Inside China’s Pivot: Smarter Growth, Sharper Investing

July 31, 2025

Read Time 8 MIN

- Economic activity has likely bottomed out, but the recovery remains uneven, with a clear shift in consumer demand toward new consumption trends focused on experiences, emotions, and value, rather than big-ticket spending.

- Policy is shifting to a strategic approach, with targeted support for innovation and quality growth over broad stimulus.

- AI and technology are scaling rapidly, driven by government prioritization and significant capital investment.

- Competition is intense, especially in EVs and e-commerce, but policy is starting to push back on margin-eroding price wars.

- As sentiment improves, selectivity is key, focused on companies with pricing power, capital discipline, and alignment with policy and structural growth trends.

Boots on the Ground in China: Firsthand Insights from a Transforming Economy

Investor sentiment toward China has been cautious in recent years, shaped by regulatory overhang and global tensions. But after two weeks on the ground across five cities—meeting company leaders, walking factory floors, and observing evolving consumer behavior — we came away with a more nuanced, forward-looking view. While macro recovery remains slow and uneven, innovation is moving fast, and selective policy support is clearly guiding capital, talent, and attention into strategic growth areas.

For investors, this means opportunity—but not necessarily broad exposure. It’s about being focused and aligned with the direction of change.

Economic Landscape: Stabilization with Strategic Focus

China’s recovery is advancing, though still gradual and uneven. Activity has likely bottomed out. Green shoots are emerging across sectors, but challenges remain—from deflationary pressures to lingering overcapacity in sectors like property, EVs, manufacturing, and more recently in some e-commerce segments.

The government remains committed to a ~5% GDP growth target in 2025, favoring a measured approach.1 Premier Li Qiang continues to stress “high-quality development,” with policy support aimed at boosting domestic demand and accelerating innovation in areas such as AI, automation, and clean energy—rather than deploying blunt, broad-based stimulus.2

Ongoing trade tensions with the U.S. have added pressure on China’s export sector, but Beijing has responded with measured pragmatism. The central bank stands ready to inject liquidity and adjust rates if needed.3 Notably, policymakers have begun publicly addressing the issue of “involution”—China’s race-to-the-bottom price wars, especially pronounced in EVs and e-commerce. The emerging push toward more rational growth, profitability, and quality-focused business models marks a positive shift for long-term investors.

That said, the path ahead may be more complex than in past reform cycles. Unlike the 2015–2016 supply-side reforms—where overcapacity was concentrated in SOEs and commodity-linked sectors—today’s challenges cut across a broader range of industries, particularly in the private sector. With demand still tepid, the adjustment will likely be gradual. Nonetheless, the policy direction is clear—and welcome: steering the economy toward healthier, more sustainable growth.

Taken together, these signals point to a steady, pragmatic macro approach—one that balances near-term support with long-term strategic alignment. For investors, this underscores the need for focus: identifying companies with pricing power, capital discipline, and alignment with the sectors where policy, innovation, and demand intersect.

On the Ground Observations by Themes

1. Technology and Artificial Intelligence

China’s AI Push: Progress with Pragmatic Challenges

China’s ambition to become a global AI leader is more than aspirational—it’s backed by substantial capital and national commitment. In 2025 alone, the government allocated over $50 billion to AI development, signaling its strategic priority within China’s broader economic transition.4

Technology giants like Alibaba* and Tencent* are playing central roles. Alibaba is rapidly expanding its cloud and compute infrastructure for external use, while Tencent is embedding AI into internal workflows—with early gains seen in areas like targeted advertising and digital operations.4 Both firms have pivoted toward supporting national tech priorities, and in doing so, appear to have regained policy favor.

These moves are helping build out China’s domestic AI ecosystem, but key constraints remain—chief among them, access to advanced chips. U.S. firms like Nvidia continue to dominate the high-end GPU market, creating a structural bottleneck for model training and scalability. In response, local players such as Huawei and others are accelerating R&D. The partial easing of U.S. export controls, allowing Nvidia to resume shipments of chips like the H20 and RTX Pro, signals not only geopolitical pragmatism but also the depth of China’s demand—even for second-tier hardware.

