFi lending/borrowing pool operator Rari Capital), and NEAR Protocol, a $10B market cap smart contract protocol whose non-profit foundation announced an $800M global funding initiative in October aimed at fostering the development of its DeFi ecosystem and incentivizing developers to build new product.11, 12 Since the announcement of that fund, daily transactions on the NEAR protocol have risen from 300k/day to 500k/day and NEAR’s Github commits have outperformed sharply. Meanwhile the NEAR token has doubled over the same period.13 Catching these inflections in Github commits will be an important element in VanEck’s fund management process as we seek to launch active liquid token strategies in 2022.

3 Month Github Commits by Crypto Project

Source: Cryptomiso.

To receive more Digital Assets insights, sign up in our subscription center.

Follow Us

Related Topics

DISCLOSURES

Important Information Regarding Cryptocurrencies.

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The cryptocurrencies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any cryptocurrencies, or to participate in any trading strategy. Past performance is no guarantee of future results.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. References to specific securities and their issuers or sectors are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies, such as Bitcoin, comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

MSCI All-Country World Index is designed to represent performance of large- and mid-cap stocks across developed and emerging markets.

MVIS CryptoCompare Decentralized Finance Leaders Index is designed to track the performance of the largest and most liquid decentralized finance assets.

MVIS CryptoCompare Smart Contract Leaders Index is designed to track the performance of the largest and most liquid smart contract assets.

MVIS CryptoCompare Media & Entertainment Leaders Index is designed to track the performance of the largest and most liquid media & entertainment assets.

1 TradingView, 1/4/22.

2 Bloomberg.

3 Messari, VanEck research as of 1/4/22.

4 Pitchbook, “Venture Capital Funding for Crypto Companies is Surging,” NYTimes, 12/1/2021.

5 Glassnode, 1/4/22.

6 MVIS, as of 1/4/22.

7 TokenTerminal, VanEck, as of 1/4/22.

8 MVIS, as of 1/4/22.

9 Messari, as of 1/4/22.

10 Slintel, https://www.slintel.com/tech/source-code-management/github-market-share#alternatives-and-competitors.

11 “Near announces $800M in funding initiatives to support ecosystem growth,” 10/25/21, https://near.org/blog/near-announces-800-million-in-funding-initiatives-to-support-ecosystem-growth/.

12 Cryptomiso.

13 Messari, NEAR Protocol Blockchain explorer, as of 1/4/22.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

Related Funds

DISCLOSURES

Important Information Regarding Cryptocurrencies.

VanEck assumes no liability for the content of any linked third-party site, and/or content hosted on external sites.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The cryptocurrencies discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any cryptocurrencies, or to participate in any trading strategy. Past performance is no guarantee of future results.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. References to specific securities and their issuers or sectors are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies, such as Bitcoin, comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

MSCI All-Country World Index is designed to represent performance of large- and mid-cap stocks across developed and emerging markets.

MVIS CryptoCompare Decentralized Finance Leaders Index is designed to track the performance of the largest and most liquid decentralized finance assets.

MVIS CryptoCompare Smart Contract Leaders Index is designed to track the performance of the largest and most liquid smart contract assets.

MVIS CryptoCompare Media & Entertainment Leaders Index is designed to track the performance of the largest and most liquid media & entertainment assets.

1 TradingView, 1/4/22.

2 Bloomberg.

3 Messari, VanEck research as of 1/4/22.

4 Pitchbook, “Venture Capital Funding for Crypto Companies is Surging,” NYTimes, 12/1/2021.

5 Glassnode, 1/4/22.

6 MVIS, as of 1/4/22.

7 TokenTerminal, VanEck, as of 1/4/22.

8 MVIS, as of 1/4/22.

9 Messari, as of 1/4/22.

10 Slintel, https://www.slintel.com/tech/source-code-management/github-market-share#alternatives-and-competitors.

11 “Near announces $800M in funding initiatives to support ecosystem growth,” 10/25/21, https://near.org/blog/near-announces-800-million-in-funding-initiatives-to-support-ecosystem-growth/.

12 Cryptomiso.

13 Messari, NEAR Protocol Blockchain explorer, as of 1/4/22.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.