New Fallen Angel Bonds Drive Performance

August 10, 2020

Read Time 4 MIN

Fallen angel bonds, as represented by the ICE US Fallen Angel High Yield 10% Constrained Index (“Fallen Angel Index”), are outperforming the broad U.S. high yield market, as represented by the ICE BofA High Yield Index (“High Yield Index”), year-to-date by 5.23% as of July 31, 2020.1 This year’s new fallen angels are the primary drivers. As we have noted previously, outperformance versus the broad high yield market historically follows periods of high fallen angel volume, and this year has not been an exception. With over $140B of new fallen angels so far this year, it is already a record year, and we expect more fallen angel volume going forward.2

From an issuer standpoint, four of the top five contributors have entered this year, including Occidental Petroleum, Ford and Kraft Heinz.

Top 5 contributors to outperformance vs broad high yield market:

| 12/31/2019 – 7/31/2020 | Contribution to Outperformance (%) |

|

| Total | 5.23 | |

| Occidental Petroleum | 1.28 | |

| EQT Corporation | 1.04 | |

| T-Mobile | 1.00 | |

| Kraft Heinz | 0.89 | |

| Ford | 0.64 |

Source: FactSet. Contribution to outperformance represents the opportunity cost of an investment manager’s investment decisions relative to the overall benchmark. It is calculated by summing the three factors: allocation, security and interaction effects.

There are three main explanations for this outperformance:

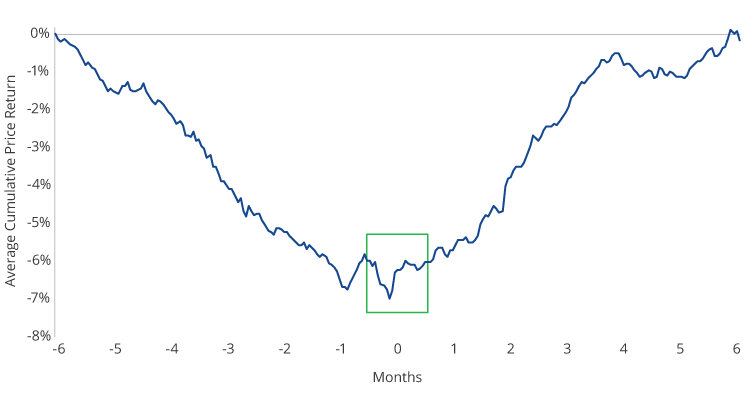

- The fallen angel technical effect: This has been more pronounced this year as the average six-month price return prior to entering the index for all 2020 fallen angels YTD is ~-18%, which is more than twice the historical average (~-7%).3 Within six months of entering the index, the new fallen angel bonds prices tend to recover and usually go back to where they were six months before entering the index.

Average Fallen Angel Bond Cumulative Return: 6 Months Before to 6 Months After Entering the Index

Source: FactSet. This chart is for illustrative purposes only. Past performance is not indicative of future results. Data is based on bond constituents of the ICE BofA US Fallen Angel High Yield Index that were downgraded to high yield and entered the index in 2004 or later. Index data on and prior to February 28, 2020 reflects that of the ICE BofA US Fallen Angel High Yield Index (H0FA). From February 28, 2020 forward, the index data reflects that of the ICE US Fallen Angel High Yield 10% Constrained Index (H0CF).

- Contrarian sector approach: The recovery of the energy sector helps demonstrate this. Fallen angels’ overweight to energy has contributed 1.57% to outperformance this year versus the High Yield Broad Market Index and has returned 42.57% since 3/31/2020 (as of 7/31/2020).4

- Higher relative credit quality: New fallen angels have been rated BB, increasing the index’s BB exposure to 92.78% vs 56.58% in the broad high yield market.5 Accordingly, this year’s outperformance thus far is coming from the BB allocation, which has contributed to more than 100% of its return while other credit quality allocations have detracted performance.

Kraft, Ford and the new energy fallen angels have averaged a 19.36% price return since index entry.6 The average of all 2020 fallen angels is about 12%, which is above the historical average.7 Kraft, EQT and EQM were helped even more as the Federal Reserve (Fed) announced an expansion of the Corporate Credit Facilities on April 9, a few days after they entered the index. Ford has had more support from the Fed, as they bought some of its bonds as part of their program to support liquidity. However, EQT bonds are the top performers (based on price return) since index entry in March 2020 with a 31.20% price appreciation.8