On the infrastructure side, China enjoys a cost and capacity advantage. Abundant electricity and excess industrial space make it relatively easier to scale data centers. Buildout is progressing rapidly—but near-term challenges persist: overcapacity in lower-tier regions, high capital intensity, and delayed monetization. That said, we expect utilization rates to improve by 2026, especially across Tier-1 city clusters where AI adoption is accelerating and policy support is concentrated.

A notable catalyst has been the so-called "Deepseek moment"—a breakthrough that reframed the importance of AI inferencing over brute-force training. This has sparked a shift toward practical, scalable applications of AI, with greater emphasis on edge deployment and commercial use cases rather than just foundational model horsepower.

In sum, China’s AI ambitions are moving quickly and deliberately, even as they navigate external constraints. For investors, this is not a story of broad thematic exposure—it’s about precision. The opportunity lies in identifying companies that combine technological depth, policy alignment, and capital discipline—those positioned to lead as China builds its own distinct AI architecture for the decade ahead.

2. Advanced Manufacturing and Robotics

China’s automation and systems integration capabilities are rapidly setting a global benchmark. Across EVs and electronics supply chains, “lights-out” factories—run by engineers rather than laborers—are becoming the norm, signaling a decisive shift toward high-efficiency, high-tech production.

Companies like Shenzhen Inovance* are well-positioned to benefit from the accelerating adoption of factory automation. At the same time, the humanoid robotics supply chain is expanding, with more Chinese firms—including component makers and integrators—being tapped to support initiatives like Tesla’s Optimus robot.

The integration of robotics into real-world manufacturing is no longer conceptual. Partnerships like UBTech and BYD* deploying humanoid robots on production lines to automate repetitive tasks, reduce labor costs, and improve operational precision. The technological progress is striking—but ultimately, capital discipline and execution will determine which companies emerge as long-term winners in this fast-evolving space.

An automated EV components factory floor and Ola at a robotic exhibition.

3. Electric Vehicles (EVs) and Autonomous Driving

China continues to make strong headway in Advanced Driver Assistance Systems (ADAS), with adoption rising quickly—especially in Level 2+ systems that offer partial automation with human oversight. While Nvidia chips still power much of the underlying compute, domestic players like Huawei and Horizon Robotics are gaining momentum, driven by national priorities and increasing OEM demand.

A test ride in a Pony.ai robotaxi in Shenzhen demonstrated Level 4 autonomy already functioning in real-world conditions—clear evidence that the technology is advancing rapidly. However, widespread L4 rollout in passenger vehicles will take time, as challenges remain around cost, safety validation, and user experience. Crucially, the regulatory framework for fully autonomous driving is still under development, and will be key to enabling scaled commercial deployment.

The pace of innovation is encouraging, but a mature ecosystem—combining regulation, infrastructure, and consumer readiness—will be essential for the next stage of autonomy to take hold.

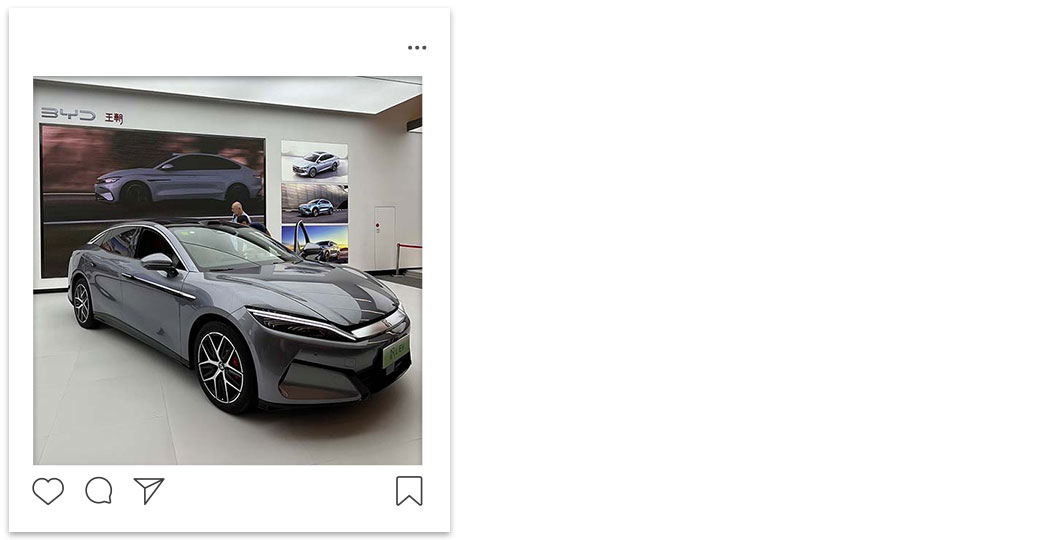

BYD’s latest EV lineup on-site.

