EMET ETF: Question & Answer

Read Time 5 MIN

Metals markets have taken center stage in recent years as demand has increased sharply, while supply has often struggled to keep pace. A major driver of base and industrial metals markets has been global electrification—expanding power generation, modernizing grid infrastructure, and building out the technologies that move, store, and use electricity more efficiently.

At the heart of this buildout is copper, a foundational industrial metal with few practical substitutes in many electrical applications. Investor interest has grown accordingly, but there are relatively few straightforward public equity options designed to capture upstream exposure to copper and other metals tied to electrification through the companies that produce, refine, process, and recycle them. This FAQ answers frequently asked questions on copper, select “green metals,” and how investors can access this theme through the VanEck Copper and Green Metals ETF (EMET).

- Why copper?

- How are green metals used?

- How can investors access exposure to these metals?

- What are the risks of investing in these metals?

- How prominent is China’s role in these supply chains?

- How do portfolios in this theme typically gain exposure to Chinese companies?

- Do equity-based approaches generate Schedule K-1 tax statements?

- How can investors buy VanEck ETFs?

Why copper?

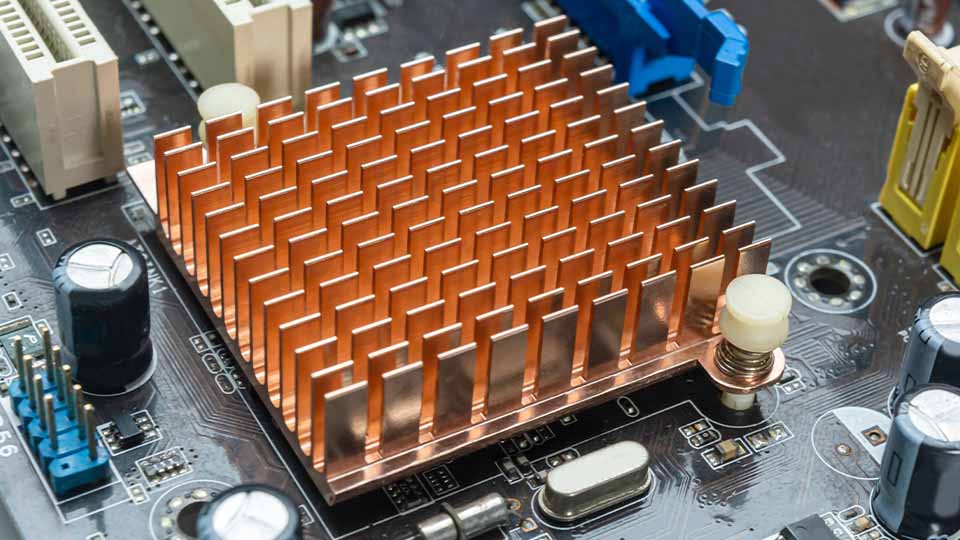

Copper is a widely used base metal prized for its electrical conductivity, durability, and workability. It is essential to the “electricity value chain”—from generation and transmission to distribution, end-use wiring, and electrified transportation.

Electrification is ultimately about moving electricity reliably and efficiently—and copper is one of the main materials that makes that possible. Copper’s importance tends to show up in four places:

- Grid infrastructure and buildout

Transmission and distribution systems rely heavily on conductive metals. As grids expand to connect new generation and utilities upgrade aging infrastructure, copper demand is often tied to the physical scale of wiring, transformers, substations, and distribution networks. - Power generation and interconnection

Adding capacity—especially when it requires new interconnections—can mean more conductors, cabling, and electrical equipment across the system. - Electrified transportation

Electric vehicles and charging networks add copper in motors, inverters, wiring harnesses, and charging equipment, alongside the copper embedded in the power system that supplies them. - Electrification of buildings and industry

Upgrades like heat pumps, electrical retrofits, data centers, and industrial electrification can raise copper intensity through wiring, busbars, and power management equipment.

Because many copper applications have limited near-term substitution options without sacrificing performance, copper often serves as a “picks and shovels” input to the electrification theme.

How are green metals used?

“Green metals” is a practical umbrella term for metals and minerals commonly used in electrification and related technologies. To be specific, in addition to copper this can include battery materials (e.g., lithium, nickel, cobalt, manganese, graphite), industrial and specialty inputs (e.g., zinc, tin, molybdenum, vanadium), platinum group metals (e.g., platinum, palladium, rhodium), and rare earth elements used in certain magnets (e.g., neodymium, praseodymium, dysprosium, terbium).

While copper is the backbone of electrical infrastructure, these other metals support key technologies built on top of that backbone:

- Batteries / energy storage: lithium, nickel, cobalt, manganese, and graphite are common inputs depending on battery chemistry.

- Motors and magnets: rare earth elements like neodymium and praseodymium are often used in permanent magnets for high-efficiency motors and generators; dysprosium and terbium can be used to improve high-temperature performance in some magnet applications.

- Power electronics and specialty components: metals like tin, indium, and others can appear in soldering, coatings, and electronics-related uses.

- Catalysts and industrial processes: platinum group metals can be used in catalysts and select industrial applications tied to cleaner fuels and emissions-reduction technologies.

The key point: copper connects the system, while the broader set of metals supports specific technologies within electrification and clean-tech supply chains.

How can investors access exposure to these metals?

Physical investment in many of these metals is often impractical for most investors. Some have futures markets, but futures can be complex and introduce risks tied to market structure (including contango/backwardation), roll yield, and position management.

