3 Ways to Be a Smart Investor During an Election Year

September 14, 2020

Read Time 6 MIN

If asked to describe 2020 in a single word, one could argue that “challenging” fits the bill. In addition to sending daily life into a tailspin, COVID-19 had a similar impact on the marketplace, taking investors on a wild ride. Now that summer has come to a close, many are quickly reminded of the election and wondering what they can, and should be, doing as a way to gear up their portfolios for the possibility of yet another, wild ride.

In order to address some of these concerns, we have broken down three action items every investor can take in order to not only prepare their portfolios, but to keep things in perspective.

1. Do Not Fall Victim to Headline Risk—Stay the Course With Your Long-Term Strategy

What has the ability to adversely impact your portfolio more than the “wrong” candidate? You. Elections are filled with emotion. Therefore, investors should remember that the news is not one size fits all and is not built with your specific portfolio in mind. Your individual plan, goals and timeframe are uniquely your own. For every news report foretelling gloom and doom, you can often find one with an opposing view. It behooves investors to consume their news through a bit of a skeptic’s lens in order to distinguish between rhetoric and policy. Our CEO, Jan van Eck stresses this point in his latest quarterly outlook, telling investors to focus on policy, not politics.

As heated presidential debates unfold and policy decisions are discussed, candidates may propose dramatic changes. However, what is advertised during an intense debate versus what comes to fruition once the elected candidate is in office, are often quite different. Therefore, investment decisions are not meant to be made in response to what a candidate may say during a debate or campaign rally, despite how the market may behave on a short-term basis.

Similar to breaking news, the market may react to the individuals who have chosen to take dramatic action, based purely on shock value. In the end, we believe fundamentals will prevail and the market will bounce back to where it should be. Although it may be challenging, staying focused on your long-term goals and remaining pragmatic can be your best course of action when it comes to managing your investment strategy during an election year. Just because there is a semi-unusual situation taking place does not mean it’s time to abandon all logic. If anything, allow for the fundamentals you know to be true to be your voice of reason.

2. Hedge with Diversification

The notion of going to cash versus not going to cash during volatile times is a conundrum many struggle with. Going to cash can be smart, particularly if the technical and fundamental picture for the market looks weak. However, timing this is often hard, much less timing when to get back in. So don’t sell to cash “just because” you anticipate a volatile time. First, concentrate on diversification, and then consider strategies or funds that incorporate risk-management techniques to offer guidance as to when you should raise cash. Over the long-term, you want to stay invested. You just need to stay smart about how to handle periods of volatility.

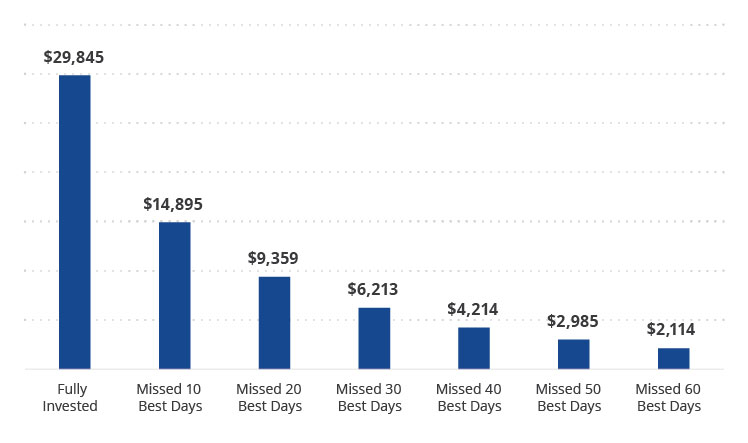

The chart below shows there is a hefty price tag to be paid for missing out on some of the market’s best performing days. One can never guarantee when these days will occur and trying to time the market can come with substantial risk. Therefore, the only way to potentially be a part of it is by remaining responsibly invested.

The Case for Staying Invested—Even During an Election Year

Growth of $10,000 investment in the S&P 500 between January 4, 1999 and December 31, 2018

Source. JP Morgan & Bloomberg.

The yearning for a defensive approach to potential volatility is not only understandable, it’s smart. Diversification is the foundation to a well-built portfolio and is one of the most organic hedging strategies against volatility. By dispersing your money across various asset classes, you are essentially spreading out risk. Each asset class reacts differently to the same situation, ultimately creating an environment within your portfolio that is based on give and take. By diversifying, your outperformers pad the potential losses of your underperformers. Remember, you wouldn’t parachute out of a plane just because it’s experiencing turbulence—investing during different market cycles is no different.

3. Know Where to Poke Holes

The possibility of a new President presents many questions and some investors may find themselves trying to hypothesize the types of economic changes that could take place as a result of a particular candidate’s victory. Although it’s impossible to predict the future, it is possible to draft an educated guess. But first, investors must know where and who they should look to.

Identifying the differences and/or similarities in each candidate’s government spending policy certainly can be a great place to start. By doing so, investors can begin to recognize and monitor the potential areas for future concern. Although each candidate is likely to do things very differently, if their spending policies are of similar caliber, the direct impact this could have on investors is likely to be less economically disruptive.

The Federal Reserve (Fed) is another area investors should not look past. While the President of the United States is one of the most powerful and coveted positions in the world, one must also remember the structure of the U.S. government: a democracy. In addition to major decisions being at the hands of the President, they are also at the hands of the Senate, Congress and the Fed. While the Fed does not have a direct relationship to the election, it is a true power player when it comes to the overall health of our economy and monetary system. Interest rates, which are determined by the Fed, have an extraordinary impact on both the health and growth of the economy. Although the President plays a strong role in appointing the Chairman of the Fed and will offer his/her insights, some of the most significant and impactful decisions are made solely by the Fed. Our CEO discusses some of the Fed’s latest decisions and why he does not anticipate the Fed changing course anytime soon in this quarter’s market outlook.

The market is a living and breathing organism and is much more resilient than many realize. “Market cycle” is a phrase we often hear. But what does this really mean, and how does this impact investors? Think of “cycle” as being a synonym for “season”. The market goes through multiple seasons, induced by a variety of factors. Each of nature’s seasons are unique and produces different outputs; however, they are all completely necessary in order for Mother Nature to regulate herself. The market is no different.

Tune into our Trends with Benefits podcast, where host Ed Lopez speaks with Jeff Hirsch, Editor of Stock Trader’s Almanac. The pair discusses the election season from a historical perspective, diving into what the data says about the outcome of an election, its economic impact and what typically happens two years after the election.

IMPORTANT DISCLOSURES

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) discussed in this podcast.

The views and opinions expressed are those of the speaker(s) but not necessarily those of VanEck. Commentaries are general in nature and should not be construed as investment advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any discussion of specific securities/financial instruments mentioned in the commentary is neither an offer to sell nor a solicitation to buy these securities. Fund holdings will vary. All indices mentioned are measures of common market sectors and performance. It is not possible to invest directly in an index. Information on holdings, performance and indices can be found at vaneck.com.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.Related Funds

IMPORTANT DISCLOSURES

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) discussed in this podcast.

The views and opinions expressed are those of the speaker(s) but not necessarily those of VanEck. Commentaries are general in nature and should not be construed as investment advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any discussion of specific securities/financial instruments mentioned in the commentary is neither an offer to sell nor a solicitation to buy these securities. Fund holdings will vary. All indices mentioned are measures of common market sectors and performance. It is not possible to invest directly in an index. Information on holdings, performance and indices can be found at vaneck.com.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.