4. New Consumption Trends

Chinese consumers are not simply pulling back — they are reprioritizing. While overall sentiment remains cautious, spending patterns are shifting in more emotionally driven and experience-oriented directions. A rising trend known as “dopamine consumption”—small indulgences that deliver immediate joy or gratification—is fueling demand across categories like bubble tea, travel, branded gold, outdoor gear, and IP-based collectibles also known as pop toys.

One standout example is the viral craze surrounding Labububmonster figurines—collectible toys sold in “blind boxes” that conceal the character inside. Young adults eagerly line up to buy them, drawn not just by the product but by the experience: the thrill of surprise, the joy of sharing with friends, and the social ritual of trading figures—sometimes at significant resale premiums. Here, it’s not about price—it’s about novelty, identity, and emotional gratification.

This trend is more than a short-term reaction and reflects a structural shift, led by younger generations, toward value, identity, and utility over traditional brand status or big-ticket goods. Emotional consumption has grown at an average annual rate of 12% since 2013 and is projected to surpass $270 billion in 2025.5

Companies that tap into these evolving preferences by delivering affordability, creativity, and cultural relevance are outperforming. Companies like Pop Mart and Laopu Gold, which align closely with these emotional consumption trends, have delivered standout equity performance this year. Within our portfolio, we see similar positioning strength in names such as Miniso*, ANTA Sports*, Trip.com*, and gaming leaders like Netease* and Tencent*—all well poised to capture this next wave of experience-driven consumer growth.

Labubu dolls on display in a Chinese shop.

Miniso’s new “Pink” flagship store in Shanghai.

Recommended subscription

Positioning for What’s Next

The China opportunity remains real, but it’s no longer about broad beta. It’s about depth over breadth. Innovation is moving fast. Policy is becoming more pragmatic. And the consumer is evolving.

At VanEck, the focus remains on companies with pricing power, capital discipline, and alignment with structural growth themes—particularly in AI infrastructure, advanced manufacturing, electric mobility, and emerging consumer behavior.

Valuations are compelling, and sentiment is turning a corner. For investors with a discerning lens and on-the-ground insight, the next leg of China’s transformation appears increasingly attractive.

Investing in China with VanEck

VanEck Emerging Markets Fund offers exposure to high quality, structural growth companies at a reasonable price poised to represent future development and growth of emerging markets.

* Data as of 6/30/2025. Portfolio weight: Alibaba(1.62%), Tencent (2.46%), Shenzhen Inovance (0.79%), BYD Company Ltd. (1.68%), Xiaomi Corporation Ltd. (0.33%), ANTA Sports Products Ltd. (0.70%), Trip.com Group Ltd. (1.02%).

To receive more Emerging Markets Equity insights, sign up in our subscription center.

IMPORTANT DISCLOSURES

1 China keeps its economic growth target at 'around 5%' for 2025.

2 China can maintain high growth and transition to consumer-led economy, premier Li says.

3 China's central bank pledges to speed up policy response to economic conditions.

4 China’s AI capital spending set to reach up to US$98 billion in 2025 amid rivalry with US.

5 Young Chinese consumers are spending to feel good amid slower economic growth.

* All country and company weightings are as of May 31, 2025. Any mention of an individual security is not a recommendation to buy or to sell the security. Fund securities and holdings may vary.

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

The MSCI Emerging Markets Investable Market Index (IMI) captures large, mid, small-cap cap representation across emerging markets (EM) countries. The index covers approximately 99% of the free float-adjusted market capitalization in each country.

The MSCI EM IMI Growth Index is a benchmark that captures the performance of large and mid-cap securities exhibiting growth characteristics within the MSCI Emerging Markets Investable Market Index (IMI).

