Navigate ETF Premiums and Discounts Accurately

June 18, 2020

Read Time 7 MIN

Measuring an ETF’s Value

A premium or discount is the difference between a fund’s share price and its Net Asset Value (NAV). In order to understand why premiums and discounts can occur in ETFs, investors first need to understand the basics of ETF pricing, both in terms of NAV and market price. Both are important measures of an ETF’s value, and their significance can vary depending on what the investor is measuring and trying to achieve.

How is NAV calculated?

NAV is a measure of a fund’s value, including the fund’s holdings as well as any liabilities, such as accrued expenses or borrowing. Both ETFs and mutual funds calculate NAV once per day. For domestic equities, the calculation is straightforward and will generally be based on the closing prices of the stocks held in the portfolio. For funds holding international securities that trade in a different time zone, the NAV may be based on the closing price of the securities in their local markets, in which case the NAV may not represent a contemporaneous value of those securities, although there would likely be an adjustment to account for changes in foreign currencies. Alternatively, some fund companies may use estimated fair values of these holdings which reflect changes in market value after the stocks ceased to trade in their local markets. This estimate, typically provided by a third party and overseen by the fund manager, includes not only changes in foreign exchange rates but also general movements in the domestic equity market when foreign markets were closed. The goal of these various methodologies is to generate the fairest valuation of a fund’s assets in order to calculate as accurate a NAV as possible.

What Role NAV plays in Mutual Funds vs. ETFs

NAV has importance to investors beyond the fair estimation of a fund’s value. Mutual fund investors can transact at NAV, as can the Authorized Participants who can create and redeem ETF shares. Unlike mutual fund investors, however, ETF investors generally buy or sell their shares at the market price quoted by ETF market makers throughout the day on a stock exchange. These secondary market prices reflect not only the market makers’ valuation of these bonds but also any anticipated trading costs. Differences between the market price and NAV are measured by the premium or discount.

How is an ETF’s market price determined?

What ensures that these market quotes are “fair”? Competition for trading volume among market makers is a key driver, and it is not unusual for premiums and discounts and wider bid-ask spreads to be more prevalent in smaller ETFs or those that do not exhibit strong two-way trading flows (i.e. both buying and selling). For all ETFs, however, the arbitrage potential created by the creation/redemption process provides boundaries on the extent to which market prices typically deviate from NAV, since Authorized Participants transact with the ETF at NAV and provide or receive the underlying securities at their market value. As a result, significant deviations between and ETF’s market price and a portfolio’s NAV, are typically short-lived.

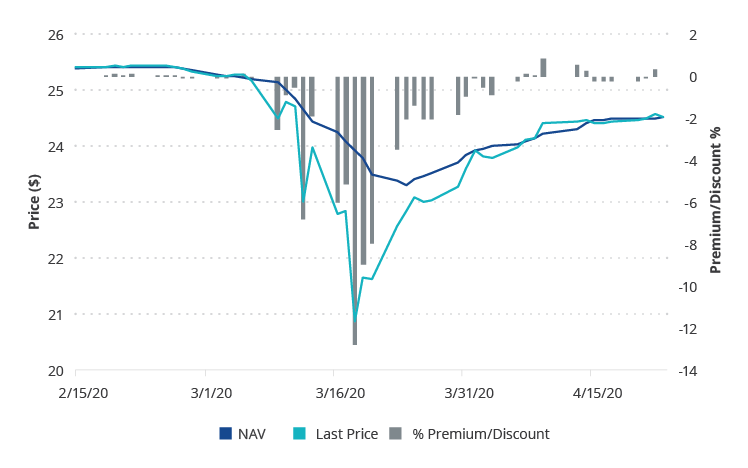

VanEck Vectors® Investment Grade Floating Rate ETF (FLTR®) - Premium/Discounts 2/14/2020 - 4/23/2020

Source: VanEck as of 5/31/20.

