How to Avoid Cryptocurrency Scams

April 26, 2022

Read Time 8 MIN

Please note that VanEck holds a position in Ethereum.

With crypto scams on the rise, we walk you through simple ways to protect your digital assets and steps to take if you encounter fraudulent crypto activity.

The best way to learn is by doing; fortunately, this does not need to be the case with cryptocurrency scams. Crypto scams have been on the rise lately, as investors are enticed by “gurus” who convince those looking for quick profits that they can turn around significant returns for what is usually a substantial fee, or others who enact false trades for a non-existent NFT to gain access to a crypto wallet.

I would like to share some crypto mistakes so that you do not fall victim to cryptocurrency scams.

@ZeroBeta recently wrote the following on Twitter:

“You don’t learn Crypto/Web3 from a curriculum.

You learn it by installing Metamask, buying some ETH, minting a Bored Ape, joining a Discord, getting a DM, entering your seed phrase, losing your Bored Ape, emailing OpenSea.”

If you are about to dive into crypto, and have no idea why this is humorous, then my notes below should explain and help to identify popular scams in today’s crypto world.

We’ll cover what to look for across the most common platforms including Discord and OpenSea.

Phishing for Crypto on Discord

If you’ve read my blog on how to purchase an NFT and created a crypto wallet, then you may have joined the Discord communication app to find details on new projects.

What is Discord?

Discord is a communication app that allows communities to create servers where participants can chat and collaborate on ideas and projects.

Within Discord, you can receive requests from other users to begin a conversation.

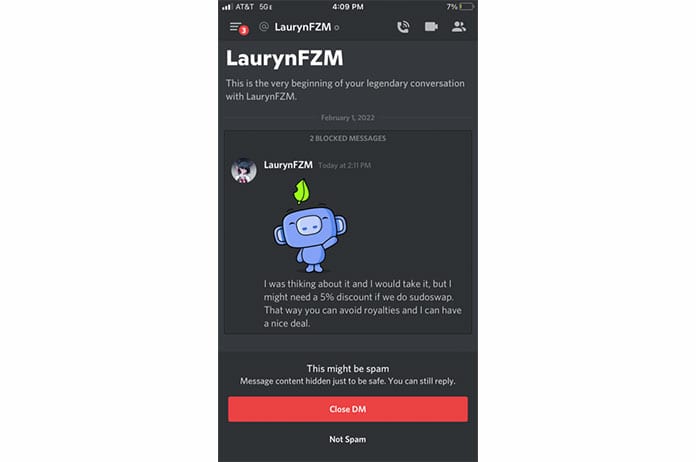

Discord App Conversation

Source: Discord.

Communication requests look similar to the image above. Here, it looks like someone wants to engage in a transaction using a reputable tool called SudoSwap.

What is SudoSwap?

SudoSwap essentially allows two parties to exchange NFTs. There are many iterations of this, such as NFTTrader.io.

While this may seem legitimate, a fake SudoSwap link could be used to get the user to complete a fraudulent transaction, where instead of receiving an NFT, one might potentially sign away their entire crypto wallet!

This is just one of many ways scammers take advantage of people every day.

Discord Security Tips

When spending time on Discord, users may be targeted for a few reasons:

- It is a popular project or community.

- The community is actually part of a large scam. Maybe the project was listed on Twitter and so it looked legitimate – this does not necessarily mean it is legitimate.

- The Discord channel has actually been the target of a hack, meaning the admins have lost control of the project and newcomers have no idea that getting a “whitelist” spot and connecting your wallet is all hackers need to access your wallet.

The best way to navigate these risks includes the following:

- Turn off direct DM’s (Direct Messages) from discord members. If they can’t DM you, then they can’t send you a malicious link. Most projects will never directly DM you.

- Don’t be lazy – If you do want to participate in a private deal, while using a mostly secure 3rd party vendor, then you should offer to set up the swap yourself. This ensures that you are the one in control of which site you use.

- Don’t get caught up in the hype of projects. I have been involved in communities where the total number of participants was over 500,000 people, yet 400,000 were bots all trying to pump the project, pump volume and leave you holding the bag.

With some precaution, joining Discord and being part of a Discord channel remains one of the best ways to truly understand a project and the community as a whole.

Free is Almost Never Free

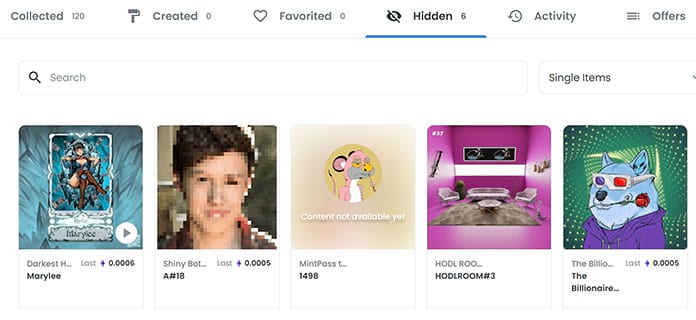

OpenSea is an online crypto marketplace that looks and functions similar to eBay. You can list NFTs for sale with a “buy-it now” price or add them to an auction. Within your user profile, there is a “hidden” section that contains NFTs that you maybe never intended to own. OpenSea created this functionality to denote NFTS that were transferred to you but are part of an unverified collection. Think of it as an extra layer of safety or precaution taken by OpenSea on your behalf.

Hidden NFTs on OpenSea

Source: OpenSea.

The discovery of the “Hidden” section can sometimes be exciting for folks who were simply airdropped NFTs with potential value.

Airdrops happen for a number of reasons, but the most common one is that your wallet address was made public. For instance, you shared it on Twitter in order to participate in a contest, and now scammers know where to send their scams.

My #1 rule here is this: unless you were the one to hide these NFTs, it’s best to not interact with them. The reason for this is simple - you don’t want to accidently sign away access or permissions from your wallet. Similar to the imitation Discord links above, NFTs can be malicious in their own right.

Best Practices to Keep NFTs and Crypto Wallets Safe

- When looking through someone else’s wallet because you want to see what influencers are buying, for example, never use one of their NFTs to bring you to the OpenSea collection or make a purchase from that point in your search. These NFTs might bring you to the site of an unverified collection.

- If you have an NFT show up in your main collection that you didn’t purchase or ask for, then hide it right away. This doesn’t delete the Digital asset, but moves it to the “Hidden” section and out of sight from you and potentially fellow collectors, who may be perusing your collection looking for something to purchase.

- Look for the blue check mark. Similar to the verified check mark that Twitter offers, the blue check marks verify that the collection is the official collection. It does not mean, however, that OpenSea condones, supports or otherwise endorses the project. You still need to do your due diligence.

How to Protect Your Seed Phrase

What is a seed phrase?

Coinbase defines a seed phrase as:

A seed phrase is a series of words generated by your cryptocurrency wallet that gives you access to the crypto associated with that wallet. Think of a wallet as being similar to a password manager for crypto, and the seed phrase as being like the master password. As long as you have your seed phrase, you’ll have access to all of the crypto associated with the wallet that generated the phrase — even if you delete or lose the wallet.1

It is imperative to secure seed words. Keep them safe; put them in a vault if you must. The truth of this, though, is that you might be the threat!

Whether if it is to set up a new wallet or to import your transactions into a website to track your taxes, you must be diligent and cautious in where and why you choose to type in those valuable 12 or 24 words.

Trust Wallet, for example, is a fantastic choice for crypto wallets, but even Trust Wallet will tell its users that they will never be asked to paste in their seed phrase to a fraudulent “Trust Wallet” website. Yet, people do, and just like any popular banking site, there are fake “Trust Wallet” websites waiting for you to make this mistake.

If you mistakenly put your seed words into a malicious website, here is what you should do:

- Review the wallet in question and quickly take inventory of what you have.

- If you have the respective cryptocurrency needed to move those assets out of the wallet, then do so immediately. This is another reason why it makes sense to have more than one crypto wallet in case you need to quickly move assets to another wallet before hackers can get to them.

- Before you say good-bye to that wallet forever, I would recommend taking a quick look at MyCrypto.com. If you connect the wallet in question to that site, it may reveal that you have unclaimed, airdropped tokens. If you do, then you can always send crypto back to retrieve these if valuable.

- Learn from your mistakes.

Access our crypto and digital assets education and research for more insights to the digital assets space.

Subscribe for updates and register for upcoming webinars and replays of our crypto discussions.

Related Topics

Related Insights

© Van Eck Securities Corporation, a wholly-owned subsidiary of Van Eck Associates Corporation.

DISCLOSURES

1 Coinbase.

Sources:

CNN.

OpenSea.

Coinbase.

VanEck owns no rights to the NFTs. Images of NFTs were taken directly from respective websites.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the cryptocurrencies mentioned herein. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Van Eck Associates Corporation

Related Funds

© Van Eck Securities Corporation, a wholly-owned subsidiary of Van Eck Associates Corporation.

DISCLOSURES

1 Coinbase.

Sources:

CNN.

OpenSea.

Coinbase.

VanEck owns no rights to the NFTs. Images of NFTs were taken directly from respective websites.

Please note that VanEck may offer investments products that invest in the asset class(es) or industries included herein.

This is not an offer to buy or sell, or a recommendation to buy or sell any of the cryptocurrencies mentioned herein. The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies. The value of cryptocurrency may be derived from the continued willingness of market participants to exchange fiat currency for cryptocurrency, which may result in the potential for permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency disappear. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Investing in cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future.

Investors should conduct extensive research into the legitimacy of each individual cryptocurrency, including its platform, before investing. The features, functions, characteristics, operation, use and other properties of the specific cryptocurrency may be complex, technical, or difficult to understand or evaluate. The cryptocurrency may be vulnerable to attacks on the security, integrity or operation, including attacks using computing power sufficient to overwhelm the normal operation of the cryptocurrency’s blockchain or other underlying technology. Some cryptocurrency transactions will be deemed to be made when recorded on a public ledger, which is not necessarily the date or time that a transaction may have been initiated.

- Investors must have the financial ability, sophistication and willingness to bear the risks of an investment and a potential total loss of their entire investment in cryptocurrency.

- An investment in cryptocurrency is not suitable or desirable for all investors.

- Cryptocurrency has limited operating history or performance.

- Fees and expenses associated with a cryptocurrency investment may be substantial.

There may be risks posed by the lack of regulation for cryptocurrencies and any future regulatory developments could affect the viability and expansion of the use of cryptocurrencies. Investors should conduct extensive research before investing in cryptocurrencies.

Information provided by Van Eck is not intended to be, nor should it be construed as financial, tax or legal advice. It is not a recommendation to buy or sell an interest in cryptocurrencies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

Van Eck Associates Corporation