MSCI China Index captures large and mid-cap representation across China equity securities. The index covers approximately 85% of the free float-adjusted market capitalization in the China equity universe.

MSCI India Index captures large and mid-cap representation of the Indian equity market. The index covers approximately 85% of the free float-adjusted market capitalization in India.

MSCI Brazil Index captures large and mid-cap representation of the Brazilian equity market. The index covers approximately 85% of the free float-adjusted market capitalization in Brazil.

MSCI Peru Index captures large and mid-cap representation of the Peruvian equity market. The index covers approximately 85% of the free float-adjusted market capitalization in Peru.

MSCI Argentina Index captures large and mid-cap representation of the Argentinian equity market. The index covers approximately 85% of the free float-adjusted market capitalization in Argentina.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

You can lose money by investing in the Fund. Any investment in the Fund should be part of an overall investment program, not a complete program. The Fund is subject to risks which may include, but are not limited to, risks associated with active management, consumer discretionary sector, direct investments, emerging market issuers, ESG investing strategy, financials sector, foreign currency, foreign securities, industrials sector, information technology sector, market, operational, restricted securities, investing in other funds, small- and medium-capitalization companies, special purpose acquisition companies, special risk considerations of investing in Brazilian, Chinese, Indian, Latin American and Taiwanese issuers, and Stock Connect risks, all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks. Investments in Chinese issuers may entail additional risks that include, among others, lack of liquidity and price volatility, currency devaluations and exchange rate fluctuations, intervention by the Chinese government, nationalization or expropriation, limitations on the use of brokers, and trade limitations.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of a fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.

Related Funds

IMPORTANT DISCLOSURES

1 China keeps its economic growth target at 'around 5%' for 2025.

2 China can maintain high growth and transition to consumer-led economy, premier Li says.

3 China's central bank pledges to speed up policy response to economic conditions.

4 China’s AI capital spending set to reach up to US$98 billion in 2025 amid rivalry with US.

5 Young Chinese consumers are spending to feel good amid slower economic growth.

* All country and company weightings are as of May 31, 2025. Any mention of an individual security is not a recommendation to buy or to sell the security. Fund securities and holdings may vary.

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

The MSCI Emerging Markets Investable Market Index (IMI) captures large, mid, small-cap cap representation across emerging markets (EM) countries. The index covers approximately 99% of the free float-adjusted market capitalization in each country.

The MSCI EM IMI Growth Index is a benchmark that captures the performance of large and mid-cap securities exhibiting growth characteristics within the MSCI Emerging Markets Investable Market Index (IMI).

MSCI China Index captures large and mid-cap representation across China equity securities. The index covers approximately 85% of the free float-adjusted market capitalization in the China equity universe.

MSCI India Index captures large and mid-cap representation of the Indian equity market. The index covers approximately 85% of the free float-adjusted market capitalization in India.

MSCI Brazil Index captures large and mid-cap representation of the Brazilian equity market. The index covers approximately 85% of the free float-adjusted market capitalization in Brazil.

MSCI Peru Index captures large and mid-cap representation of the Peruvian equity market. The index covers approximately 85% of the free float-adjusted market capitalization in Peru.

MSCI Argentina Index captures large and mid-cap representation of the Argentinian equity market. The index covers approximately 85% of the free float-adjusted market capitalization in Argentina.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

You can lose money by investing in the Fund. Any investment in the Fund should be part of an overall investment program, not a complete program. The Fund is subject to risks which may include, but are not limited to, risks associated with active management, consumer discretionary sector, direct investments, emerging market issuers, ESG investing strategy, financials sector, foreign currency, foreign securities, industrials sector, information technology sector, market, operational, restricted securities, investing in other funds, small- and medium-capitalization companies, special purpose acquisition companies, special risk considerations of investing in Brazilian, Chinese, Indian, Latin American and Taiwanese issuers, and Stock Connect risks, all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks. Investments in Chinese issuers may entail additional risks that include, among others, lack of liquidity and price volatility, currency devaluations and exchange rate fluctuations, intervention by the Chinese government, nationalization or expropriation, limitations on the use of brokers, and trade limitations.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of a fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

© Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation.