Index Insights: Follow the Growth Leaders in China and India

May 15, 2020

Read Time 3 MIN

The rapid growth in the Chinese and Indian economies over the past decade is widely known to investors. Yet not many have been able to translate such macroeconomic tailwinds into substantial equity investment gains. Despite this disconnect, there is an abundance of exceptional companies in both countries’ equity markets. These companies are not just notable Chinese or Indian companies, but companies that would be considered great anywhere.

Focus on the Companies, Not the Markets

The process of identifying exceptional companies begins with an analysis of every publicly traded company in the equity universe, which for China and India, totals more than 6,600 companies. We apply 24 fundamental metrics to covered company, dividing all indicators into four categories: Growth, Value (GARP part of the analysis), Profitability and Cash Flow (Quality part of the analysis). These metrics are aggregated into a final MarketGrader Score (MG ScoreTM) between 0 and 100. We then rate as ‘BUY’ all of those with an MG ScoreTM greater than 60 and as ‘SELL’ all of those with an MG ScoreTM below 50. The remaining companies are rated ‘HOLD’.

Ultimately, the goal is to identify companies with the following characteristics:

- Consistent top to bottom line growth—not just explosive short-term growth—with sustainable margins and high cash flow generation.

- Reasonable valuations relative to sustainable growth rates, and not based just on absolute, out of context, valuation multiples.

- A sound capital structure that does not impair operating growth, combined with high returns on invested capital and low capital intensity.

China and India Through MarketGrader’s GARP Lens

For more than two decades, MarketGrader has been implementing the process described above to view global equity markets from a unique vantage point: through a GARP + Quality lens focused on the financial health of individual companies rather than on broad asset or sub-asset classes (such as large vs. small or emerging vs. developed economies).

Our approach is decidedly bottom-up and grounded in stock selection. We believe that the important macroeconomic factors driving growth in these countries can be harnessed by owning the companies best positioned to profit from those trends and thus compound growth over many years. Our China and India Growth Leaders Indices were built based on this approach. Selecting the constituents of these Indices requires both knowing what to include (the highly-rated companies) and knowing what to exclude (low-rated companies).

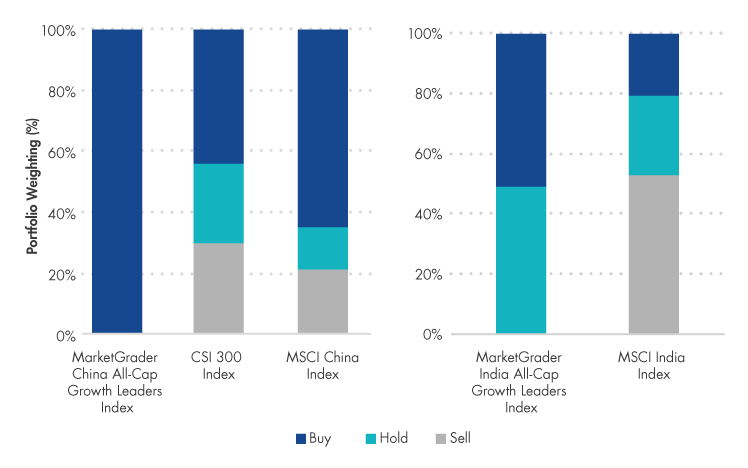

Broad-based indices that cover the entire market may include companies with poor growth, value or quality attributes. The chart below highlights the MG ScoreTM breakdown by weighting of the MarketGrader China All-Cap Growth Leaders Index and MarketGrader India All-Cap Growth Leaders Index compared to broad benchmarks. By incorporating MarketGrader’s scoring methodology and applying it to a broad universe of stocks, investors may be able to sidestep some of the troublesome companies that are held in the benchmark indices.

MarketGrader China and India All-Cap Growth Leaders Index Comparison

How to invest

The VanEck Vectors® India Growth Leaders ETF (GLIN) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MarketGrader India All-Cap Growth Leaders Index (MGINGRNR). The Index consists of 80 companies domiciled in India that the index provider has determined exhibit favorable fundamental characteristics.

Related Insights

April 18, 2024

February 29, 2024

February 21, 2024

Important Disclosures

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

An investment in the VanEck Vectors China Growth Leaders ETF may be subject to risks associated with investments in Chinese securities, including A-shares, which include risk of the RQFII regime and Stock Connect program, foreign and emerging markets investments. In addition, the Fund is subject to foreign currency risk, non-diversification risk, and other risks associated with investing in the consumer discretionary sector, consumer staples sector, financials sector, industrials sector, swaps, futures, investing in other funds, small-and medium capitalization companies, cash transactions, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading, passive management, fund shares trading, premium/discount risk and liquidity of fund shares and concentration risks, all of which may adversely affect the Fund.

The Fund may gain exposure to the China A-Share market by directly investing in China A-Shares and investing in swaps that are linked to the performance of China A-Shares. An investment in the Fund involves a significant degree of risk, including, but not limited to, risk of the RQFII regime and the Fund’s principal investment strategy, investing in China and A-shares, investing through Stock Connect, foreign securities, emerging market issuers, foreign currency, consumer discretionary sector, consumer staples sector, financials sector, investing in swaps, futures, other funds, small-and medium-capitalization companies, cash transactions, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversification, concentration risks and the Adviser’s and Sub-adviser’sability to manage the Fund, which depends upon the availability of China A-Shares and the willingness of swap counterparties to engage in swaps linked to the performance of China A-shares all of which may adversely affect the Fund. The Fund may invest in derivatives, which entail certain risks, including counterparty, liquidity, and tax risks (including short-term capital gains and/or ordinary income). Foreign and emerging markets investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s returns. The Fund may also invest in shares of other funds and absorb duplicate levels of fees with respect to these investments. Small-and Medium-capitalization companies may be subject to elevated risks.

An investment in the VanEckVectors India Growth Leaders ETF may be subject to risks which include, among others, special risk considerations of investing in Indian issuers, foreign securities, emerging market issuers, foreign currency, depositary receipts, consumer staples sector, basic materials sector, consumer discretionary sector, financials sector, industrials sector, information technology sector, small-and medium capitalization companies, cash transactions, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares and concentration risks, all of which may adversely affect the Fund.

The CSI 300 is a free-float market capitalization weighted index compiled and managed by China Securities Index Co. Ltd. consisting of 300 A-share stocks listed on the Shenzen and/or Shanghai Stock Exchanges.

The MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 704 constituents, the index covers about 85% of this China equity universe.

The MSCI India Index is designed to measure the performance of the large and mid cap segments of the Indian market. With 84 constituents, the index covers approximately 85% of the Indian equity universe.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Important Disclosures

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

An investment in the VanEck Vectors China Growth Leaders ETF may be subject to risks associated with investments in Chinese securities, including A-shares, which include risk of the RQFII regime and Stock Connect program, foreign and emerging markets investments. In addition, the Fund is subject to foreign currency risk, non-diversification risk, and other risks associated with investing in the consumer discretionary sector, consumer staples sector, financials sector, industrials sector, swaps, futures, investing in other funds, small-and medium capitalization companies, cash transactions, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading, passive management, fund shares trading, premium/discount risk and liquidity of fund shares and concentration risks, all of which may adversely affect the Fund.

The Fund may gain exposure to the China A-Share market by directly investing in China A-Shares and investing in swaps that are linked to the performance of China A-Shares. An investment in the Fund involves a significant degree of risk, including, but not limited to, risk of the RQFII regime and the Fund’s principal investment strategy, investing in China and A-shares, investing through Stock Connect, foreign securities, emerging market issuers, foreign currency, consumer discretionary sector, consumer staples sector, financials sector, investing in swaps, futures, other funds, small-and medium-capitalization companies, cash transactions, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversification, concentration risks and the Adviser’s and Sub-adviser’sability to manage the Fund, which depends upon the availability of China A-Shares and the willingness of swap counterparties to engage in swaps linked to the performance of China A-shares all of which may adversely affect the Fund. The Fund may invest in derivatives, which entail certain risks, including counterparty, liquidity, and tax risks (including short-term capital gains and/or ordinary income). Foreign and emerging markets investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s returns. The Fund may also invest in shares of other funds and absorb duplicate levels of fees with respect to these investments. Small-and Medium-capitalization companies may be subject to elevated risks.

An investment in the VanEckVectors India Growth Leaders ETF may be subject to risks which include, among others, special risk considerations of investing in Indian issuers, foreign securities, emerging market issuers, foreign currency, depositary receipts, consumer staples sector, basic materials sector, consumer discretionary sector, financials sector, industrials sector, information technology sector, small-and medium capitalization companies, cash transactions, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares and concentration risks, all of which may adversely affect the Fund.

The CSI 300 is a free-float market capitalization weighted index compiled and managed by China Securities Index Co. Ltd. consisting of 300 A-share stocks listed on the Shenzen and/or Shanghai Stock Exchanges.

The MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 704 constituents, the index covers about 85% of this China equity universe.

The MSCI India Index is designed to measure the performance of the large and mid cap segments of the Indian market. With 84 constituents, the index covers approximately 85% of the Indian equity universe.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.