A Big Month for Fallen Angels, But Not a Worrisome Trend

March 02, 2020

Read Time 8 MIN

In February, we saw the credit ratings downgrades of Macy’s, EQT Corporation, EQM Midstream Partners and Kraft Heinz, one of the largest fallen angels ever. While we may be starting to see a rise in downgrades to fallen angel status, we believe this is still on a one-off basis rather than a sign of a systemic decline in the credit markets.

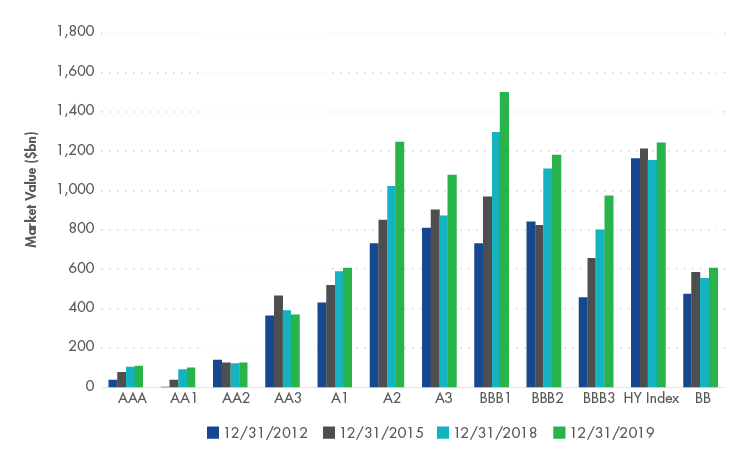

Last year we examined the risk of a wave of fallen angels given the growing size of the BBB rated segment of the bond market and the rising media attention on the potential for credit rating downgrades of investment grade bonds to overwhelm the high yield market. The BBB rated space has only grown further since then, reaching approximately $3.6 trillion at the end of 2019, while the BBB- rated segment reached nearly $1 trillion.1 The growth of the BBB- segment has outpaced that of the overall investment grade universe by nearly double since 2012.

U.S. Corporate Debt by Rating: BBB Rated Segment Growing

Source: ICE Data Indices as of 12/31/2019.

Credit Environment Benign for High Yield Bonds in 2019

The volume of new fallen angels entering the ICE BofA US Fallen Angel High Yield Index in 2019 was actually the lowest since the index’s inception in 2003, at only $17 billion of market value. Meanwhile, there were several “rising stars” (upgrades of high yield bonds to investment grade), including some with meaningful weights in the index, such as mining company Teck Resources Limited and Continental Resources, an upstream energy company. The fallen angel and rising star activity in 2019, which on a net basis led to a reduction in the market value of fallen angels, was indeed indicative of a benign credit environment.

Is the Wave of Downgrades Coming in 2020?

With global central banks now providing ever more liquidity and our firm’s positive outlook on growth, we do not believe a massive wave of downgrades will occur in the absence of a geopolitical shock that resulted in an abrupt slowdown or recession. Nevertheless, given the sheer size of the BBB and BBB- rated universe—over 50% of all investment grade bonds—and events from the first two months of 2020, we do expect to see an increase in fallen angel volume driven by idiosyncratic downgrades, even if the systemic risk of a “junk tsunami” is not imminent.

In early February, both EQT Corporation, an energy exploration and production company, and EQM Midstream Partners, a midstream oil and gas company that was spun off from EQT in 2018, were downgraded to high yield by both S&P Global Ratings and Fitch Ratings, resulting in approximately $7 billion of fallen angel bonds. Macy’s, with nearly $2.5 billion of index eligible debt, was downgraded to BB+ from BBB- by S&P Global Ratings, leaving it one downgrade away from fallen angel status. More significantly, Kraft Heinz became the fifth largest fallen angel ever after both S&P and Fitch downgraded its bonds on February 14, resulting in approximately $22 billion of fallen angel bonds. Kraft Heinz is the largest fallen angel since the downgrades of General Motors in 2005 and Ford in 2006.

Kraft Heinz provides a good example of how fallen angel investing is often characterized by significant differentiation versus the broad high yield market in terms of both sector and issuer exposure. Fallen angel investing is characterized by its contrarian approach. The disciplined buying of oversold bonds of a downgraded issuer, or those of an entire sector, often means that fallen angel investors go overweight sectors and issuers after there has been a significant price adjustment due to negative credit trends. Both forms of concentration have generally led to historical outperformance. In terms of issuer exposure, an examination of large exposures historically shows a significant effect on both absolute performance and outperformance relative to the broad U.S. high yield over the year following their respective downgrades.

Contrarian Approach of Fallen Angel Investing Helps Drive Outperformance

| Issuer | Start Date | Fallen Angel Weight |

U.S High Yield Weight |

Contribution to Return (1 Year After Inclusion) |

Contribution to Outperformance (1 Year After Inclusion) |

|---|---|---|---|---|---|

| General Motors | 5/31/2005 | 20.6% | 5.7% | 2.52% | 0.79% |

| Ford Motor Company | 8/31/2005 | 12.5% | 4.0% | 1.56% | 0.36% |

| ArcelorMittal SA | 11/30/2012 | 9.4% | 1.2% | 1.07% | 0.25% |

| Freeport McMoran | 2/29/2016 | 5.5% | 0.9% | 2.11% | 0.70% |

Source: FactSet. Fallen Angel Weight represents average weight in the ICE BofA US Fallen Angel High Yield Index in the 1-year period following index entry. U.S. High Yield Weight represents the average weight in the ICE BofA US High Yield Index in the 1-year period following index entry. Contribution to Return represents the return of the issuer’s bonds to the total return of the ICE BofA US Fallen Angel High Yield Index in the 1-year period following index entry. Contribution to Outperformance represents the impact of the issuer’s bonds to performance relative to the ICE BofA US Fallen Angel High Yield Index in the 1-year period following index entry.

The current environment is characterized by a relatively small fallen angel universe and a very large BBB- rated bond universe in both number of issuers and market capitalization. Several extremely large issuers could gain outsized weights in the high yield market should they become fallen angels. Kraft Heinz is the most recent example, but others, such as Ford Motor Company, could have an even greater representation in the fallen angel universe should they be downgraded.

An appealing aspect of fallen angel investing is the exposure to the secular recoveries that often occur after fundamentals have bottomed out, but investors may be less comfortable with issuer-specific credit stories. We therefore believe that reasonably capping exposure to a single issuer is a prudent approach that limits the risk of further deterioration while maintaining the benefits of a more unconstrained approach.

Historically, fallen angel performance has benefitted most when a fallen angel volume is high. This makes intuitive sense, as the more oversold bonds an investors can gain exposure to the better, given the tendency to fully recover in value after the downgrade to high yield. Limiting this exposure, naturally, could mean lower alpha potential. We believe that setting a cap too low could have significant impact on potential alpha; it certainly would have historically.

Fallen Angel Volume Has Corresponded with Strong Returns

Source: ICE Data Indices. Data as of 12/31/2019. Fallen Angels are represented by the ICE BofAML US Fallen Angel Index and US High Yield is represented by the ICE BofAML US High Yield Index.

We expect the current environment will continue. Slow and steady economic growth and very accommodative central banks are supportive for corporate credit. Although the BBB rated market has grown significantly, credit metrics in that segment have actually improved overall, so the wave of downgrades many fear is not a foregone conclusion. However, we believe the risk of idiosyncratic downgrades, rather than a systematic deterioration of credit fundamentals, will be the primary risk in the near to medium term for high yield investors, and fallen angel investors in particular.

If history is a guide, this may provide significant opportunity for fallen angel investors. But we believe a prudent, risk managed approach that prevents excessive concentrations in single issuers adds a level of protection in the current environment while preserving the alpha potential of fallen angel investing.

Related Insights

April 10, 2024

April 09, 2024

March 22, 2024

March 22, 2024

March 15, 2024

DISCLOSURES

1 Source: ICE Data Indices. Data as of 12/31/2019.

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) included herein.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed in this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

ICE BofAML US Fallen Angel High Yield Index (H0FA, “Index”), formerly known as BofA Merrill Lynch US Fallen Angel High Yield Index prior to 10/23/2017, is a subset of the ICE BofAML US High Yield Index (H0A0, “Broad Index”), formerly known as BofA Merrill Lynch US High Yield Index prior to 10/23/2017), including securities that were rated investment grade at time of issuance. H0FA is not representative of the entire fallen angel high yield corporate bond market.

ICE BofAML US High Yield Index (H0A0, “Broad HY Index”), formerly known as BofA Merrill Lynch US High Yield Index prior to 10/23/2017, is comprised of below-investment grade corporate bonds (based on an average of various rating agencies) denominated in U.S. dollars.

ICE Data Indices, LLC and its affiliates (“ICE Data”) indices and related information, the name "ICE Data", and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data's prior written approval. The licensee's products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by ICE Data. ICE Data MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS).

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Related Funds

DISCLOSURES

1 Source: ICE Data Indices. Data as of 12/31/2019.

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) included herein.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed in this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

ICE BofAML US Fallen Angel High Yield Index (H0FA, “Index”), formerly known as BofA Merrill Lynch US Fallen Angel High Yield Index prior to 10/23/2017, is a subset of the ICE BofAML US High Yield Index (H0A0, “Broad Index”), formerly known as BofA Merrill Lynch US High Yield Index prior to 10/23/2017), including securities that were rated investment grade at time of issuance. H0FA is not representative of the entire fallen angel high yield corporate bond market.

ICE BofAML US High Yield Index (H0A0, “Broad HY Index”), formerly known as BofA Merrill Lynch US High Yield Index prior to 10/23/2017, is comprised of below-investment grade corporate bonds (based on an average of various rating agencies) denominated in U.S. dollars.

ICE Data Indices, LLC and its affiliates (“ICE Data”) indices and related information, the name "ICE Data", and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data's prior written approval. The licensee's products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by ICE Data. ICE Data MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS).

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.