Rates – What Goes Up Must Go Down?

January 05, 2023

Read Time 2 MIN

Fed Signal To The Market

Yield curves in key markets bear-flattened (short rates up more than longer ones), following the hawkish U.S. Federal Reserve (Fed) minutes and a huge upside surprise in the ADP employment change (+235K). The Fed’s message to the market is that the rate cuts expectations are too aggressive (Fed Funds Futures price in 35-40bps of easing in 2023), leading to suggestions that U.S. Dollar might be poised to rally if the market expectations for rates move closer to the Fed projections. We keep an eye on the U.S. labor market report tomorrow, and the December inflation print next week for more color.

Brazil Policy Agenda

The policy space debate is very active in emerging markets (EM), especially in countries like Brazil. Brazil’s 10-year bond yield is oscillating around 13%, which means that the real yield adjusted by expected inflation is extremely high. Why the market continues to price in very few rate cuts this year then? The answer lies in the renewed concerns about the policy agenda (reforms rollback, more spending under new administration), which might require either a “warning shot” rate hike from the central bank or the higher-for-longer policy rate. The new cabinet’s inauguration speeches failed to clarify the situation, and even though at some point the market might price in most of the negativity, it does not look like we are there yet.

EM Disinflation

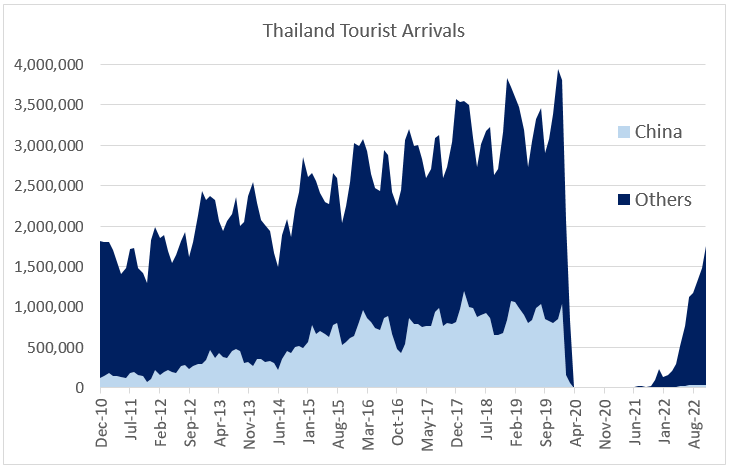

An extra policy complication in EM is that the disinflation process is not just bumpy but that peak inflation is being pushed forward in several countries. We’ve got a serious upside surprise in Colombia this morning, with annual headline inflation rising above 13% and core inflation now approaching 10%. The central bank might need to address this “hiccup” with another 100bps rate hike. Headline inflation in the Philippines rose less than expected, but it is yet to peak (=more tightening). Some members of Mexico’s central bank board suggested that hawkish policy stance should be kept for longer. Even in Thailand – where the disinflation trend is more established – headline inflation reaccelerated in December, signaling that it is premature to talk about rate cuts. Unlike EM peers in other regions, however, Thailand might be uniquely positioned to benefit from China’s reopening and the resumption of tourism inflows (see chart below), which should strengthen the external balance and allow the central bank to proceed with smaller rate hikes. Stay tuned!

Chart at a Glance: China Reopening – A Major Boon for Thailand

Source: Bloomberg LP.

Related Topics

Related Insights

February 26, 2024

January 04, 2024

October 27, 2023

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan's index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG - JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan's index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG - JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.