| Issuer | Month of Entry |

Sector | Industry | Weight at Index Entry (%) |

Avg PR since Index Entry as of 7/31/2020 |

| Kraft Heinz | March | Consumer Goods | Food - Wholesale | 10.00 | 8.26% |

| Ford | May | Automotive | Automakers | 10.00 | 18.45% |

| Occidental Petroleum | May | Energy | Integrated Energy | 10.00 | 26.11% |

| Western Midstream | May | Energy | Gas Distribution | 3.83 | 14.99% |

| Apache Corporation | July | Energy | Energy - Exploration & Production | 2.86 | 14.23% |

| EQT Corporation | March | Energy | Gas Distribution | 2.83 | 31.20% |

| EQM Midstream Partners | March | Energy | Gas Distribution | 2.41 | 19.36% |

| Services Properties Trust | June | Real Estate | REITs | 2.35 | 6.84% |

| Cenovus Energy | May | Energy | Integrated Energy | 2.20 | 28.12% |

| Carnival Corporation | July | Leisure | Recreation & Travel | 2.16 | 0.23% |

Alpha Potential Despite Tighter Yields

Yields and spreads have tightened significantly from the elevated levels at the end of March. Nevertheless, we believe new fallen angels may provide high yield investors with outperformance versus the broader high yield market due to the significant price returns driven by buying deeply discounted bonds. In our view, a fallen angel high yield strategy performs best in an environment like the current one, characterized by the high volume of fallen angels. Given our outlook for an additional $100 to $150 billion of new fallen angels this year, we do not believe that the current cycle or the potential to outperform has run its course.

Related Insights

Fallen angels outperformed broad high yield by 0.24% in March and 0.10% YTD, due in part, to tighter spreads. Q1 2024 saw two fallen angels and two rising stars.

April 17, 2024

April 10, 2024

April 09, 2024

March 22, 2024

DISCLOSURES

1Source: ICE Data Indices

2Source: FactSet, ICE Data Indices, LLC and Morningstar as of July 31, 2020.

3Source: FactSet and VanEck.

4Source: FactSet and ICE Data Indices.

5Source: ICE Data Indices. Data as of July 31, 2020.

6Source: ICE Data Indices. Data as of July 31, 2020.

7Source: ICE Data Indices. Data as of July 31, 2020.

8Source: ICE Data Indices. Data as of July 31, 2020.

A fallen angel bond is a bond that was initially given an investment-grade rating but has since been reduced to junk bond status.

High yield bonds may be subject to greater risk of loss of income and principal and are likely to be more sensitive to adverse economic changes than higher rated securities.

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) included herein.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed in this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any discussion of specific securities/financial instruments mentioned in the commentary is neither an offer to sell nor a recommendation to buy these securities. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

ICE BofAML US High Yield Index (H0A0, “Broad HY Index”), formerly known as BofA Merrill Lynch US High Yield Index prior to 10/23/2017, is comprised of below-investment grade corporate bonds (based on an average of various rating agencies) denominated in U.S. dollars.

ICE US Fallen Angel High Yield 10% Constrained Index (H0CF, Index) is a subset of the ICE BofA US High Yield Index and includes securities that were rated investment grade at time of issuance.

ICE Data Indices, LLC and its affiliates (“ICE Data”) indices and related information, the name "ICE Data", and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data's prior written approval. The licensee's products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by ICE Data. ICE Data MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS).

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURES

1Source: ICE Data Indices

2Source: FactSet, ICE Data Indices, LLC and Morningstar as of July 31, 2020.

3Source: FactSet and VanEck.

4Source: FactSet and ICE Data Indices.

5Source: ICE Data Indices. Data as of July 31, 2020.

6Source: ICE Data Indices. Data as of July 31, 2020.

7Source: ICE Data Indices. Data as of July 31, 2020.

8Source: ICE Data Indices. Data as of July 31, 2020.

A fallen angel bond is a bond that was initially given an investment-grade rating but has since been reduced to junk bond status.

High yield bonds may be subject to greater risk of loss of income and principal and are likely to be more sensitive to adverse economic changes than higher rated securities.

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) included herein.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed in this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any discussion of specific securities/financial instruments mentioned in the commentary is neither an offer to sell nor a recommendation to buy these securities. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

ICE BofAML US High Yield Index (H0A0, “Broad HY Index”), formerly known as BofA Merrill Lynch US High Yield Index prior to 10/23/2017, is comprised of below-investment grade corporate bonds (based on an average of various rating agencies) denominated in U.S. dollars.

ICE US Fallen Angel High Yield 10% Constrained Index (H0CF, Index) is a subset of the ICE BofA US High Yield Index and includes securities that were rated investment grade at time of issuance.

ICE Data Indices, LLC and its affiliates (“ICE Data”) indices and related information, the name "ICE Data", and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data's prior written approval. The licensee's products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by ICE Data. ICE Data MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS).

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.