Equitable distribution of costs

The premium or discount incorporates costs that shareholders otherwise would incur if they were to replicate the fund’s portfolio and are costs that would be borne by the mutual fund buying those same securities. The difference is that with an ETF, the costs are paid by transacting shareholders. For example, if an ETF investors’ selling of shares results in a redemption, those sellers pay for the costs of the redemption, because the market maker will have incorporated these costs into their prices. Shareholders who remain in the fund do not bear these transaction costs because the redemption is satisfied via the in-kind delivery of securities, and those securities are valued for the purpose of the redemption based on that day’s NAV. As a result, ETF portfolio managers generally do not have to sell securities for redemptions. On the other hand, mutual fund investors who redeem their shares at NAV are effectively transferring the execution risk, and all the associated costs, to shareholders who remain in the fund. To the extent that the underlying securities are sold at market values that are less than those used to calculate the NAV, it is the remaining shareholders who will experience that loss. This is an important distinction that we will return to in a later section. Note that if there is active buying and selling in the ETF shares, ETF market prices may reflect lower transaction costs (through a narrower bid-offer spread) since the secondary layer of liquidity provided by the ETF structure reduces the need to trade the underlying securities. In that case, not only are existing shareholders protected, but transacting shareholders benefit from tighter bid-offer spreads.

Does NAV pricing make mutual funds better?

Given the apparent stability of the NAV relative to an ETF’s market price during market stress, and the fact that mutual fund investors can transact at NAV, many investors may conclude that the mutual fund is a superior structure. Although the mutual fund structure may satisfy the needs of many investors and may be better suited for certain asset classes and investment strategies, we believe that choosing mutual funds over ETFs solely based on premium/discount potential is misguided.

ETF Discounts & Premiums—ETFs vs. Mutual Funds

As described herein, ETF market prices better reflect the market’s real-time assessment of not only the portfolio’s value but also trading costs. ETFs provide not only a valuable price discovery tool for the overall marketplace, but also provide investors with real time executable pricing on their investment. In times of market stress, a discount to NAV may represent the price of immediate liquidity in an uncertain market. ETFs provide the benefits of price transparency and liquidity in stressed conditions, which is when these benefits have the greatest value. Mutual funds do not provide either. For investors who do not need to transact in stressed markets, NAVs and market prices generally converge as market volatility dies down. This can be driven both by narrowing bid-offers and decreasing costs of liquidity, which can increase the market price, or as underlying security values provided by pricing vendors adjust downwards to reflect actual transactions taking place, which would decrease the NAV.

Further, the inherent inequitable distribution of costs should be a concern for mutual fund investors. As described previously, the costs associated with redemptions are borne by remaining shareholders, while transacting shareholder receive NAV. This means that investors who are trading in periods of market stress are potentially having their trading costs subsidized by long-term shareholders. This provides an incentive to be the first to redeem in such a situation, potentially further exacerbating this effect. For funds that invest in fixed income or other less liquid asset classes, this poses a very significant risk for remaining shareholders, since NAV prices of the underlying securities may dislocate from their executable market prices in times of stress. At the same time, those who choose to invest in the same fund during times of market stress may be overpaying relative to the market value of the underlying assets.

The ETF structure has several inherent benefits to investors:

1.The trading of the ETF shares provides a second layer of liquidity that allows investors to transact throughout the day

2.The structure provides transparency to both the exposure and cost

Mutual funds do not provide the same level of liquidity and transparency, but can certainly satisfy the needs of long-term investors who do not need to trade intraday nor seek to invest in less liquid asset classes, if they are comfortable with the more inequitable distribution of costs or relative lack of transparency. We believe both structures can be suitable for long-term investors, but that ETFs can also be suitable for investors seeking liquidity, trading opportunities, tactical exposure, or hedging tools. All investment vehicles, whether ETF or mutual fund, as well as separately managed accounts, hedge funds or closed-end funds, have inherent benefits and drawbacks. Investors should understand the relative advantages and disadvantages that each structure provides, so they can choose the vehicle best suited to their needs and the investment strategy.

IMPORTANT DISCLOSURES

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

An investment in the Fund may be subject to risk which includes, among others, foreign securities, foreign currency, credit, interest rate, floating rate, floating rate LIBOR, restricted securities, financial, market, operational, sampling, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified and concentration risks, all of which may adversely affect the Fund.

Diversification does not assure a profit nor protect against loss.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Related Funds

IMPORTANT DISCLOSURES

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

An investment in the Fund may be subject to risk which includes, among others, foreign securities, foreign currency, credit, interest rate, floating rate, floating rate LIBOR, restricted securities, financial, market, operational, sampling, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified and concentration risks, all of which may adversely affect the Fund.

Diversification does not assure a profit nor protect against loss.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.