A common alternative is equity exposure through companies involved in:

- Mining and production

- Refining and processing

- Recycling and recovery

These businesses’ revenues and profitability can be influenced—sometimes significantly—by the supply/demand balance for the metals they produce and process, along with operating costs, capital intensity, permitting timelines, and geopolitics.

For investors seeking a more streamlined way to access this theme, the VanEck Copper and Green Metals ETF (EMET) is designed to provide liquid, diversified exposure to global producers of copper and other critical minerals that underpin electrification and grid buildout.

Visit the fund page for the fact sheet, holdings, performance and more.

What are the risks of investing in these metals?

Investing in copper- and electrification-metals-related equities can involve several categories of risk:

- Commodity cycle risk: prices can be volatile and driven by growth expectations, inventory cycles, and supply disruptions.

- Operational and project risk: mining and processing projects are capital-intensive and can face delays, cost overruns, and technical challenges.

- Regulatory and permitting risk: environmental standards, permitting timelines, and community/social license issues can affect supply growth.

- Equity market risk: even if metal prices rise, equity performance can be influenced by broader market sentiment and company-specific execution.

- Geopolitical and supply-chain concentration risk: governments may intervene to secure supply chains or restrict trade; disruptions can affect prices and margins.

How prominent is China’s role in these supply chains?

China is a major participant in processing and refining across several metals used in electrification and clean-tech supply chains, and it has historically been particularly prominent in rare earths and portions of the battery-materials supply chain. As a result, policy shifts, export controls, and industrial strategy can influence global pricing and availability.

At the same time, many countries are investing to diversify supply chains through domestic production, “friend-shoring,” expanded recycling, and new processing capacity—efforts that may evolve over multiple years given the long lead times in mining and refining.

How do portfolios in this theme typically gain exposure to Chinese companies?

Exposure can come through companies listed in Hong Kong, the U.S. (ADRs), or mainland listings accessed via market access programs (where eligible). The exact mechanics vary by vehicle and strategy, but the broader concept is straightforward: because China is significant in parts of these supply chains, global baskets of producers and processors often include Chinese firms.

Do equity-based approaches generate Schedule K-1 tax statements?

Typically, equity-based approaches that invest in operating companies (miners, refiners, processors, recyclers) do not generate Schedule K-1s the way many commodity pool / partnership structures can. (As always, investors should review a product’s tax documentation for specifics.)

How can investors buy VanEck ETFs?

To receive more Natural Resources insights, sign up in our subscription center.

Important Disclosures

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, which do not reflect actual results, are valid as of the date of this communication, and subject to change without notice. Information provided by third-party sources are believed to be reliable and has not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of 3rd party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investments in companies involved in the production, refining, processing and recycling of green metals used to facilitate the energy transition from fossil fuels to cleaner energy sources and technologies are subject to a variety of risks. Under certain market conditions, the Fund may underperform as compared to funds that invest in a broader range of investments. There may be significant differences in interpretations of what is considered a "green" metal and the definition used by the Index Provider may differ with those used by other investors, investment advisers or index providers. Additionally, there may also be a limited supply of companies involved in green metals, which may adversely affect the Fund.

An investment in the Fund may be subject to risks which include, but are not limited to, risks related to investments in green metals, clean energy companies, regulatory action and changes in governments, rare earth and strategic metals companies, special risk considerations of investing in Asian, Australian, Chinese, African, South African, Canadian and Latin American issuers, Stock Connect, foreign securities, emerging market issuers, foreign currency, basic materials sector, mining industry, small- and medium-capitalization companies, cash transactions, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount, liquidity of fund shares, non-diversified and index-related concentration risks, all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks. Investments in Chinese issuers may entail additional risks that include, among others, lack of liquidity and price volatility, currency devaluations and exchange rate fluctuations, intervention by the Chinese government, nationalization or expropriation, limitations on the use of brokers, and trade limitations.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

©Van Eck Securities Corporation, Distributor | 666 Third Avenue | New York, NY 10017

Related Funds

Important Disclosures

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities/financial instruments mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, which do not reflect actual results, are valid as of the date of this communication, and subject to change without notice. Information provided by third-party sources are believed to be reliable and has not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of 3rd party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investments in companies involved in the production, refining, processing and recycling of green metals used to facilitate the energy transition from fossil fuels to cleaner energy sources and technologies are subject to a variety of risks. Under certain market conditions, the Fund may underperform as compared to funds that invest in a broader range of investments. There may be significant differences in interpretations of what is considered a "green" metal and the definition used by the Index Provider may differ with those used by other investors, investment advisers or index providers. Additionally, there may also be a limited supply of companies involved in green metals, which may adversely affect the Fund.

An investment in the Fund may be subject to risks which include, but are not limited to, risks related to investments in green metals, clean energy companies, regulatory action and changes in governments, rare earth and strategic metals companies, special risk considerations of investing in Asian, Australian, Chinese, African, South African, Canadian and Latin American issuers, Stock Connect, foreign securities, emerging market issuers, foreign currency, basic materials sector, mining industry, small- and medium-capitalization companies, cash transactions, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount, liquidity of fund shares, non-diversified and index-related concentration risks, all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks. Investments in Chinese issuers may entail additional risks that include, among others, lack of liquidity and price volatility, currency devaluations and exchange rate fluctuations, intervention by the Chinese government, nationalization or expropriation, limitations on the use of brokers, and trade limitations.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

©Van Eck Securities Corporation, Distributor | 666 Third Avenue | New York, NY 10017